Stock Options Analysis Option Articles

Post on: 16 Март, 2015 No Comment

Original Articles

The Stock Options Analysis section is an area designated for various original articles and essays related to option trading and option trading strategies with a special emphasis on Leveraged Investing.

There’s no shortage of ideas to explore and discuss when it comes to trading stock options. I’ve enjoyed watching this area of the site grow over time, and I hope it adds value to your visit. If you would like to be notified when a new original article is added to this page, please consider subscribing to the Great Option Article Alert via the form at the bottom of this page (you’ll also receive a special thank-you gift for doing so).

Please note: in order to keep this page manageable, certain original articles have been grouped together and moved to their own section, such as in the Stock Investing Advice and Dividend Stock Investing sections.

Finally, if you have any specific issues or questions you would like to see addressed, please feel free to use the CONTACT page and communicate those items to me.

If you haven’t done so already, and if you read nothing else on this site, please read my original essay, Leveraged Investing or No Substitute for Planting a Tree

Original Articles — Stock Options Analysis

OPTION TRADING

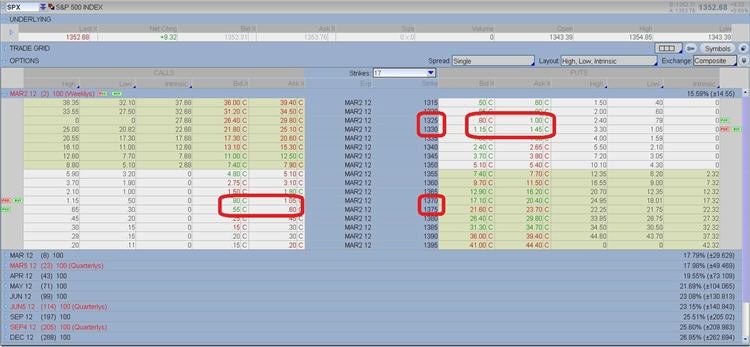

How to Use Technical Analysis to Sell Puts — Here’s a great example of why I love basic technical analysis and how to incorporate it into the selling of puts. In this example, it resulted in me doubling my annualized returns, allowed me to ring the register twice on a trade, and my capital was still freed up more than a month early.

Why I Won’t Trade Iron Condors — Don’t let their cool sounding name deceive you — iron condors can be merciless birds who devour large chunks of your capital. Here’s why you should think twice before trading them.

Investment Income from Options — Here are 2 smart option trading methods for generating sustainable investment income.

How to Become a More Disciplined and Patient Trader — Want to be a more disciplined trader? The solution I found to increased trading patience and discipline might surprise you.

How to Avoid Catastrophic Option Trading Losses — Catastrophic option losses are completely avoidable in my opinion — as long as you’re not making either of these structurally risky mistakes.

Standard Deviation vs. Technical Analysis for Option Traders — If you want to be a successful option trader, you’re going to want to incorporate some kind of strategy designed to give you insights about a stock’s likely future performance. In general, that means choosing between standard deviation (statistics) or technical analysis. So which approach is right for you?

Option Trading Tips — 4 Part Series — Overview of my 4 part Option Trading Tips series where I share my best advice for those new or relatively new to options.

Consider Selling Options — Part 1 of 4 — You basically have two choices when it comes to trading options — you can either be a net buyer of options, or a net seller. In this article, I explain why I’m a net seller of options and detail the structural advantages of doing so.

Avoid Chasing Option Premium — Part 2 of 4 — As a net seller of options, one of your greatest temptations will be the temptation to chase premium, to justify lowering your quality and trade set up standards because of the potential outsized gains you see in lesser quality (i.e. higher risk) trades.

Be Wary of Monthly Option Income Needs — Part 3 of 4 — In general, the more consistent and frequent you want or need to be paid, the less you’ll have to settle for. So how do you balance your monthly income needs with what your option selling generates?

Learn From Every Trade (Keep an Option Trading Journal) — Part 4 of 4 — Not everyone wants to heart this, but it’s true. If you want to be a successful trader, you’ll need to keep some kind of trading journal. The good news is that this can be fun and customized in a way that works for you.

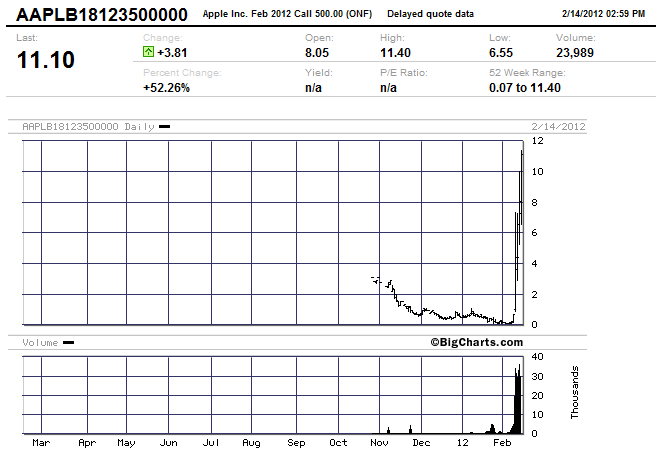

Drawbacks of Trading Illiquid Options — It’s important that you understand the drawbacks to trading illiquid options. In this article, we look at the impact of illiquidity in terms on option pricing and your ability to roll and otherwise adjust positions.

Option Trading Secrets Revealed: There Are None! — Just because you don’t know how something works, or you don’t have a lot of direct experience with something, doesn’t mean there are actual secrets involved. It just means you lack knowledge and/or experience. Anyone who tells you otherwise is manipulating and disrespecting you.

