Should You Still Desire Bond ETFs For Your Portfolio

Post on: 17 Апрель, 2015 No Comment

Should You Still Desire Bond ETFs For Your Portfolio?

Nearly 12 years of ultra-easy, unconventional monetary policy in Japan have led to some of the lowest yielding bonds in the world. Specifically, the Bank of Japan (BOJ) had hoped that by printing yen its currency would lose value such that export demand would increase. Moreover, by simultaneously using the new-found yen to purchase government debt obligations, the subsequent decline in yields would encourage borrowing and spending.

Here in 2013, however, it is difficult to see the success of Japans experimentation. In spite of a general trend of declining longer-term yields, the wages of Japanese workers have been stagnant for more than a decade. Of course, any debts that those employees hold are mostly fixed, leaving each with less money to live on annually. Similarly, if wages fall and if prices of goods fall because businesses need to sell inventory a condition called deflation the result is an economy stuck in neutral or worse.

While any comparison between the United States and Japan is suspect, the similarities should not be ignored either. For example, wage deflation has been a significant challenge for the U.S. Federal Reserve over the five-year course of American quantitative easing (QE); household income has been declining while the cost of living has been increasing. Not surprisingly, the U.S. continues to grow its economy at an alarmingly slow rate. Similarly, the Fed has struggled to meet a moderate inflation target of 2.0%, leading some to support the case that we remain mired in a state of deflationary stress.

There has been at least one significant difference, however. Over the course of Japans efforts to enhance its economic prospects, the yields on Japanese Government Bonds (a.k.a. JGBs) have largely been contained. This is a good thing for believers in the Land of the Rising Sun because the country boasts the worst debt-to-GDP level of any country on earth. American investors, however, are a less patient and less docile bunch. When our Fed hinted slowing down its ultra-accommodating monetary policy in May, 10-year Treasury interest rates spiked from 1.6% to nearly 3.0%!

Conservative/moderate investors in America have been dumping bond holdings right and left. Worse yet, bonds of all stripes mutual fund, ETF, individual, short, long, intermediate, taxable, tax-free are finding it difficult to attract any buyers; outflows on bond funds/ETFs were epic in August. In fact, it is downright scary to consider what the yields might be today were it not for the U.S. Fed purchasing $85 billion per month.

And that brings us back to the Feds decision on whether or not to taper their bond purchasing from $85 billion per month to $65 billion or $75 billion. Keep in mind, these are levels that are consistent with QE2 from the Fed a few years back a point that the Fed is likely to emphasize to persuade folks that they are still working hard to keep longer-term bond yields extraordinarily low.

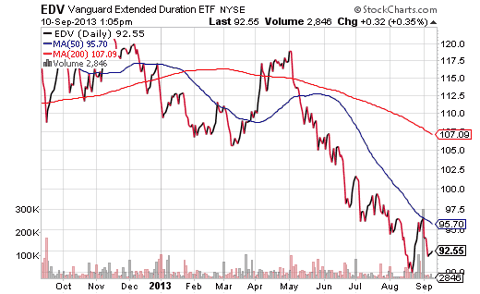

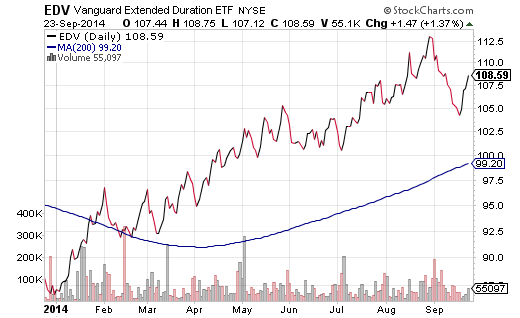

The problem? Investors appear to be losing patience as well as faith. One look at the 20%-25% bearish losses on funds like iShares 20 Year Treasury (TLT) and Vanguard Extended Duration Treasury (EDV), and one recognizes the challenges that currently face buy-n-holders of safe haven bonds. EDV has not been able to seriously challenge a 50-day short-term trendline since the Feds taper talk in May .

Obviously, if the trend for bonds were to continue unabated, a buy-n-holder of bond assets might be cruising for a bruising.Yet how likely is the trend to continue unabated? How likely is it for the Federal Reserve to taper or slow or tighten in future months when inflation is lower than targeted and wage deflation is dragging on the economy? How likely is it for the Fed to do much more than save some face in mid-September when they meet, when real estate is highly dependent on the manipulated rate structure that theyve set up? And how likely is it for institutional money to completely abandon an entire asset class after the 140 basis point surge? From where I sit not bloody likely.

So when will bond investments turn around? Well, the debt ceiling debacle did it back in 2011 but I wouldnt count on a drawn-out debate this time. More likely, bonds will be back in favor when the investment community interprets genuine commitment to keep intermediate-term rates from climbing beyond its reach. And to be frank, if bonds were able to hold steady, the cash flow alone might be a worthwhile reason to maintain some exposure. In essence, yield-hungry folks would be able to generate better income streams fromsafer harbor investments.

Lets not forget another reason to own fixed income. Bond ETFs can reduce overall portfolio volatility. So while it may seem that the 2-year stock rally is the only thing worthy of notice, and the 2-year 0% return for most bond holdings are unsavory, the next stock market correction of 10%-20% would change those figures in a heartbeat.

At this time, though, my client portfolios do not happen to have much in the way of treasury debt. My largest income holdings include PIMCO Short-Term High Yield (HYS), PowerShares Senior Loan (BKLN), iShares 1-3 Year Corporate (CSJ) and iShares Intermediate Corporate (CIU). The latter has been hit the hardest by the spike in the 10-year Treasury. However, if the June lows for CIU hold, the 3% annualized cash flow delivered monthly could be augmented by a modest amount of price appreciation on a Sell the Rumor, Buy the News Fed tapering event.

You can listen to the ETF Expert Radio Show “LIVE”, via podcast or on your iPod. You can follow me on Twitter @ETFexpert .

Disclosure Statement : ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial. Inc. and/or its clients may hold positions in the ETFs. mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial. Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationship.

Share this post: