Startup stock options explained

Post on: 4 Май, 2015 No Comment

Startup stock options explained

Posted August 23, 2011

Stock options are a big part of the startup dream but they are often not well understood, even by senior execs who derive much of their income from stock options. Heres my attempt to explain the main issues employees should be aware of.

What they are

Stock options as typically granted give you the right to buy shares of stock in the future for a price which is determined today. The strike price is the price at which you can buy the shares in the future. If in the future the stock is worth more than the strike price, you can make money by exercising the options and buying a share of stock for the strike price. For example, your are granted 5,000 shares of stock at $4 per share in a startup. 5 years later, the stock goes public and three years after that its run up to $200 per share. You can exercise the option, paying $20,000 to buy 5,000 shares of stock which are worth $1,000,000. Congrats, youve made a $980,000 pretax profit, assuming you sell the shares immediately.

There is a small but necessary catch: when you are granted your options, they are not vested. This means that if you leave the company the week after you join, you lose your stock options. This makes sense; otherwise rather than being an incentive to stay, theyd be an incentive to job-hop as much as possible, collecting options from as many employers as you can. So, how long do you have to stay to keep your options? In most companies, they vest over four years. The most common structure is a cliff after one year when 25% of your shares vest, with the remaining shares vesting pro-rata on a monthly basis until you reach four years. Details vary from company to company; some companies vest options over 5 years and some over other periods of time, and not all employers have the cliff.

The cliff is there to protect the company and all the shareholders, including other employees from having to give shares to individuals who havent made meaningful contributions to the company

Why should you care about whether that guy who got fired after six months walked away with any options or not? Because those options dilute your ownership of the company. Remember each share represents a piece of ownership of the company. The more shares there are, the less value each one represents. Lets say when you join the startup and get 5,000 shares, there are 25,000,000 total shares outstanding. You own .02% two basis points of the company. If the company issues another 25,000,000 options or shares over the intervening five years so there are 50,000,000 shares at the IPO (typically either as part of fundraising including an IPO or to hire employees), youre left with .01% one basis point or half of your original percentage. You have had 50% dilution. You now make half as much for the same company value.

That said, dilution is not necessarily bad. The reason the board approves any dilutive transaction (raising money, buying a company, giving out stock options) is that they believe it will make the shares worth more. If your company raises a lot of money, you may own a smaller percentage, but the hope is that the presence of that cash allows the company to execute a strategy which enhances the value of the enterprise enough to more than compensate for the dilution and the price per share goes up. For a given transaction (raising $10 million) the less dilutive it is the better, but raising $15 million may be more dilutive than raising $10 million while increasing the value of each existing share.

Ownership percentage

This brings us to the number which is much more important (though it is less impressive sounding) than the number of shares what portion of the company do you own. This is often measured in percentage terms, which I think is unfortunate because very few employees other than founders wind up with one percent or even half a percent, so youre often talking about tiny fractions, which is irritating. I think it is more useful to measure it in basis points hundredths of a percent. Regardless of units, this is the number that matters. Why?

Lets say company A and company B are both, after lots of hard work, worth $10 billion (similar to Red Hat, for example). Long ago Albert went to work at company A and Bob went to work at company B. Albert was disappointed that he only got 5,000 options, and they were granted at a price of $4 each. Bob was very happy he was granted 50,000 options at only 20 cents each. Who got the better deal? It depends. Lets say company A had 25,000,000 shares outstanding, and company B had 500,000,000 shares outstanding. After many years and 50% dilution in each case, company A has 50,000,000 shares outstanding so they are worth $200 each and Albert has made a profit of $980,000 on his options ($1 million value minus $20,000 exercise cost). Company B has 1 billion shares outstanding, so they are worth $10 each. Bobs options net him a profit of $9.80 each, for a total profit of $490,000. So while Bob had more options at a lower strike price, he made less money when his company achieved the same outcome.

This becomes clear when you look at ownership percentage. Albert had 2 basis points, Bob had one. Even though it was less shares, Albert had more stock in the only way that matters.

