Should You Invest in a 401k Without an Employer Match

Post on: 13 Июнь, 2015 No Comment

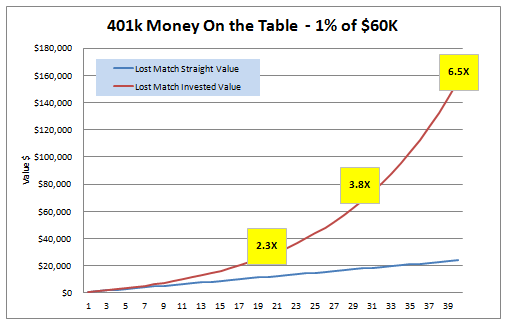

The economic crisis has affected many companies here in the US, and as a result, many companies are slashing their 401k match and other benefits to conserve cash. The good news is that these cuts help keep companies profitable and may prevent many layoffs. The bad news is that employees are losing out on free money. You should reexamine your situation any time your benefits change.

Should You Contribute to a 401k Without an Employer Match?

In most cases it is still a good idea to contribute to a 401k plan, even without an employer match. Here are a few benefits to continuing your 401k contributions:

- Automatic and guaranteed savings. 401k contributions are made automatically with each paycheck you never have to worry about transferring money, writing a check, mailing a letter, etc. Automation guarantees you will make your investment on time.

- Lower taxable income. Contributions to a Traditional 401k plan lower your taxable income because the contributions are invested with money that has not yet been taxed. This leads to the next benefit:

- Tax deferred growth. Investing in a Traditional 401k plan means your contributions will grow without the drag of taxes until you make your withdrawals. Your money gets taxed when you withdraw it, and possibly at a lower tax rate if your tax bracket is lower in retirement than it is now.

Other considerations

It is usually a good option to continue contributing to a 401k without an employer match, but there are some other factors you need to keep in mind.

- Expenses and fees. Many 401k plans have higher fees than you will find for comparable funds outside of the 401k plan. You may find it less expensive to invest on your own than through your 401k plan. If that is the case, look into investing in an IRA so you can continue investing in a tax advantaged retirement plan.

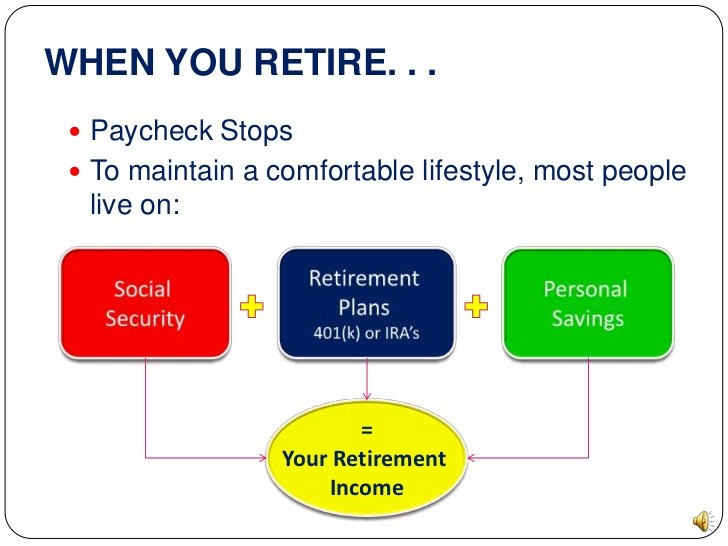

- Investing in a 401k or IRA. You may decide to invest in an IRA instead of a 401(k) if you are eligible. Here are some differences between Roth and Traditional IRAs. You can open an IRA at almost any financial institution and you can find very inexpensive options at places such as Vanguard, Fidelity, T. Rowe Price, etc.

- Retirement contributions and income limits. You will need to pay attention to the 401(k) contribution limits and Roth and Traditional IRA contribution limits. Be sure to note the associated income limitations of each. For example, if you are eligible for an employer sponsored retirement plan, deductible IRA contributions begin to phase out for single filers at an AGI of $55,000, and at $89,000 for married filers. If those income limits affect you, then you may wish to invest in a Roth IRA or a non-deductible Traditional IRA.

Continue investing

Just because you no longer receive free money doesnt mean you should use that as an excuse to stop investing. Retirement investing is an important part of financial planning and you should continue investing even without a company match. The free money may be gone, but the tax advantages remain.