Small Business Finance the basics

Post on: 9 Август, 2015 No Comment

Small Business Finance — the basics

When it comes to small business finance, we need to understand basic concepts in accounting, and make decisions about start-up funding and continued investment in our enterprise. Let me overview the basics here in each of these areas.

Before we can talk about financing for a small business, let’s make certain we have a solid business plan and we’re following it. If you focus on financial matters before developing a business model, it’s like having the cart out in front of the horse — not a good idea at all.

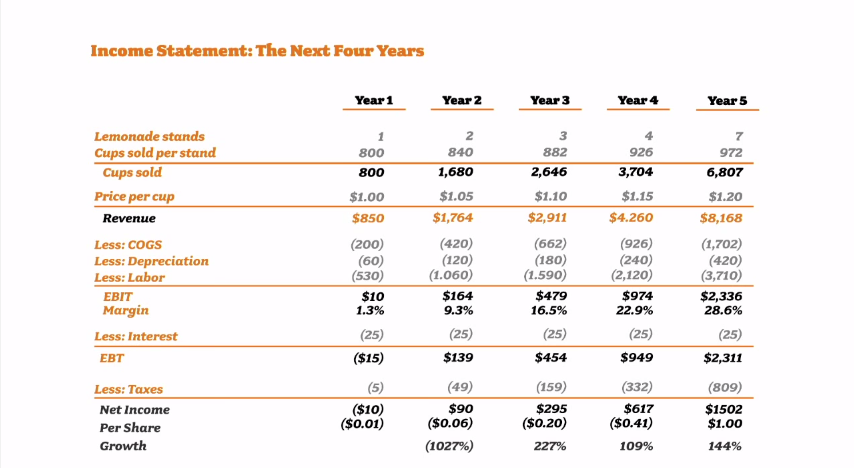

With a good business plan, you’ll have a financial model built based on a solid business strategy, and that will allow you to be well versed in revenue streams, expenses and cash flow, as well as be conversant and convincing when it comes to the need for start-up funding and capital investment in your ongoing enterprise.

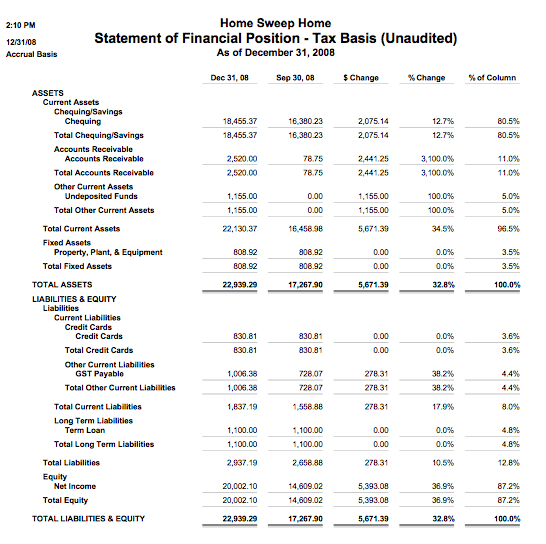

Understanding small business finance is also important when it comes to tax time so you have a good handle on what your expenses are versus income. You’ll also want to know these things when it comes time to conduct a review of the business — which you should be doing regularly. There are plenty of sites that let you compare accounting software. You need to know what you’ve invested versus the return you’re seeing on that investment.

This discussion provides an overview, with more detailed discussion found in the pages linked herein. Keep in mind that with a small enterprise, rolling out slowly or in a limited manner can mean lower risk, a simple approach is easier to implement and manage, and better planning leads to better results. With that in mind, let’s look at the general topics of small business finance.

Understanding Basic Small Business Finance

Let’s look at the basics first so we get our feet on the ground with respect to small business finance. Some of this may be very elementary in nature, but it pays to get a clear understanding from the very start. I’ve encountered people who have difficulty understanding finance in business. even at a very basic level, so make certain you’re not one of them. A good understanding of the basics helps us think more clearly and comprehensively about our endeavor and will eventually help lead us to success.

