Stock Splits and Stock Dividends

Post on: 2 Апрель, 2015 No Comment

Entries to the Retained Earnings Account, Book Value

Earnings Per Share, Other

Stock Splits and Stock Dividends

Stock splits

Let’s say that a board of directors feels it is useful to the corporation if investors know they can buy 100 shares of stock for under $5,000. This means that the directors will work to keep the selling price of a share between $40 and $50 per share. If the market price of the stock rises to $80 per share, the board of directors can move the market price of the stock back into the range of $40 to $50 per share by approving a 2-for-1 stock split. Such an action will cause the total number of shares outstanding to double and, in the process, cause the market price to drop from $80 down to $40 per share. For example, if a corporation has 100,000 shares outstanding, a 2-for-1 stock split will result in 200,000 shares outstanding. Since the corporation’s assets, liabilities, and total stockholders’ equity are the same as before the stock split, doubling the number of shares should bring the market value per share down to approximately half of its pre-split value.

After a 2-for-1 stock split, an individual investor who had owned 1,000 shares might be elated at the prospect of suddenly being the owner of 2,000 shares. However, every stockholder’s number of shares has doubledcausing the value of each share to be worth only half of what it was before the split. For example, if a corporation had 100,000 shares outstanding, a stockholder who owned 1,000 shares owned 1% of the corporation (1,000 100,000). After a 2-for-1 stock split, the same stockholder still owns just 1% of the corporation (2,000 200,000). Before the split, 1,000 shares at $80 each totaled $80,000; after the split, 2,000 shares at $40 each still totals $80,000.

A stock split will not change the general ledger account balances and therefore will not change the dollar amounts reported in the stockholders’ equity section of the balance sheet. (Although the number of shares will double, the total dollar amounts will not change.)

Although the 2-for-1 stock split is typical, directors may authorize other stock split ratios, such as a 3-for-2 stock split or a 4-for-1 stock split.

While account balances do not change after a stock split, there is one change that should be noted: the par value per share decreases with a stock split. Even though there are more shares of stock, the total par value is unchanged. For example, if the par value is $1.00 per share and there are 100,000 shares outstanding, the total par value is $100,000. After a 2-for-1 split, the par value is $0.50 per share and there are 200,000 shares outstanding for a total par value of $100,000. Note that the total par value remained at the same amount. A memo entry is made to indicate that the split occurred and that the par value per share has changed.

Stock Dividends

A stock dividend does not involve cash. Rather, it is the distribution of more shares of the corporation’s stock. Perhaps a corporation does not want to part with its cash, but wants to give something to its stockholders. If the board of directors approves a 10% stock dividend, each stockholder will get an additional share for each 10 shares held.

Since every stockholder received additional shares, and since the corporation is no better off after the stock dividend, the value of each share should decrease. In other words, since the corporation is the same before and after the stock dividend, the total market value of the corporation remains the same. Because there are 10% more shares outstanding, however, each share should drop in value. With each stockholder receiving a percentage of the additional shares and the market value of each share decreasing in value, each stockholder should end up with the same total market value as before the stock dividend. (If this reminds you of a stock split, you are very perceptive. A stockholder of 100 shares would end up with 150 shares whether it were a 50% stock dividend or a 3-for-2 stock split. However, there will be a difference in the accounting.)

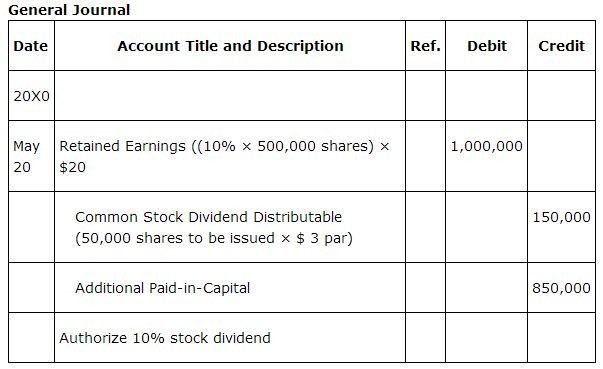

Even though the total amount of stockholders’ equity remains the same, a stock dividend requires a journal entry to transfer an amount from the retained earnings section of the balance sheet to the paid-in capital section of the balance sheet. The amount transferred depends on whether the stock dividend is (1) a small stock dividend, or (2) a large stock dividend.

Small stock dividend. A stock dividend is considered to be small if the new shares being issued are less than 20-25% of the total number of shares outstanding prior to the stock dividend.

On the declaration date of a small stock dividend, a journal entry is made to transfer the market value of the shares being issued from retained earnings to the paid-in capital section of stockholders’ equity.

To illustrate, let’s assume a corporation has 2,000 shares of common stock outstanding when it declares a 5% stock dividend. This means that 100 (2,000 shares times 5%) new shares of stock will be issued to existing stockholders. Assuming the stock has a par value of $0.10 per share and a market value of $12 per share on the declaration date, the following entry is made on the declaration date:

When the 100 shares are distributed to the stockholders, the following journal entry is made:

Large stock dividend. A stock dividend is considered to be large if the new shares being issued are more than 20-25% of the total value of shares outstanding prior to the stock dividend.

On the declaration date of a large stock dividend, a journal entry is made to transfer the par value of the shares being issued from retained earnings to the paid-in capital section of stockholders’ equity.

To illustrate, let’s assume a corporation has 2,000 shares of common stock outstanding when it declares a 50% stock dividend. This means that 1,000 new shares of stock will be issued to existing stockholders. The stock has a par value of $0.10 per share and the stock has a market value of $12 per share on the declaration date. The following entry should be made on the declaration date:

When the 1,000 shares are distributed to the stockholders, the following journal entry should be made: