Statement of Cash Flows Using the Indirect Method

Post on: 22 Апрель, 2015 No Comment

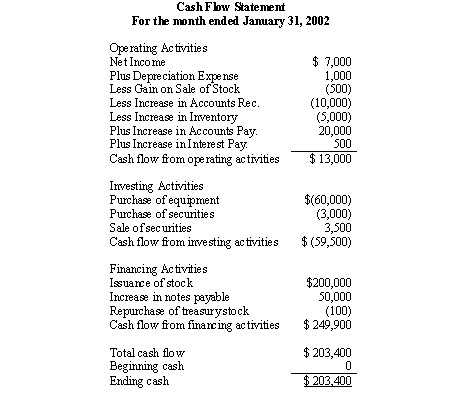

Determining the Firm’s Cash Position Through the Cash Flow Statement

You can opt-out at any time.

In order to prepare a statement of cash flows. you have to look back at the comparative balance sheets for XYZ company. From the two years of balance sheet data and some income statement data, you build your statement of cash flows. In this example, we will assume that net income is $110,500, depreciation is $50,000, and the firm pays out dividends in the amount of $65,000.

Cash Flows From Operations

The Statement of Cash Flows has three sections. The first section is Cash Flows from Operating Activities. Line 1 of this section is Net Income. To net income, add Line 2, which is depreciation. After taking net income and depreciation into account in the section for operating activities, you then consider any increases or decreases in your current asset and current liability accounts between the two years of balance sheet information from the comparative balance sheets .

Looking at the balance sheets. accounts receivable, line 3, has increased from $170,000 to $200,000 for an increase of $30,000. Since that increase occurred on the asset side of the balance sheet, it is shown as a negative figure. Why? If the firm extended $30,000 more in credit to its customers, then it had $30,000 less to use. Likewise, inventory, line 4, increased by $20,000. Prepaid expenses, line 5, decreased by $10,000. A decrease in asset account. a source of funds to the firm, is a positive number. Cash increased by $35,000 but it is not included in our initial analysis. It will soon become clear why.

Now look at the liabilities section of the balance sheet. Line 6, accounts payable, increased by $35,000. Short-term bank loans didn’t change. Accrued expenses, line 7, such as taxes and wages, decreased by $5,000. Since this is a decrease in a liability account, it is a use of funds to the firm and a negative number.

Line 8 is Net Cash Flows from Operating Activities, the summary of the first section of the Statement of Cash Flows. When you add up the adjustments to net income and depreciation, you get $150,500. The firm is generating a positive net cash flow from its operating activities.

Cash Flows from Investing Activities

The next section of the Statement of Cash Flows is Cash Flows from Investing Activities. Usually, this section includes any long-term investments the firm makes plus any investment in fixed assets. such as plant and equipment. Line 9 shows that the firm invested $30,000 more in long-term investments in 2009. That shows up as a negative number as it was a use of assets. The firm also spent $100,000 for more plant and equipment as stated on line 10.

Line 11 is Net Cash Flows from Investing Activities. the summary of the second section of the Statement of Cash Flows. It is a negative $130,000 since this was the outlay in 2009.

Cash Flows from Financing Activities

The last section of the cash flow statement is Cash Flows from Financing Activities. In this case, you have financed your firm with long-term bank loans that have increased by $50,000 as indicated on Line 12. Dividends to investors in the amount of $65,000 have also been paid, which is a cash outflow and a negative number as stated on line 13. Net Cash Flows from Financing Activities, Line 14, is a negative $15,000.

Net Cash Flows for the Business Firm

Now, we combine the three sections of the cash flow statement to see where the firm is from a cash flow perspective. When you sum the net cash flows from each section (line 15), you get a positive $5,500. This is the net increase in cash flows over the year for the business firm. Looking back at the cash account on the comparative balance sheets, the analysis is correct. Cash has increased by $5,500 from year to year.

Another calculation you will want to make is that of free cash flow .

XYZ Company Statement of Cash Flows