Statements of Cash Flows

Post on: 23 Апрель, 2015 No Comment

The terms Cash Flow Statement and Statement of Cash Flows are interchangeable.

The Cash Flow Statement is relatively easy to prepare. It is better to use logic and common sense to understand what is happening and how information should be presented in this statement.

The Income Statement and Balance Sheet are both prepared using Accrual Accounting. This involves making a combination of adjustments to the books, including accruals, deferrals, apportioning costs such as depreciation, and charging Income with future expenditure such as warranty claims and post-retirement benefits. Every time we make an adjustment in the books and records, the resulting financial statements comply with accrual accounting, but are also farther away from cash accounting.

Before 1987 we prepared a third financial statement called the Statement of Changes in Financial Position. This was generally prepared on a Working Capital basis, but could also be prepared on a Cash Flow basis.

In 1987 FASB mandated the use of the Cash Flow Statement, in place of the Statement of Changes. The Statement of Cash Flows removes all accruals, deferrals and other non-cash adjustments, and provide investors and creditors with information about a company’s Sources and Uses of Cash. An Income Statement might show a Profit or a Loss, but that says nothing about how the company’s Management managed the company’s money.

Today this is more important than every. Managers are frequently caught cooking the books, hiding losses and liabilities, overstating or understating Income, all for the purpose of influencing the market price of company stock. Managers frequently benefit personally from increases in company stock prices, so there is a high incentive for these people to manipulate information.

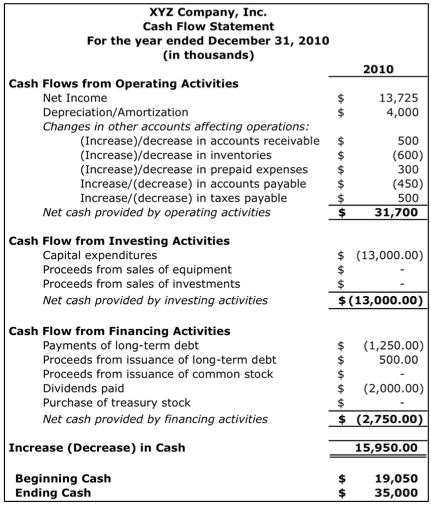

The Cash Flow Statement is fairly simple.There are only 3 sections, which report Increases and Decreases in Cash. The sections are always presented in the following order.

Operating Cash Flows

Inflows: Money received from customers for sales of products or services.

Outflows: Money paid to suppliers, employees, etc. for normal business expenses.

Investing Cash Flows

Inflows: Money received from selling assets, including land, buildings equipment, stocks, bonds. Money received from loans made to others, such as Notes Receivable.

Outflows: Money paid to purchase assets; and money paid out to make loans to others.

Financing Cash Flows

Inflows: Money received from stockholders purchasing company stock, from bondholders for bonds payable, and money borrowed from banks and other creditors.

Outflows: Money paid to stockholders for dividends, to bondholders, banks and other creditors.

The Statement of Cash Flows also reconciles the Cash balance from the beginning to end of the year. The beginning and ending Cash balances can be found on the Balance Sheet.

Direct and Indirect Method

There are 2 ways to present the Statement of Cash Flows — Direct and Indirect. FASB recommends the Direct Method, but most companies use the Indirect Method. A recent survey of company shows the following: