Stock Market Timing trading signals for DIA SPY QQQ

Post on: 29 Март, 2015 No Comment

Providing Expert Analysis in Market Timing for

Investors & Market Professionals on a Global Basis !

StockMarketTiming.com, LLC is a leading subscription-based independent financial service for investors and traders who are looking for a consistent and effective method for increasing their savings in both bullish and bearish markets. We have developed a market timing system that has one of the best long-term track records for trading the popular Exchange Traded Funds ( ETFs ) — DIA. SPY. and QQQ. Our number one goal has always been to produce results that consistently outperform the buy-and-hold strategy of investing.

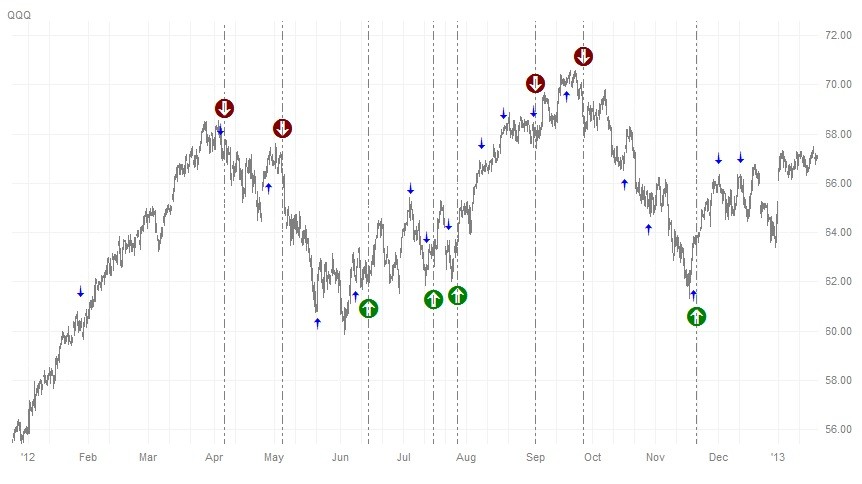

SMT’s ETF-Market Timing Service provides exact entry and exit signals (long, short, or hold cash) for trading DIA, SPY, and QQQ, along with a very comprehensive weekly newsletter.

Our ETF — Market Timing Service has consistently outperformed the market with real-time trading results since its inception. We have the highest regard for preservation of capital and risk management.

Our proprietary methodology combines our knowledge, experience and interpretation of technical analysis with a a brilliantly designed mechanical system which validates our interpretation. The mechanical system combines trend-following’ and ‘momentum’ to identify tradable impulses. This method uses what we call ‘reactive technical analysis’. Instead of trying to 100% forecast or predict the market’s direction based on past market data as in interpretive technical analysis, reactive technical analysis is geared to reacting to the market’s movements as soon as possible after they occur. Using the combination of these methods is why our performance results have been exceptional.

Results of our ETF Market Timing Service

Our Track Record vs. Buy-and-Hold Returns

Results of Year 2015 (close: 3/11/15) — Our ETF-Market Timing Service is once again outperforming the buy-and-hold strategy of investing. In Year 2015 members are up an average of +3.0% ( +2.6% DIA, +2.3% SPY, and +3.9% QQQ ). The buy-and-hold strategy is only up an average of +0.1% ( -0.9% DIA, -0.5% SPY. and +1.8% QQQ ). Our results are outperforming the buy-and-hold strategy by +2.8%. After a very successful Year 2014 with an average return of +18.3%. a record number of new members are joining our services, which is a win-win situation for all.

Results of Year 2014 — Our ETF-Market Timing Service performed spectacular in Year 2014. Members of our ETF-Market Timing service profited +14.1% DIA, +16.8% SPY, and +23.9% QQQ with an average return of +18.3%. The buy-and-hold average of the three ETFs is +12.0%. We outperformed the buy-and-hold strategy by +6.3%.

Cumulative Results (2000-2014) — Members of our ETF-Market Timing service profited from our real-time trading methodology each year an average of +19.9% DIA. +19.0% SPY. and +26.8% QQQ. whereas the average yearly gain of the buy-and-hold strategy is +4.2% DIA, +4.1% SPY, and +5.4% QQQ. Our average yearly gain is +21.9% (1/3 in each ETF: DIA, SPY, QQQ), whereas the buy-and-hold gain is +4.5% (1/3 in each ETF: DIA, SPY, QQQ).

Overall Performance — We have outperformed the stock market 10 of 15 years and never had a losing year. Our average return per year is +21.9%. whereas the buy-and-hold is +4.5%.