First, let’s look at the costs of doing business. Here is where we make investments in time, space, emotion, effort and money to make our business happen. Focusing on the monetary aspects of costs, we might have:

- loans

- employee salaries/bonuses

- rent/lease

- materials

- supplies

- contractors

- services

- utilities

- insurance

- equipment

- tools

- inventory

- fees

- taxes (payroll, income, property)

Some of these costs are monthly, some of them are periodic or irregular in nature. All have to be accounted for and anticipated as part of the business planning process, and monitored as part of day-to-day business management. Costs are relatively easy to understand — they usually arrive as a bill and need to be paid.

The more difficult aspect of small business finance is to distinguish between gross revenue and profit. Gross revenue is what your customer pays you for goods and services. From that amount, you need to subtract the costs associated with goods and services, and all other expenses to arrive at your profit.

For example, let’s say you’re in the house painting business and you buy paint, paint brushes and rollers, and contract with two guys to help you paint a house. You have direct costs for materials, supplies, and contractors that need to be subtracted from what you make from the homeowner on the job. Let’s say you charged a flat fee of $1,500 to paint the house. From that, perhaps you’ll need to subtract:

- $250 for paint

- $600 for contract help

- $150 in tools and materials

That’s $1,000 in expenses for a $1,500 job, leaving you with what appears to be $500 profit. You’ve done a job estimate in advance and it looks like a profitable job indeed. Not so fast. There are other things that chew away at that apparent profit. Remember, you have general operating costs associated with your business. These are known as indirect costs and include such things as:

- equipment

- vehicles

- fuel

- rent on a building or storage unit

- insurance

- uninsured damage and losses

It’s hard to estimate how much of these overhead costs are attributable to a particular job, but they chew up your potential profits nonetheless. If you have dozens of jobs in a particular month, the amount that business overhead consumes is minimal per dollar earned. If you only have one job, your overhead could consume all potential profit or even give you a loss for a particular month. In any event, high overhead is a burden you need to steer clear of, and low overhead is generally the best position to be in.

Likewise, you might have customer issues with the house painting job that delays payment to you. If the payment shows up months after the job is completed, you will have already paid your contractors and suppliers. and the income looks like a windfall. It’s not. It offsets costs you’ve already incurred, so don’t look at it as if someone dropped a pile of cash in your lap.

The key to success is to sort out what your normal business financial picture looks like from the one time expenses and incomes that are irregular. In that way, you can determine what your general return on investment might be. You’re looking to see whether over the long term you can make reasonable profit from the enterprise or whether you’re throwing money into a black hole.

One of the small business finance tools you can use to determine what your hot, straight and normal financial picture should look like, if you’re in a service business, is to run a billing capacity calculation. Performing this calculation should help you see what full employment looks like, and it can be quite an eye-opener.

When you have a realistic view of your financial picture, including return on investment, then you can make decisions about additional investment, expansion, cost cutting or bailing out altogether.

Startup Funding

For a very small venture, or something that is quite simple in nature, you might be inclined to be self-funded. That would be my first choice for the most basic enterprises where start-up costs are limited and manageable. The advantage of something that is self-funded is quite simply that you’ll be especially careful about how the money is used in the business, and you’re the only one telling you how to spend it. The downside is the risk isn’t shared.

In the event that you are seeking a small loan and you need it quickly, you can consider getting a cash advance as another way to self-fund the business. This option for small business start-up would most likely apply to relatively small enterprises. It’s also a good thing to consider in the event you need a small cash infusion to carry you over between the ebb and flow of revenue. The advantage of the cash advance is it’s quick and easy, and can be done repeatedly whenever it’s needed. The disadvantage is that it can easily be abused if you’re not conservative in your approach to small business finance management. And, of course, the price of the cash advance convenience is a higher cost of money than other sources.

The following funding options will require some sort of a credit check, so make certain you’re credit worthy when seeking this type of business finance.

