SmartBeta ETFs Could Be a Good Fit for Your Portfolio

Post on: 8 Май, 2015 No Comment

Indexing News:

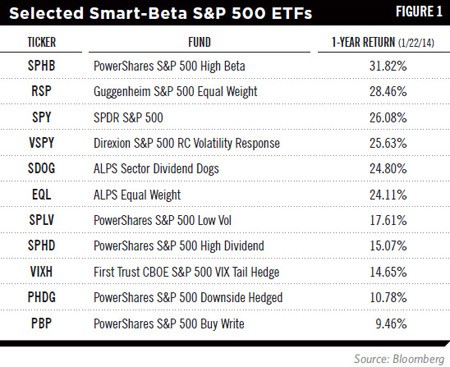

As the number of strategic- or smart-beta exchange traded funds proliferate, potential investors should understand how the various products work and how the strategies can fit into an investment portfolio.

These smart-, alternative- or strategic-beta ETFs that track specific factors can cover a number of broad themes, including equal weight, low volatility and fundamental strategies, which employ varying screens and weights, as opposed to traditional market-capitalization-weighted methodologies, writes Anthony B. Davidow, vice president for alternative beta and asset allocation strategist at Schwab Center for Financial Research, for InvestmentNews .

Its important that investors understand the different sector allocations, market capitalizations and value-growth tilts of these strategies before making any investment decisions, particularly as the strategies gain popularity, Davidow said.

Investors can think of the new breed of smart-beta ETFs as a compromise between traditional beta-indexing funds and actively managed strategies. These factor-based ETFs passively track an underlying index, but the indices are customized to mirror actively managed investment styles. [What Smart Beta ETFs Bring to the Table ]

For instance, smart-beta ETFs can track companies based on financial health like cash flow, dividends, earnings and book value, or other factors like momentum and relative strength.

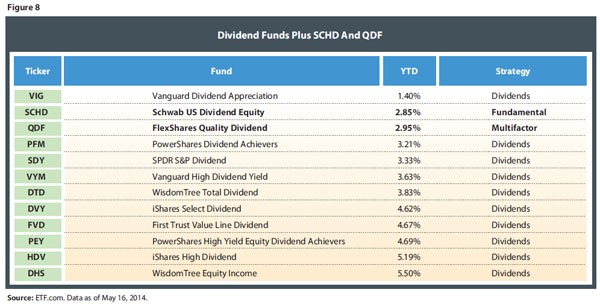

Fundamental strategies can potentially generate excess returns: When it comes to the smart beta slice of the portfolio, we have focused on fundamental strategies because of their strong absolute and relative results compared to traditional market-cap indexes and many actively managed funds, Davidow added.

Davidow also suggests advisors and investors could incorporate smart-beta ETFs based on different preferences. For those who are worried about tracking errors, fundamental index-based funds may exhibit larger deviations. Fundamental-based ETFs, though, do not provide downside protection. As Davidow argues, smart-beta funds could generate alpha. Additionally, the strategic-beta options, like other ETFs, come with low fees, compared to active funds.

Looking ahead, the smart-beta ETF space could be on the verge of a boom as investors, faced with an aging bull market, rising rates and other head winds, could seek new ways to capture returns, writes Jeff Benjamin for InvestmentNews. [Large Waves in the Smart-Beta ETF Space ]

Specifically, some are addressing the shortcomings of cap-weighted index funds. Since market-cap indices would overweight the largest stocks, companies that have outperformed would gain a larger tilt, so investors may be overexposed to the best performers. Instead, smart-beta ETFs could allow investors to tap into companies with strong fundamentals or other factors that could weather the changing environment ahead.

For more information on smart-beta strategies, visit our indexing category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.