Should You Buy Gold Stocks Right Now

Post on: 18 Июль, 2015 No Comment

There is a serious problem in the gold mining business these days, and it’s not because of the stagnant spot price. Costs are going up industry-wide, and it is making buying gold stocks much less attractive.

Gold prices have been in consolidation for about a year and a half, and I feel they should experience an upward breakout later this year. But cash costs per ounce are going up, and I would say that the majority of gold producers are reporting this in their quarterly earnings reports.

It begs the question: should you buy gold stocks right now? My answer is no. I’d rather see you just buy gold. Why take the investment risk of betting on the spot price of gold, a company’s ability to meet production targets, and the industry-wide trend of higher costs? Right now, it’s not worth it. You might as well just speculate on gold prices, not gold stocks. That’s enough investment risk.

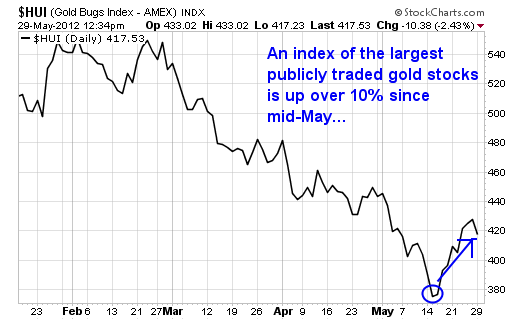

Barrick Gold Corporation (NYSE/ABX) is one of several large-cap gold stocks that are having a tough time on the stock market these days. Gold stocks have corrected much more than the actual spot price of gold due to rising costs. Earnings estimates for Barrick have been revised downward for upcoming quarters; and while you might argue that $30.00 a share is a floor for the stock, why bother taking the risk? Barrick’s stock chart is featured below:

Chart courtesy of www.StockCharts.com

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

While I do feel that investors should already have exposure to gold and that gold prices are getting set for a breakout, I don’t see that breakout happening in the very near term. Even on days when the spot price is rallying, daily gains are unenthusiastic; the action is reminiscent of a trade that has basically played itself out.

Right now I have two mid-tier gold stocks that I like and one large-cap name that represents good value. I also have one development-stage junior explorer that I like, but that stock’s already gone up in price. Practically, there’s no need to take the risk with gold stocks given current fundamentals. I would argue that silver is more attractive on a relative basis, but I still come back to the same conclusion. Unless the spot price is roaring, gold stocks aren’t going anywhere. Accordingly, for the investment risk, if you want to invest in gold today, you’re better off speculating on the spot price.

Nowadays, there are a lot of options for gold investors, and you don’t have to go to the futures pit or deal with gold stocks. With so many gold exchange-traded funds (ETFs) out there (and many employ leverage), you can go long or short, create your own hedge, and even make a big bet, just as you would in the stock market. How about a mutual fund of gold stocks? Forget it. Just bet on the spot price.

I want to highlight one more chart for you, and this is the SPDR Gold Shares (NYSEArca/GLD) ETF, which is one of the largest ETFs dedicated to changes in the spot price of gold. As you can see in the chart, the recent consolidation is very similar to the consolidation experienced in 2008/2009.

Chart courtesy of www.StockCharts.com

My bet is that history is going to repeat itself at least one more time, and a breakout in gold prices is in the cards for sometime this year. (See “Looking for a Great Track Record? Look at SPDR Gold Shares .”) I recognize, of course, that commodities are inherently volatile; even with the sovereign debt crises, massive money printing, and the prospects for inflation, gold can still go down for the simple reason that speculators withdraw from the marketplace.

There is no true value for gold; only what the marketplace perceives it to be on any given day. Without question, gold at $1,250 an ounce is as equal in possibility as $2,050. This is the true risk with commodity investing, whether it is in gold stocks, the spot price, or an exchange-traded fund (ETF). The long-term trend might still be intact, but it could cause you a lot of grief getting there.