How many shares outstanding is normal? At some level the number is totally arbitrary, but many VC funded companies tend to stay in a similar range which varies based on stage. As a company goes through more rounds of funding and hires more employees, it will tend to issue more shares. A normal early stage startup might have 25-50 million shares outstanding. A normal mid-stage (significant revenue and multiple funding rounds, lots of employees with a full exec team in place) might have 50-100 million shares outstanding. Late stage companies that are ready to IPO often have over 100 million shares outstanding. In the end the actual number doesnt matter, what matters is the total number relative to your grant size.

I talked briefly about exercising options above. One important thing to keep in mind is that exercising your options costs money. Depending on the strike price and the number of options you have, it might cost quite a bit of money. In many public companies, you can do a cashless exercise or same-day-sale where you exercise and sell in one transaction and they send you the difference. In most private companies, there is no simple way to do the equivalent. Some private companies allow you to surrender some of the shares youve just exercised back to the company at their fair market value; read your options agreement to see if this is offered. Ill talk more about fair market value below, but for now Ill just say that while its great to have this option, it isnt always the best deal if you have any alternative.

The other really important thing to consider in exercising stock options are taxes, which I will discuss later.

Fair market value

In my opinion, the process by which the fair market value of startup stock is determined often produces valuations at which it would be very difficult to find a seller and very easy to find buyers in other words a value which is often quite a bit lower than most peoples intuitive definition of market value. The term fair market value in this context has a very specific meaning to the IRS, and you should recognize that this technical meaning might not correspond to a price at which it would be a good idea to sell your shares.

Why is the IRS involved and what is going on? Stock option issuance is governed in part by section 409a of the internal revenue code which covers non-qualified deferred compensation compensation workers earn in one year that is paid in a future year, other than contributions to qualified plans like 401(k) plans. Stock options present a challenge in determining when the compensation is paid. Is it paid when the option is granted, when it vests, when you exercise the option, or when you sell the shares? One of the factors that the IRS uses to determine this is how the strike price compares to the fair market value. Options granted at below the fair market value cause taxable income, with a penalty, on vesting. This is very bad; you dont want a tax bill due when your options vest even if you havent yet exercised them.

Companies often prefer lower strike prices for the options this makes the options more attractive to potential employees. The result of this was a de-facto standard to set the fair market value for early stage startup options issuance purposes to be equal to 10% of the price investors actually paid for shares (see discussion on classes of stock below).

In the case of startup stock options, they specify that a reasonable valuation method must be used which takes into account all available material information. The types of information they look at are asset values, cash flows, the readily determinable value of comparable entities, and discounts for lack of marketability of the shares. Getting the valuation wrong carries a stiff tax penalty, but if the valuation is done by an independent appraisal, there is a presumption of reasonableness which is rebuttable only upon the IRS showing that the method or its application was grossly unreasonable.

Classes of stock

Most startups have both common and preferred shares. The common shares are generally the shares that are owned by the founders and employees and the preferred shares are the shares that are owned by the investors. So whats the difference? There are often three major differences: liquidation preferences, dividends, and minority shareholder rights plus a variety of other smaller differences. What do these mean and why are they commonly included?

The biggest difference in practice is the liquidation preference, which usually means that the first thing that happens with any proceeds from a sale of the company is that the investors get their money back. The founders/employees only make money when the investors make money. In some financing deals the investors get a 2x or 3x return before anyone else gets paid. Personally I try to avoid those, but they can make the investors willing to do the deal for less shares, so in some situations they can make sense. Investors often ask for a dividend (similar to interest) on their investment, and there are usually some provisions requiring investor consent to sell the company in certain situations.

Employees typically get options on common stock without the dividends or liquidation preference. The shares are therefore not worth quite as much as the preferred shares the investors are buying.

How much are they worth

That is, of course, the big question. If the fair market value doesnt match the price at which you reasonably believe you could find a buyer, how do you about estimating the real world value of your options?

If your company has raised money recently, the price that the investors paid for the preferred shares can be an interesting reference point. My experience has been that a market price (not the official fair market value, but what VCs will pay) for common shares is often between 50% and 80% of the price the investors pay for preferred shares. The more likely that the company will be sold at a price low enough that the investors benefit from their preference the greater the difference between the value of the preferred shares and the common shares.