The Hidden Risk of Option Income Trading — The biggest risk involving option income trading, in my opinion, comes from needing your trades to consistently generate a certain amount of income each and every month. Option income can be very lucrative, but the more lucrative it is, the more irregular it will be as well.

The Profound Difference Between Debit and Credit Spreads — Does your own psychology determine whether you’re drawn more toward net debit or more toward net credit strategies? In this article, we look at the structural differences between net debit and net credit trades and what that says about the individuals who trade them.

Why I Don’t Buy LEAPS — There may be a place for LEAPS (Long Terms Equity AnticiPation Securities) or basically very long dated options (both on the call side and the put side) in the portfolios of both long term investors and intermedicate traders, and yet I resist simple buy and hold LEAPS strategies. In this article, I detail what I see as the three primary drawbacks to such a strategy.

In Defense of the Option Trader — Leveraged Investing, or value investing with options, is all about trading options from the perpective of a long term investor. Even so, in this article, I make the case for the speculative option trader who understands the risks involved and knows what he or she is doing, and more importantly, why.

The Myth of Monthly Cash Flow — In this article I make the case that if you want to be successful generating high yield income from your option trades, you’ll ditch the monthly income quota mindset.

VALUE INVESTING

Option Trading Strategies for Value Investors — The primary drawback of value investing is that great companies rarely go on sale. Crappy companies go on sale all the time — that is when they’re not going out of business. Learn how options can bridge the gap between quality and price and allow you to buy great companies at great prices.

What I Learned About Investing From My 7 Year Old — It turns out that the principles involved in running a successful Coca-Cola stand in a front yard during a neighborhood-wide garage sale are the same ones used by successful long term investors. Learn what I learned from my entrepreneurial son.

Why Value Investing vs. Value Trading Matters — Learn the important difference between value investing and what I call value trading . Are you missing huge opportunities to build long term wealth because you assume value investing means only buying beaten down and battered businesses?

Margin of Safety and Options — 3 Ways to Protect Your Portfolio — If, as Benjamin Graham said, the essence of investing is the management of risk and not the management of returns, how can the individual protect his or her capital from the risk of permanent loss? Here are 3 strategic approaches.

Warren Buffett’s Real Rule Number One of Investing — Warren Buffett has a famous quote where he says that the number one rule of investing is to never lose money. And Rule #2, he says, is to See Rule #1. In this article, I make the case that Buffett’s real number one rule of investing is something else, or rather than this criterial is what enables him to not lose money.

You CAN Invest Like Warren Buffett — Some people are just $^#%#$%#. especially when they’re delibeately dishonest and intentionally seek to disempower others. In this piece, I respond to one such person and explain why you can learn a ton from Warren Buffett, and yes, you really can invest like him.

Warren Buffett 1981 Shareholder Letter — Covers: different ramifications of outright acquisitions vs. non-controlling ownership via stock purchases; an entertaining metaphor involving toads and princesses; a summary of the Berkshire Hathaway corporate acquisition philosophy; some important comments on inflation; and relevant commentary on the insurance industry.

Warren Buffett 1980 Shareholder Letter — Covers: power of retained earnings; intelligent share buybacks; inflation; and insurance operations.

Warren Buffett 1979 Shareholder Letter — Covers: the imporrance of Return on Equity (ROE) as an investing metric; important commentary on inflation; insights on selecting the best businesses to invest in; and discipline in the insurance industry (very applicable to option trading).

Warren Buffett 1978 Shareholder Letter — Covers: why Buffett loves the insurance model; Buffett’s investing criteria; the opportunities of common stock; the case for a concentrated portfolio; and why you build more wealth investing than trading.

Warren Buffett 1977 Shareholder Letter — Covers: return on equity vs. earnings per share growth; structurally advantaged investments; and buying shares vs. acquiring companies.

When is the Best Time to Buy High Quality Stocks? — So when is the best time to buy a great business? When it’s firing on all cylinders? Or when it’s struggling to execute? We also look at the impact that purchase price has on an investment.

How to Calculate Annualized Returns — See the formula for calculating annualized returns on your option trades and the benefits of this metric on your trade performance and trade management decisions.

How to Value Stocks — An Alternative to Intrinsic Value — Why the concept of intrinsic value of a business or stock is inherently faulty and the more laid back valuation alternative I propose to replace it.

Valuation and Stock Options — An Example — How to value stocks the lazy way, and why being underwater on a short put position doesn’t necessarily mean you’re drowning.

The 3 Types of Value Investing — Which Type of Value Investor Are You? — In this article, I detail the three type of value investors as I see things — value traders, value investors, and synthetic value investors.

Why is Warren Buffett Successful? — Buffett is successful because he’s Bufett and has certain ingrained qualities. But he also recognized the lethal (in a good way) cocktail of quality, price (valuation), and time.

Warren Buffett Interviews — A hodge podge of various Warren Buffett interviews.

MARKETS AND INVESTING

Fire Hydrant Investing — What kind of investor are you? Here’s my investing epiphany based on an interesting and amusing scene I witnessed from my own driveway.

2 Industries You Should Never Invest In — Are there any industries you shouldn’t invest in or trade on ethical or moral grounds? Or how do you respond to others who criticize your investments? I propose a 3 step solution to both questions. See if you agree.

Do You Have Time for Wealth? — A serious question and some tough love. Do you actually have time for wealth? I’m not talking about investment horizon here — I’m talking about priorities.

Are You Overlooking This Critical Source of Investing Returns? — I love giving myself huge discounts on my stocks, but successful investing is not just about the big, manufactured discounts. Don’t underestimate the incredible power of simply owning world class businesses in the first place.

Why Bear Markets Don’t Matter When You Own a Great Business — Easily spooked market participants see a bear market and panic. True investors in high quality businesses ignore bear markets and recessions and earn more income every year regardless of economic environment.