Stock Investing v Trust Investing

Post on: 14 Июнь, 2015 No Comment

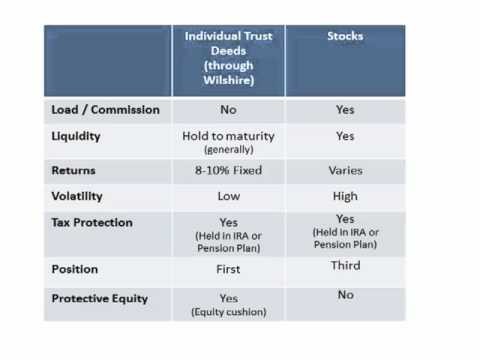

Investing in stocks vs. investing in unit trusts has always been a much debated topic. Proponents for unit trust investing would point to the fact that fund managers have the competitive advantage against retail investors, be it in terms of access to top management, analysts and to general macroeconomic information. Before I present my personal opinion, lets compare the differences in the two approaches.

Diversification

According to some financial consultants, in order to have a reasonable diversification, investors are required to have a basket of around twenty equities in ten different industries. One of the positives in investing in a fund is that one can have exposure in a number of promising stocks with relatively little capital outlay. For example, at Fundsupermart, investors can gain exposure to a basket of stocks in certain funds by applying for the regular saving plan (RSP) without putting in the initial investment. The minimum amount for a monthly RSP is about S$100. On the contrary, it will be extremely capital intensive for an individual stock investor to acquire a basket of around twenty equities in ten different industries.

Therefore, if one wants to have a relatively diversified portfolio of equities at lower cost, unit trust investing is the approach.

Loss of control

Investing in a unit trust means that you have given the power of decision making to the fund managers who should be more experienced in managing portfolios. You will not have any control on what specific stock to buy or sell. For example, if you do not like a certain industry, either based on your experience or based on some religious views, you would not be able to dictate what the fund manager invests.

Besides this loss of control in selecting the specific stock, there is another loss of control phenomenon which has become apparent since the previous financial crisis. This danger is the excessive and panicky fund redemption. In normal situations, the cash holdings in the funds, specially set aside by fund managers, will be enough to service these fund redemptions. However, during the financial crisis in 2008 and 2009, there were large, panicky fund redemptions by investors which force fund managers to liquidate some of their holdings at rock bottom prices to generate sale proceeds to fund the redemptions. Investors who do not liquidate will suffer as the fund managers are likely to sell the stocks at prices below their costs resulting in the decline in the price, or the NAV of the fund.

Loss of control for the first scenario is not necessarily bad. Some people would get very emotional whenever they manage their own investments and their decisions will be coloured by the investment biases (which I covered in Biases in Investing 25 Jan 10). The second scenario is beyond the investors control, unless one can foresee the excessive fund redemption and sell before that occurs.

Amount of time and interest available

More research is required in investing in stocks than in unit trusts. Some of the research required would be to conduct analysis on the economy (at least where the company has the main business exposure), the industry, the company, as well as, competitor analysis and to calculate the intrinsic value of the company. This is likely to take a large chunk of your personal time. Furthermore, you have to have the passion for investing to conduct all those research consistently. If you have ten companies, the amount of time spent is likely to be ten fold. Besides analyzing the companies as discreet investments, you also have to see the incremental risk impact of adding one investment to your overall portfolio. This is because one investment can have little risk but it may have a large incremental impact to the risk in your overall portfolio when it is added.

For unit trust investing, the above research will be done by the fund manager (this is what you pay them for). However, some of the research which you require to do would be to look at the costs, investment style, track record etc. Nevertheless, this research definitely takes less time than specific company analysis.

It depends on the individual investor whether he wants to put in considerable time and effort which will influence the approach to investing.

Limited flexibility in unit trust investing

Fund managers are typically restricted to invest in certain types of stocks as outlined by their investment mandate. For example, an Asian Pacific Ex Japan fund would not be able to invest in Japanese listed equities, regardless of how attractive the companies are. In addition, if this fund is a focused fund with a fund size of S$800m, it typically will invest in not more than 30 equities and each holding is likely to be around S$20-S$25m each. With this requirement, it is unlikely to invest in micro cap stocks such as Techcomp which is sporting a market capitalization of S$60m. Thus, fund managers have to operate within certain boundaries which do not restrict the stock investor.

In addition, typically, fund managers have a certain style such as value or growth. Besides, they are likely to be more inclined towards fundamental analysis and not technical analysis. Therefore, as a corollary of their specific style or type of analysis which they are more inclined to use, they would not invest in certain types of stocks. This may result in missed opportunities.

Furthermore, another constraint which fund managers face is that they are unable to hold a big proportion of their assets in idle cash for an extended period of time. As a result, fund managers are typically faced with a problem of investing those cash into assets even in times when there are limited attractive assets to invest. A stock investor does not have this constraint as he can decide as and when to deploy those cash into assets.

For stock investing, stock investors can sell for quick gains if their analysis warrants it. However, for fund managers, it is likely that there will be a longer time lapse than the individual investors as they have to go through the research, analysis, evaluation and finally the execution process through the various departments.

Overall, unit trust investing has limited flexibility than stock investing.

For unit trust investing, there are likely to be additional fees such as sales charge, redemption fees, annual management fees and performance fees. Therefore, ceteris paribus, unit trust investing has more charges than stock investing.

Information asymmetry

Information asymmetry has three aspects. The first aspect refers to the information which fund mangers are likely to have. For example, companies would invite fund managers for plant visits, road shows etc. so that they can get to know the companies better. Sometimes, during these plant visits, fund managers may be able to interview the distributors, suppliers and customers (although these are typically arranged by the companies).

Secondly, fund managers are usually supported by a robust team of investment analysts who are typically highly qualified personnel, such as CFAs or PhDs. Furthermore, they have sophisticated computer systems such as value at risk computer systems to add value in the investment decision process.

Thirdly, for investments abroad such as in Vietnam, fund managers operating in Vietnam are likely to have more information and clearer understanding of how the companies operate there. In addition, they would likely be more aware of any changes in the local governmental policies and listing requirements which may affect the companies.

For this aspect, fund managers typically have an edge over the retail investors.

Conclusion both have their uses

Therefore, in a nutshell, it depends on oneself. If one exhibits one or more of the following, it is best to consider investing in a fund, instead of investing in stocks by themselves.

- No competency, or interest, or time to analyse stocks by economy, industry, company, competitor etc.;

- Not objective in managing own assets (i.e. decision making coloured by biases in investing);

- Not knowledgeable in the functioning of the overseas markets, e.g. governmental policies and listing requirements which may affect the companies;

- Not comfortable with a focused portfolio but would like a basket of well diversified portfolio.