The other thing to keep in mind is that most people dont have the opportunity to buy preferred shares for the price the VCs are paying. Lots of very sophisticated investors are happy to have the opportunity to invest in top-tier VC funds where the VCs take 1-2% per year in management fees and 25-30% of the profits. All told, theyre netting around 60% of what theyd net buying the shares directly. So when a VC buys common shares at say 70% of the price of preferred shares, that money is coming from a pension fund or university endowment who is getting 60% or so of the value of that common share. So in effect, a smart investor is indirectly buying your common shares for around the price the VCs pay for preferred.

If there hasnt been a round recently, valuing your shares is harder. The fair market value might be the closest reference point available, but I have seen cases where it is 30-60% (and occasionally further) below what a rational investor might pay for your shares. If its the only thing you have, you might guess that a market value would be closer to 2x the fair market value, though this gap tends to shrink as you get close to an IPO.

Expiration and termination

Options typically expire after 10 years, which means that at that time they need to be exercised or they become worthless. Options also typically terminate 90 days after you leave your job. Even if they are vested, you need to exercise them or lose them at that point. Occasionally this is negotiable, but that is very rare dont count on being able to negotiate this, especially after the fact.

The requirement to exercise within 90 days of termination is a very important point to consider in making financial and career plans. If youre not careful, you can wind up trapped by your stock options; Ill discuss this below.

Occasionally stock options will have acceleration language where they vest early upon certain events, most frequently a change of control. This is an area of asymmetry where senior executives have these provisions much more frequently than rank-and-file employees. There are three main types of acceleration: acceleration on change of control, acceleration on termination, and double trigger acceleration which requires both a change of control and your termination to accelerate your vesting. Acceleration can be full (all unvested options) or partial (say, 1 additional years vesting or 50% of unvested shares).

In general, I think acceleration language makes sense in two specific cases but doesnt make sense in most other cases: first, when an executive is hired in large part to sell a company, it provides an appropriate incentive to do so; second when an executive is in a role which is a) likely to be made redundant when the company is sold and b) would be very involved in the sale should it occur it can eliminate some of the personal financial penalty that executive will pay and make it easier for them to focus on doing their job. In this second case, I think a partial acceleration, double trigger is fair. In the first case, full acceleration may be called for, single trigger.

In most other cases, I think executives should get paid when and how everyone else gets paid. Some executives think it is important to get some acceleration on termination. Personally I dont Id rather focus my negotiation on obtaining a favorable deal in the case where Im successful and stick around for a while.

How many should you get

How many stock options you should get is largely determined by the market and varies quite a bit from position to position. This is a difficult area about which to get information and Im sure that whatever I say will be controversial, but Ill do my best to describe the market as I believe it exists today. This is based on my experience at two startups and one large company reviewing around a thousand options grants total, as well as talking to VCs and other executives and reviewing compensation surveys.

First, Ill talk about how I think about grant sizes, then give some specific guidelines for different positions.

I strongly believe that the most sensible way to think about grant sizes is by dollar value. As discussed above, number of shares doesnt make sense. While percent of company is better it varies enormously based on stage so it is hard to give broadly applicable advice: 1 basis point (.01 percent) of Google or Oracle is a huge grant for a senior exec but at the same time 1 basis point is a tiny grant for an entry level employee at a raw series-A startup; it might be a fair grant for a mid-level employee at a pre-IPO startup. Dollar value helps account for all of this.

In general for these purposes I would not use the 409a fair market value. I would use either a) the value at the most recent round if there was one or b) the price at which you think the company could raise money today if there hasnt been a round recently.

What I would then look at is the value of the shares you are vesting each year, and how much they are worth if the stock does what the investors would like it to do increases in value 5-10 times. This is not a guaranteed outcome, nor is it a wild fantasy. What should these amounts be? This varies by job level:

Entry level: expect the annual vesting amount to be comparable to a small annual bonus, likely $500-$2500. Expect the total value if the company does well to be be enough to buy a car, likely $25-50k.

Experienced: most experienced employees will fall in to this range. Expect the annual vesting amount to be comparable to a moderate annual bonus, likely $2500-$10k, and the total value if the company does well to be enough for a down-payment on a silicon valley house or to put a kid through college, likely around $100-200k.

Key management: director-level hires and a handful of very senior individual contributors typically fall into this range. Key early employees often wind up in this range as the company grows. Expect the annual vesting amount to be like a large bonus, likely $10k-40k and the total value if the company does well to be enough to pay off your silicon valley mortgage, likely $500k-$1 million.

