Sirius XM Holdings Inc Auto Sales Will Keep SIRI Stock Rolling

Post on: 4 Июнь, 2015 No Comment

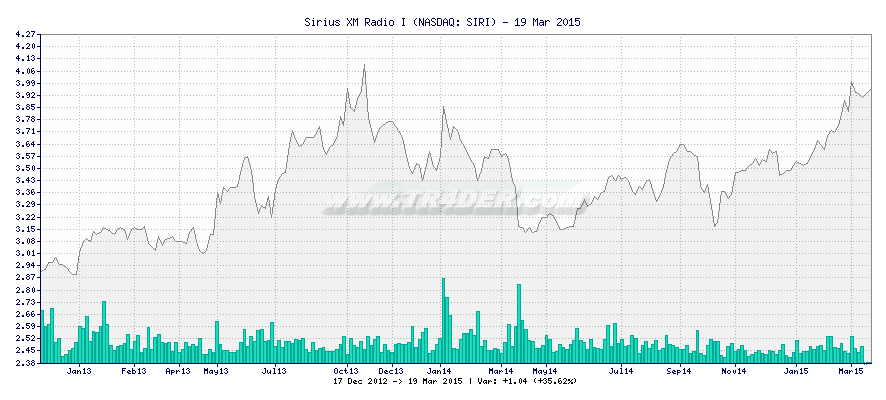

SIRI stock may be down over the past year, but the stock has auto sales and cheap gas to rely on to fuel its growth.

Sirius XM: Auto Sales Will Keep SIRI Stock Rolling

Sirius XM Holdings Inc (NASDAQ:SIRI ) continues to frustrate investors.

Despite Sirius monopoly as the only satellite radio provider in the U.S. SIRI stock has underperformed the broader market, losing about 5% of its value over the past year despite gains of 6% and 9% in the Dow Jones Industrial Average and S&P 500, respectively.

But the anxiety SIRI stock has caused is poised to take a turn for the better that is, if youve paid attention to gas prices and auto sales trends.

Sirius XM (SIRI): Powered by the Automobile

Gas prices continue to drop, with Wednesday marking 109 consecutive days of price declines. The national average price has dipped to $2.10 per gallon 43% below the 2014 peak of $3.70 per gallon, and a mark we havent seen since 2009. Moreover, AAA is projecting that U.S. average gas prices will fall below $2 per gallon this month.

Low gas prices, aside from helping consumers save more at the pump, compels consumers to drive their vehicles more, at longer distances.

So how does this help a satellite radio provider?

Sirius XM has satellite radio agreements with all of the major auto manufactures like Ford Motor Company (NYSE:F ) and Toyota Motor Corp (NYSE:TM ), as well as with rental car companies such as Hertz Global Holdings, Inc. (NYSE:HTZ ) and Avis Budget Group Inc. (NASDAQ:CAR ). More and more, if youre driving a new car, it has Sirius XM available.

So the more people drive, the more exposure they have to SIRIs services whether its in their own cars or rentals.

Whats more, cheap gas also helps consumers have more discretionary income left over each month to pay for SIRI subscriptions. So whether its existing subscribers deciding whether to keep paying, or potential subscribers who just bought a new car or enjoyed Sirius XM in their rental, a little extra pocket change helps swing the arrow in Sirius direction.

Another reason to be bullish on SIRI stock is the effect that cheap gas prices is having on auto sales, which soared to a record 16.5 million vehicles in 2014, buoyed by low interest rates and cheap gas prices. It was the industrys best year since 2006.

And industry experts predict 2015 will be equally as strong, if not stronger. Most forecasters expect vehicle sales will crack 16.5 million and could reach 17 million in 2015. This would be a 9% jump from 2013 sales of around 15.6 million.

Just as with the low gas effect, higher auto sales volumes bodes well for SIRI stock, which relies on strong auto sales volumes to grow its satellite radio subscriptions. SIRI radios are installed in roughly 26% of the vehicles on the road, which suggests there is room for growth.

The potential isnt just theoretical Sirius enjoyed a brisk 2014, just like the auto market.

SIRI ended 2014 with 22.5 million self-pay subscribers. after gaining a net of 1.75 million total subscribers, beating its target of 1.5 million. Moreover, on Jan. 7, Sirius said it expects to beat its 2014 targets for revenue, adjusted EBITDA and free cash flow when it reports fourth-quarter and full-year results Feb. 5.

Wall Street has been paying attention.

Of the 14 analysts that cover SIRI, the stock has a consensus buy rating, with 10 leaning on the buy side and four at hold. Moreover, SIRI stock has an average analyst 12-month price target of $4.25, which suggests 25% gains or more.

Bottom Line

All told, SIRI stock should go up in the not-so-distant future.

Assuming SIRI can can maintain its 40%-plus conversion rate on the projected 16.5 million vehicle sales for 2015, thats roughly 6.6 million cars it will turn into paying subscribers. And at an average rate of around $12 per customer, SIRI will be pulling in an extra $850 million in revenue about 20% of its 2013 revenue figure. No small potatoes.

So where exactly could SIRI go from here?

When taking into account SIRIs average 12-month target of $4.25 and its P/E of 50, I assign a 11% discount to adjust for SIRIs historical P/E of 44. This brings me to a range of $3.75 to $3.85 (a fair discount, especially since the average P/E of companies in the S&P 500 is closer to 20).

In short, SIRI easily could forge ahead by double digits in 2015. Given the continued march of the auto industry, theres plenty of reason to be confident in those potential gains.

As of this writing, Richard Saintvilus did not hold a position in any of the aforementioned securities.