A personal line of credit is another way to self-fund a business. It’s very much like giving yourself a loan, a little at a time. It can be a good option for a modest size business that is expected to have recurring costs over it’s start-up and early operational phases. It’s also a good way to have money on hand, just in case. A personal line of credit typically involves you having a checkbook attached to the credit account with a limit. When you need cash, you write a check. If you have good credit and decent income, a healthy credit line can be obtained without collateral.

Small business finance for start-up operations can be obtained from the Small Business Administration (SBA) in the form of a loan. Typically, you’ll need a business plan and some form of collateral. The loan is done through a bank that works with the SBA. The advantage of SBA is more hand holding for the beginner and larger loan amounts. The big disadvantage is simply dealing with the government.

A business loan from a credit union or bank works very similar to an SBA loan except you don’t have the government involved. This can make the lender a little more reluctant to make a loan, but if you have a good business plan, then I wouldn’t worry about it. The lender will want to make certain you have collateral or some demonstrated way of paying back the loan, and it will likely involve the lender as a lien holder with respect to real property, improvements and equipment associated with the business.

Private investors and cooperatives are another way to get startup funding. This route of course means that those who invest will want return on investment in the form of interest payments, dividends, discount on goods and services, and/or a piece of the action — a share of what you’re developing. The advantage of this type of funding is you’re likely to find multiple people willing to invest a modest amount, whereas finding a few to invest a lot could be rather difficult. The drawback to this is simply that private investors often want a hand at managing the affairs of the business and that can spell trouble as too many cooks spoil the broth.

Continued Investment

Once you’re up and running, you’ll have the opportunity or need to reinvest in your business. It may be time to upgrade your facility or equipment, add to your staff, or branch out into new areas for products and services. In any case, it represents a reinvestment in your business and will require funding.

The first thing to assess is how well your base business is performing. This means you need to take a close look at return on investment. The key is turning a profit so the business is paying for itself and providing reasonable income for those involved.

If you aren’t paying down startup loans, then it’s likely that you’re not making an income sufficient to support continued investment in or expansion of the business. You need to be realistic and assess whether you’ve created a black hole for your initial investment or whether you’re turning the corner and going from red to black on the general ledger.

If you’re not out of the financial woods, then you need to find ways to cut operating expenses and reduce overhead costs to increase profit margins, and/or enhance revenue streams through more or larger sales. There isn’t much sense in investing more into a business that isn’t likely to turn a reasonable profit.

Assuming that you’re making profit, it’s then a matter of determining whether additional investment will be worthwhile. Again, this is a return on investment decision that is always at the heart of small business finance. If newer, better, more and bigger will give you higher profits, then you need to see if those higher profits can justify the investment.

The sooner you see positive return on investment the better, but there are a lot of things to consider like how often the resource will be used, how it relates to your core business function, and how it contributes to the bottom line. One of the keys to continued investment in your business is to focus on effectiveness and skip the idea of prestige.

Business Insurance

So, you’ve made your investment and are enjoying some revenue. What about insurance? It’s something to consider. Know your risks and know what kind of insurance you’ll need. Here’s a guest article written to address the question, When Do You Need Business Insurance? There is no sense placing all of your hard work and investment at risk. Consider appropriate forms of insurance so a financial disaster won’t knock you out of business.

Small Business Finance Summary

To be a successful entrepreneur, you need to be good at many things. Often we tend to focus on the technical — painting the house, fixing the cars, writing the reports, transporting the goods, or running the restaurant. Yes, that’s important, but understanding and mastering small business finance is essential as well. It’s necessary to get your business started, make it self-supporting, and understand if and when to expand or enhance business operations.

You don’t have to be an accountant to be good at small business finance as long as you plan it well, keep it simple, take it slow, pay attention and thoroughly understand what you’re doing before you do it. When you master the basics and understand the financial end of what you’re doing, you’ll see more clearly what to do on the operational side to increase profits. And, profit is largely what being in business for yourself is all about.

Commit yourself to understanding small business finance and you’ll be much more likely to be happy and satisfied with whatever small business ideas you implement.