Smooth Move Equity Derivs Offset Risk

Post on: 2 Июль, 2015 No Comment

Advertisement

Equity derivatives are no longer the preserve of hedge funds. Institutional investors and corporates are increasingly using them to offset risk and manage share buybacks.

Equity derivatives markets emerged from their post-financial-crisis doldrums and saw business volumes grow rapidly last year. The growth in volumes is partly owing to the upturn in underlying stock markets across the developed economies and the fading attractions of US Treasuries and other safe-haven assets as the tapering of quantitative easing approaches. But it also stems from corporations need to hedge investment risk, and it often comes down to the ability of derivatives providers to generate new products based upon technological innovations and more sophisticated trading platforms.

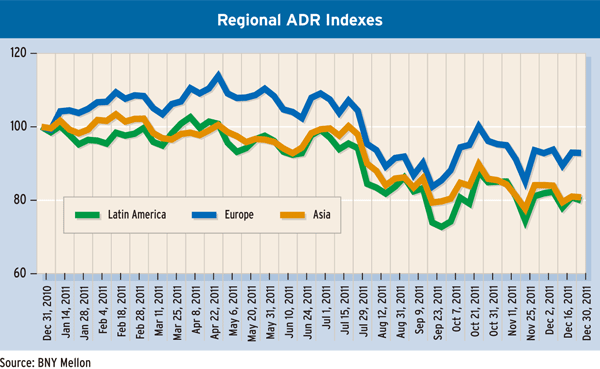

Asia was the star performer of 2013. Total volumes of equity derivatives originating there surged by some 30% over the past year. Japan has been the number-one focus for many investors, says Alastair Beattie, head of European flowexotic sales and UK flow sales at Socit Gnrale, a dominant player in Japanese equity derivatives. They prefer using derivatives, he says, in order to maximize their exposure to the upside of Abenomics, and call spreads have been especially attractive as upside volatility skew is flat.

Beattie further points to a rapid upturn in cross-border investmentnot just into Japan, where the first wave was mainly foreign investors, but also into Europe where returning US investors have focused on once-lowly-rated financials and stocks in peripheral countries. Investors in these markets, says Beattie, are happy to gain exposure through options, thereby limiting their downside risk. The advantages of derivativeslower transaction costs, liquid markets and the fact that they remain the most effective method of hedging investment riskcombined with sparkling performances from underlying equities in most developed markets, have drawn in conservative investors alongside major market participants like macro hedge funds. Volatility overall is low, observes Beattie, which makes it [equity derivatives] attractive for institutions, including pension funds and insurance companies, to invest through options.

A NEW CLASS OF INVESTOR

From controlling risk exposure to offsetting transaction costs and fees, says Adam Cohen, managing director and head of institutional clearing sales, Americas, at brokerage Newedge, derivatives have a vital role to play for institutional investors. In fact, more than 27% of US mutual funds, 63% of Italian and 53% of French mutual funds use derivatives today. What we are hearing from clients is that those who employ derivatives such as futures across their funds can equitize new cash inflows and provide flexibility and risk control to cash equity portfolios.