Stock Options and The Terminated Employee

Post on: 15 Апрель, 2015 No Comment

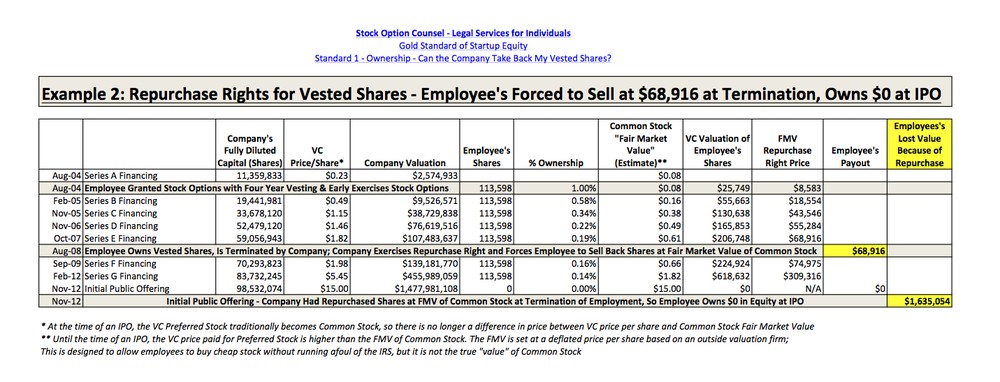

A major concern of high-level employees terminated from their employment is the fate of their stock options.

The amount at stake is often several times the employees salary, and may dwarf the amount of severance the company may offer. Executives should, therefore, have a solid understanding of stock option agreements when negotiating their exit strategy from a private company.

A stock option is the right to buy certain stock at a certain time at a certain price, known as the strike price. Stock options can be an important component of a companys overall compensation system and are used to attract, motivate, and retain talented management personnel by providing them with a method of obtaining a long-term equity stake in a corporation. Option grants may also have significant tax advantages for the corporation or the employee.

Compensatory stock options fall into two categories: incentive stock options (ISOs) and non-qualified stock options (NSOs). Incentive stock options are stock options which satisfy certain requirements of the Internal Revenue Code (Code). Stock options which do not qualify under the Code, known as non-qualified stock options, are both more simple and more common.

Corporate Currency

Stock options have been a ubiquitous part of corporate life in the 1990s, and, as characterized by the Wall Street Journal have become the currency of a new corporate age. Over the last five years, the annual value of options granted to corporate executives has quintupled to $45.6 billion.

But executives who shrewdly negotiate stock options when their careers are on the rise may sell themselves short when they are shown the door and asked to sign a severance agreement. Even in a tight labor market, high-level corporate executives risk finding a pink slip on their desk. If this happens, they should be aware they may be able to renegotiate the terms of existing stock option agreements and that their employer may be willing to provide severance pay in the form of additional stock options.

Class Concerns

The importance of stock, stock purchase plans, and stock options as a form of compensation for executives and even lower level employees has been highlighted by two recent cases.

In a recent decision by the Ninth Circuit Court of Appeals, Vizcaino v. Microsoft. 173 F.3d 713 (9 th Cir. 1999), the Court reversed a judgment against a class of temporary employees at Microsoft who claimed that they had improperly been excluded from Microsofts tax-qualified Employee Stock Purchase Plan (ESPP). The Court held that they were not independent contractors and therefore may be entitled to tens of millions of dollars which they would have received as part of the ESPP.

In a similar case, Carter v. West Publishing. No. 97-2537 (M.D. Fla. 1999), a federal district court in Florida certified a class of up to 144 former female employees of West Publishing who were allegedly excluded from a hush-hush, arbitrary stock remuneration plan because of their gender.

ESOPs Examined

An ESOP, or Employee Stock Ownership Plan, is a retirement plan covering all full-time employees under which the employer holds company stock in trust in the employee-participants names, ESOPs are usually subject to the Employee Retirement Security Income Act of 1974 (ERISA). Some confusion has arisen from the idea that ESOP might indicate Executive [or Employee] Stock Option Plan. In contrast to ESOPs, however, employee stock options are not retirement plans and are not governed by ERISA. Rather, an employee stock option is simply a right to buy a given amount of company stock at a given price for a given period of time. Employee stock options are not referred to using the ESOP acronym.

Here are some suggestions for executive-level employees to maximize use of stock options:

- Golden Parachutes. The best time to negotiate stock options is at the beginning of employment, and executives and their attorneys should confer to negotiate the best possible employment contract, including benefits such as stock options and a golden parachute. As seen below, the definition of termination for cause, change control, and other issues can be of critical importance.

Another concern an employer may have with regard to requests to modify a stock option plan is a reluctance to modify a stock option plan is a reluctance to make any alterations which must be approved by the companys board or compensation committee or may have to be reported to the SEC. These reports are open to the public and often followed by the financial media. Statutory insiders have reporting obligations under 16 or the Securities Act of 1934 whenever they receive stock or stock options as a part of a severance package.

Executives should keep in mind the nuances of their stock option plans when negotiating severance plans; be open to the possibility of renegotiating stock options; and determine whether repricing, extending the exercise period, or accelerating the vesting of stock options may be more advantageous than a simple cash payment. Although not all employers are willing to engage in such a discussion, the potential payoff for the employee can be significant.