Stock Investing 101 PricetoEarnings Ratio (P

Post on: 16 Март, 2015 No Comment

The price-to-earnings ratio, or simply P/E ratio, is a often used metric in stock valuation. Also known as earnings multiple, multiple, or simply p/e (or pe).

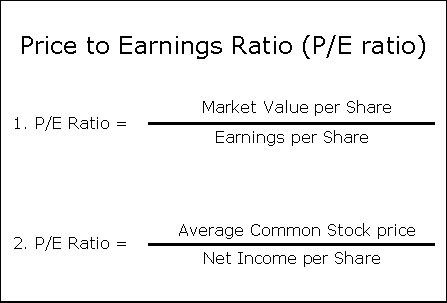

The P/E ratio is obtained by dividing the price per share by the earnings per share .

Earnings per share in this case refers to the last twelve months’ earnings. The P/E ratio derived this way is also known as trailing P/E.

If we use next year’s estimated earnings instead, we will be calculating the projected or forward P/E.

Interpreting the P/E Ratio

One simple way to understand P/E is that it gives the number of years the company will need to generate enough value to cover the cost the stock at the current market price (assuming no growth in earnings).

Like any business, the value of a stock is directly related to the company’s ability to generate cash. Thus, in a sense, a lower price-earnings ratio often suggests value.

The P/E ratio also reflects the market’s expectation regarding the future performance of the stock. Higher price-earnings ratio indicates higher expectations for the company.

Using the P/E ratio, we can compare the relative earning power of the companies regardless of their size or stock price.

On the surface, a $50 stock may seem more expensive than a $20 stock but if the $50 stock earns $5 a share while the $20 stock earns only $1, using the P/E ratio, you will be able to see that the $20 stock is twice as expensive as the $50 stock.

What is a good P/E ratio?

There maybe no such thing as a good price-to-earnings ratio. When P/E is high, one can either say its too expensive or argue that growth prospects are good. On the other hand, when P/E is low, one can say that it is a value play or that the company’s future is not too bright.

Moreover, even the average P/E varies across companies in different industries.

Conclusion

The P/E ratio is just one of the many financial ratios that are used to evaluate stocks. As it is an often quoted metric, it seems like an all important ratio to many investors but in reality, it is definitely inadequate to base your investing decision on just this metric alone.

Your new trading account is immediately funded with $5,000 of virtual money which you can use to test out your trading strategies using OptionHouse’s virtual trading platform without risking hard-earned money.

Once you start trading for real, your first 150 trades will be commission-free! (Make sure you click thru the link below and quote the promo code ’90FREE’ during sign-up)