Should Investors Fear the Market Pullback 2 Views on Stocks US News

Post on: 18 Июнь, 2015 No Comment

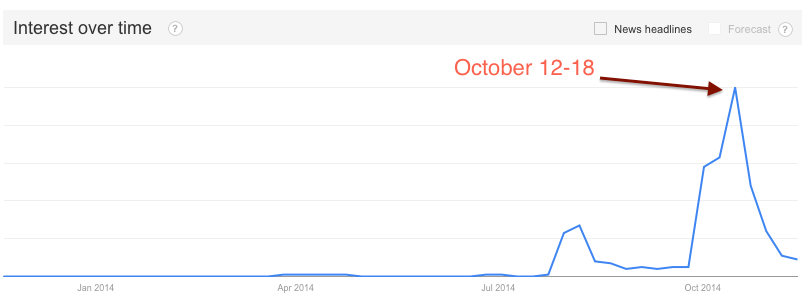

The stock market’s big swings in recent days uncovered big fears among investors.

The stock market went for so long without a serious pullback this year that many strategists thought what it needed most was a vicious whipping. That problem has been solved in just a few days as a steep decline erased a third of the year’s gains.

So what should investors do? Move quickly to hunt bargains or slow down to see if the correction goes deeper? Or is it best to do nothing and simply stay the course?

Two top professional investors say it would be a mistake to ignore the transition signalled by the current volatility. But the fund manager and the financial adviser have differing views on what’s next. Bob Zenouzi, lead manager of the Delaware Dividend Income Fund, says equities will have a harder time for a while in this changing interest-rate environment, but stocks are still better than bonds, and people should stay out of fixed income. David Edwards, president of Heron Financial Group, has a more bullish view. It’s time to buy stocks, he says.

Which is the best way to go? To answer that, you need to consider your own financial goals and risk tolerance. Looking at the big picture, it also depends on what follows the Federal Reserve’s decision for a phased pullback from its massive cash injections in bond purchases that one Fed official says was inappropriately timed, and whether an unexpected cash crunch in China’s banking sector signals deepening problems for the world’s biggest net investor.

Stocks bounced back this week after a three-day plunge. Mutual fund flows in the weeks ahead will give a fuller picture. Here are the two strategies offered by the investing pros:

Zenouzi advises investors scrub harder for good income and avoid bad fixed income. He worries that the Fed has left the markets in a muddle and that the path for interest rates is too uncertain for investors to get too bullish. If credit is unstable, then it’s difficult for any equity style to perform in a rapidly rising-rate environment, which is what we are experiencing now, he says.

The Fed is attempting a balancing act that might be as treacherous as one of Nik Wallenda’s high-elevation walks on a two-inch wire. After almost five years of easy money, it’s trying to wean America off ultra-low interest rates without killing economic growth. For now, the Fed has decided that things look good enough that it can pull back on its $1-trillion-a-year cash injections for the U.S. economy, which comes in the form of bond purchases. A fresh batch of solid housing data in the week after the Fed meeting lent support to that view, but some see the recent rise in mortgage rates as a growing threat.

We don’t believe the Fed can forecast the economy given its track record, Zenouzi says. The pullback might have created some bargains, but things have not changed fundamentally in the credit market, he says. That could create problems for a stock market that needs to see corporate earnings rise to justify investors buying stocks as interest rates rise.

The key 10-year Treasury bond yield jumped to 2.66 percent this week, which is double that of a year ago and a full percentage point above last month. Stocks ignored the rising rates until the Fed announced its new tapering plan at its June meeting. The Standard & Poor’s 500 index pulled back 5 percent in three days after the Fed announced its new policy. The market wobbled as investors briefly ignored the Fed’s argument that it has room to maneuver in a stronger economy.

We are not seeing rates rise due to better growth, Zenouzi says. That seems to be the ‘consensus’ opinion, which we believe is wrong. He sees more volatility ahead based on a close look at underlying credit spreads, which are measures of gaps between interest rates and options on credit defaults or between different bond maturities. They have a history of predicting market moves.

If rates were rising due to better growth, credit spreads would be flat to declining, Zenouzi says. What it means, he says, is that investors need to move cautiously. But that does not mean taking the traditional path of buying high-grade bonds. Interest rates are still so low that the Fed’s policies are challenging you to take on risk. I am not going to fight that, he says.