Executive: VP, SVP, and CxO (excluding CEO). Expect the annual vesting amount to be a significant fraction of your pay, likely $40-100k+, and the value if the company does well to be $1 million or more.

For those reading this from afar and dreaming of silicon valley riches, this may sound disappointing. Remember, however, that most people will have roughly 10 jobs in a 40 year career in technology. Over the course of that career, 4 successes (less than half) at increasing levels of seniority will pay off your student loans, provide your downpayment, put a kid through college, and eventually pay off your mortgage. Not bad when you consider that youll make a salary as well.

What should I ask

You should absolutely ask how many shares are outstanding fully diluted. Your employer should be willing to answer this question. I would place no value on the stock options of an employer who would not answer this clearly and unambiguously. Fully diluted means not just how many shares are issued today, but how many shares would be outstanding if all shares that have been authorized are issued. This includes employee stock options that have been granted as well shares that have been reserved for issuance to new employees (a stock pool; it is normal to set aside a pool with fundraising so that investors can know how many additional shares they should expect to have issued), and other things like warrants that might have been issued in connection with loans.

You should ask how much money the company has in the bank, how fast it is burning cash, and the next time they expect to fundraise. This will influence both how much dilution you should expect and your assessment of the risk of joining the company. Dont expect to get as precise an answer to this question as the previous one, but in most cases it is reasonable for employees to have a general indication of the companys cash situation.

You should ask what the strike price has been for recent grants. Nobody will be able to tell you the strike price for a future grant because that is based on the fair market value at the time of the grant (after you start and when the board approves it); I had a friend join a hot gaming company and the strike price increased 3x from the time he accepted the offer to the time he started. Changes are common, though 3x is somewhat unusual.

You should ask if they have a notion of how the company would be valued today, but you might not get an answer. There are three reasons you might not get an answer: one, the company may know a valuation from a very recent round but not be willing to disclose it; two the company may honestly not know what a fair valuation would be; three, they may have some idea but be uncomfortable sharing it for a variety of legitimate reasons. Unless you are joining in a senior executive role where youll be involved in fundraising discussions, theres a good chance you wont get this question answered, but it cant hurt to ask.

If you can get a sense of valuation for the company, you can use that to assess the value of your stock options as I described above. If you cant, Id use twice the most recent fair market value as a reasonable estimate of a current market price when applying my metrics above.

Early exercise

One feature some stock plans offer is early exercise. With early exercise, you can exercise options before they are vested. The downside of this is that it costs money to exercise them, and there may be tax due upon exercise. The upside is that if the company does well, you may pay far less taxes. Further, you can avoid a situation where you cant leave your job because you cant afford the tax bill associated with exercising your stock options (see below where I talk about being trapped by your stock options).

If you do early exercise, you should carefully evaluate the tax consequences. By default, the IRS will consider you to have earned taxable income on the difference between the fair market value and the strike price as the stock vests. This can be disastrous if the stock does very well. However, there is an option (an 83b election in IRS parlance) where you can choose to pre-pay all taxes based on the exercise up front. In this case the taxes are calculated immediately, and they are based on the difference between the fair market value and the strike price at the time of exercise. If, for example, you exercise immediately after the stock is granted, that difference is probably zero and, provided you file the paperwork properly, no tax is due until you sell some of the shares. Be warned that the IRS is unforgiving about this paperwork. You have 30 days from when you exercise your options to file the paperwork, and the IRS is very clear that no exceptions are granted under any circumstances.

I am a fan of early exercise programs, but be warned: doing early exercise and not making an 83b election can create a financial train wreck. If you do this and you are in tax debt for the rest of your life because of your companys transient success, dont come crying to me.

What if you leave? The company has the right, but not the obligation, to buy back unvested shares at the price you paid for them. This is fair; the unvested shares werent really yours until you completed enough service for them to vest, and you should be thankful for having the opportunity to exercise early and potentially pay less taxes.

Taxes on stock options are complex. There are two different types of stock options, Incentive Stock Options (ISOs) and Non-Qualified Stock Options which are treated differently for stock purposes. There are three times taxes may be due (at vesting, at exercise, and at sale). This is compounded by early exercise and potential 83b election as I discussed above.

