Should You Invest in Foreign Stocks

Post on: 16 Март, 2015 No Comment

March 12, 2015 By renegade

Investing Internationally

When U.S. stocks are performing great, why should you invest elsewhere?

Many times U.S. stocks, as represented by the S&P 500, often outperform foreign stock markets. While the S&P 500 is returning double digits, you may exclude foreign companies in your portfolio. This could be a big mistake!

Here are four big reasons why it makes sense to add foreign investments to your portfolio:

1. Markets go through many cycles. Recently, foreign stock markets have lagged the United States. When investors flock to safety often they choose U.S. companies. However, when emerging markets (brazil, China, India, etc.) are hot, they can significantly outperform the S&P 500. During these periods, investments with emerging market exposure can help improve your overall returns.

2. Not all of the great companies of the world are based in the U.S. America does not have a monopoly on innovation and fresh ideas. In fact, our Genesis 12 Portfolio looks at some of the most innovative companies in Israel, which are leading the world in innovation. Many times, overseas firms shape the direction of a particular sector or industry. Foreign companies may also adapt and market ideas with amazing success in the emerging markets, Asia or Europe.

3. Emerging markets offer rapid growth potential. Just look at the BRICS nations, which consist of Brazil, Russia, India, China and South Africa. These five economies expanded by 40% or more from 2003 to 2013. Some of the leaders include China, who saw its annual gross domestic product (GDP) grow by 164% during that period while India’s annual GDP nearly doubled. Looking at the global economy, China represents more than 15% of the world’s economic output!

The International Monetary Fund projects China’s 2016 GDP will grow at 6.3% and India should see 6.5% GDP growth in 2016. In other words, these two countries are expected to grow by more than twice the present rate of economic expansion in the United States. Since 1983, China’s economy has grown by at least 6% annually, a record setting run in modern economic times!

4. International investing provides diversification for your portfolio. Many portfolios can become too concentrated if they invest too heavily in one or two asset classes. Also if you have too much exposure in a sector of the economy or too much invested in one or a few individual companies. These risks can sink your portfolio with the wrong move(s). Investing your whole portfolio in U.S. companies may also overexpose you to risks when the U.S. markets cool off. During times when the U.S. markets fall, exposure to foreign companies could help improve your returns.

Foreign investing does not come without risk

There are significant risks to investing internationally. Here are 5 risks to consider before investing in foreign stocks:

1. Many emerging markets are far less stable than the U.S. markets. These markets can see more wild swings up and down.

2. Overseas markets can see a “ripple effect” when there is a major market shock from a geopolitical event. This could impact foreign markets more severely than the U.S. markets.

3. Liquidity may be a bigger risk for foreign companies. Liquidity measures how quickly you can convert to cash. Some foreign stock markets are much smaller and see far fewers stocks trade compared to Wall Street. They often have less trading volume, shorter trading days and a far fewer companies trade on these foreign exchanges.

4. There is often less financial disclosure for foreign companies. American companies are required to disclose many financial facts and statements that many foreign firms are not required to do so within their particular country’s laws.

5. Foreign exchange rates can also positively or negatively impact foreign companies. When the U.S. dollar is strong compared to the foreign currency where the company resides, it can eat into the financial returns of that company. However on the flip side, a weak dollar can help improve the returns.

Some additional risks include potentially higher fees for trading foreign stocks. Some investors may even encounter withholding taxes on dividends, or premiums for buying certain types of shares in foreign companies.

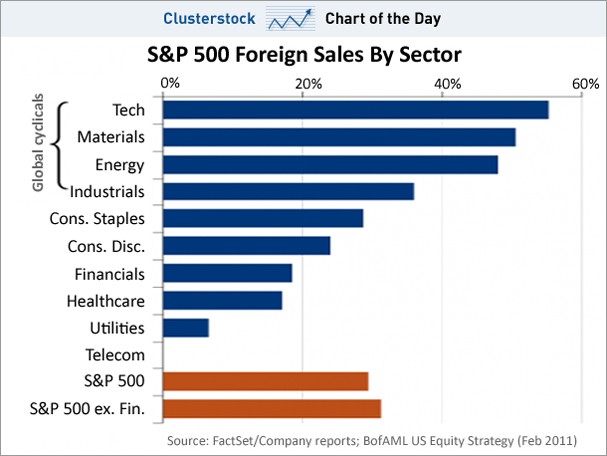

Now keep in mind, you may already have some foreign exposure

As larger U.S. companies sell more products and services across the globe, your portfolio may already have significant exposure to foreign countries. However, this often is not easy to figure out across a portfolio, especially if you have numerous positions. The best way to play foreign investing is often through investing directly in foreign companies. A good site to find a list of companies in foreign companies can be found HERE. I particularly look for ADRs, which are American Depository Receipts. Put simply, these are foreign companies trading on the U.S. stock exchanges.

Bottom Line: As you look at investing outside the U.S. you must analyze both the opportunity and the risks of international investing. To find some of the best foreign companies, we created the Foreign Profits Portfolio. which consists of our 25 favorite international companies from 17 different countries.