This section needs a disclaimer: I am not an attorney or a tax advisor. I will try to summarize the main points here but this is really an area where it pays to get professional advice that takes your specific situation into account. I will not be liable for more than what you paid for this advice, which is zero.

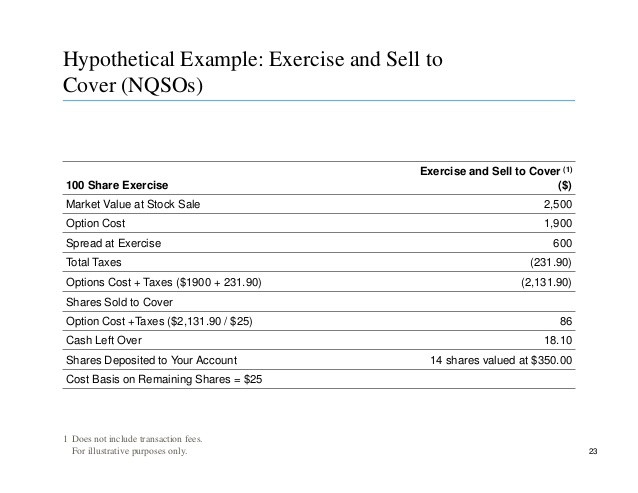

For the purposes of this discussion, I will assume that the options are granted at a strike price no lower than the fair market value and, per my discussion on early exercise, Ill also assume that if you early exercise you made an 83b election so no taxes are due upon vesting and I can focus on taxes due on exercise and on sale. Ill begin with NSOs.

NSO gains on exercise are taxed as ordinary income. For example, if you exercise options at a strike price of $10 per share and the stock is worth $50 per share at the time of exercise, you owe income taxes on $40 per share. When you sell the shares, you owe capital gains (short or long term depending on your holding period) on the difference between the value of the shares at exercise and when you sell them. Some people see a great benefit in exercising and holding to pay long term capital gains on a large portion of the appreciation. Be warned, many fortunes were lost doing this.

What can go wrong? Say you have 20,000 stock options at $5 per share in a stock which is now worth $100 per share. Congrats! But, in an attempt to minimize taxes, you exercise and hold. You wipe out your savings to write a check for $100,000 to exercise your options. Next April, you will have a tax bill for an extra $1.9 million in income; at todays tax rates that will be $665,000 for the IRS, plus something for your state. Not to worry though; its February and the taxes arent due until next April; you can hold the stock for 14 months, sell in April in time to pay your taxes, and make capital gains on any additional appreciation. If the stock goes from $100 to $200 per share, you will make another $2 million and youll only owe $300,ooo in long term capital gains, versus $700,000 in income taxes. Youve just saved $400,000 in taxes using your buy-and-hold approach.

But what if the stock goes to $20 per share? Well, in the next year you have a $1.6 million capital loss. You can offset $3,000 of that against your next years income tax and carry forward enough to keep doing that for quite a while unless you plan to live more than 533 years, for the rest of your life. But how do you pay your tax bill? You owe $665,000 to the IRS and your stock is only worth $400,000. Youve already drained your savings just to exercise the shares whose value is now less than the taxes you owe. Congratulations, your stock has now lost you $365,000 out of pocket which you dont have, despite having appreciated 4x from your strike price.

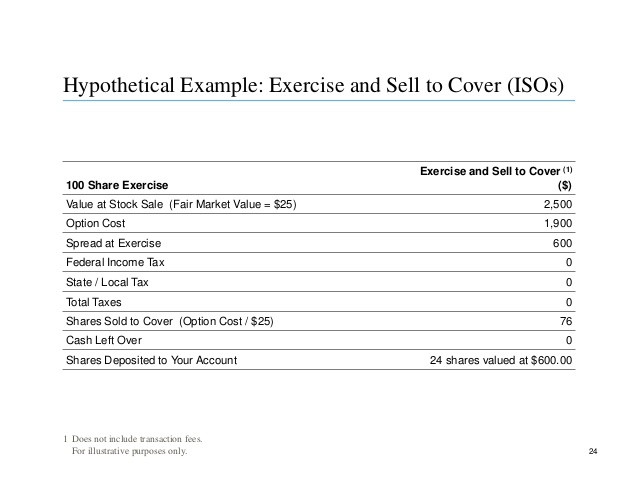

How about ISOs? The situation is a little different, but danger still lurks. Unfortunately, ISOs can tempt you in to these types of situations if youre not careful. In the best case, ISOs are tax free on exercise and taxed as capital gains on sale. However, that best case is very difficult to actually achieve. Why? Because while ISO exercise is free of ordinary income tax, the difference between the ISO strike price and value at exercise is treated as a tax preference and taxable under AMT. In real life, you will likely owe 28% on the difference between strike price and the value when you exercise. Further, any shares which you sell before you have reached 2 years from grant and 1 year from exercise are disqualified and treated as NSOs retroactively. The situation becomes more complex with limits option value for ISO treatment, AMT credits, and having one tax basis in the shares for AMT purposes and one for other purposes. This is definitely one on which to consult a tax advisor.

If youd like to know if you have an ISO or NSO (sometimes also called NQSO), check your options grant paperwork, it should clearly state the type of option.

Illiquidity and being trapped by stock options

Ill discuss one more situation: being trapped by illiquid stock options. Sometimes stock options can be golden handcuffs. In the case of liquid stock options (say, in a public company), in my opinion this is exactly as they are intended and a healthy dynamic: if you have a bunch of in-the-money options (where the strike price is lower than the current market price), you have strong incentive to stay. If you leave, you give up the opportunity to vest additional shares and make additional gains. But you get to keep your vested shares when you leave.

In the case of illiquid options (in successful private companies without a secondary market), you can be trapped in a more insidious way: the better the stock does, the bigger the tax bill associated with exercising your vested options. If you go back to the situation of the $5 per share options in the stock worth $100 per share, they cost $5 to exercise and another $33.25 per share in taxes. The hardest part is the more theyre worth and the more youve vested, the more trapped you are.

This is a relatively new effect which I believe is an unintended consequence of a combination of factors: the applicability of AMT to many ordinary taxpayers; the resulting difficulties associated with ISOs, leading more companies to grant NSOs (which are better for the company tax-wise); the combination of Sarbanes-Oxley and market volatility making the journey to IPO longer and creating a proliferation of illiquid high-value stock. While I am a believer in the wealthy paying their share, I dont think tax laws should have perverse effects of effectively confiscating stock option gains by making them taxable before theyre liquid and I hope this gets fixed. Until then to adapt a phrase caveat faber .

Can the company take my vested shares if I quit

In general in VC funded companies the answer is no. Private equity funded companies often have very different option agreements; recently there was quite a bit of publicity about a Skype employee who quit and lost his vested shares. I am personally not a fan of that system, but you should be aware that it exists and make sure you understand which system youre in. The theory behind reclaiming vested shares is that you are signing up for the mission of helping sell the company and make the owners a profit; if you leave before completing that mission, you are not entitled to stock gains. I think that may be sensible for a CEO or CFO, but I think a software engineers mission is to build great software, not to sell a company. I think confusing that is a very bad thing, and I dont want software engineers to be trapped for that reason, so I greatly prefer the VC system.

I also think it is bad for innovation and Silicon Valley for there to be two systems in parallel with very different definitions of vesting, but thats above my pay grade to fix.

What happens to my options if the company is bought or goes public?

In general, your vested options will be treated a lot like shares and you should expect them to carry forward in some useful way. Exactly how they carry forward will depend on the transaction. In the case of an acquisition, your entire employment (not just your unvested options) are a bit up in the are and where they land will depend on the terms of the transaction and whether the acquiring company wants to retain you.

In an IPO, nothing happens to your options (vested or unvested) per se, but the shares you can buy with them are now easier to sell. However there may be restrictions around the time of the IPO; one common restriction is a lockup period which requires you to wait 6-12 months after the IPO to sell. Details will vary.

In a cash acquisition, your vested shares are generally converted into cash at the acquisition price. Some of this cash may be escrowed in case of future liabilities and some may be in the form of an earn-out based on performance of the acquired unit, so you may not get all the cash up front. In the case of a stock acquisition, your shares will likely be converted into stock in the acquiring company at a conversion ratio agreed as part of the transaction but you should expect your options to be treated similarly to common shares.