Short Selling The Risks

Post on: 29 Май, 2015 No Comment

Now that we’ve introduced short selling, let’s make one thing clear: shorting is risky. Actually, we’ll rephrase that. Shorting is very, very risky. It’s not unlike running with the bulls in Spain: you can either have a great time, or you can get trampled.

You can think of the outcome of a short sale as basically the opposite of a regular buy transaction, but the mechanics behind a short sale result in some unique risks.

Short selling is a gamble. History has shown that, in general, stocks have an upward drift. Over the long run, most stocks appreciate in price. For that matter, even if a company barely improves over the years, inflation should drive its stock price up somewhat. What this means is that shorting is betting against the overall direction of the market.

So, if the direction is generally upward, keeping a short position open for a long period can become very risky. (To learn more, read Stocks Are No.1 and The Stock Market: A Look Back .)

Losses can be infinite. When you short sell, your losses can be infinite. A short sale loses when the stock price rises and a stock is (theoretically, at least) not limited in how high it can go. For example, if you short 100 shares at $65 each hoping to make a profit but the shares increase to $90 apiece, you end up losing $2,500. On the other hand, a stock can’t go below 0, so your upside is limited. Bottom line: you can lose more than you initially invest, but the best you can earn is a 100% gain if a company goes out of business and the stock loses its entire value.

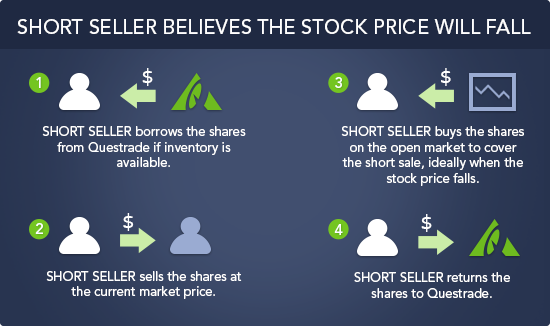

Shorting stocks involves using borrowed money. This is known as margin trading. When short selling, you open a margin account, which allows you to borrow money from the brokerage firm using your investment as collateral. Just as when you go long on margin, it’s easy for losses to get out of hand because you must meet the minimum maintenance requirement of 25%. If your account slips below this, you’ll be subject to a margin call. and you’ll be forced to put in more cash or liquidate your position. (We won’t cover margin in detail here, but you can read more in our Margin Trading tutorial .)

Short squeezes can wring the profit out of your investment. When stock prices go up short seller losses get higher, as sellers rush to buy the stock to cover their positions. This rush creates a high demand for the stock quickly driving up the price even further. This phenomenon is known as a short squeeze. Usually, news in the market will trigger a short squeeze, but sometimes traders who notice a large number of shorts in a stock will attempt to induce one. This is why it’s not a good idea to short a stock with high short interest. A short squeeze is a great way to lose a lot of money extremely fast. (To learn more, see Short Squeeze The Last Drop Of Profit From Market Moves .)

Even if you’re right, it could be at the wrong time. The final and largest complication is being right too soon. Even though a company is overvalued, it could conceivably take a while to come back down. In the meantime, you are vulnerable to interest, margin calls and being called away. Academics and traders alike have tried for years to come up with explanations as to why a stock’s market price varies from its intrinsic value. They have yet to come up with a model that works all the time, and probably never will.

Take the dotcom bubble. for example. Sure, you could have made a killing if you shorted at the market top in the beginning of 2000, but many believed that stocks were grossly overvalued even a year earlier. You’d be in the poorhouse now if you had shorted the Nasdaq in 1999! That’s when the Nasdaq was up 86%, although two-thirds of the stocks declined. This is contrary to the popular belief that pre-1999 valuations more accurately reflected the Nasdaq. However, it wasn’t until three years later, in 2002, that the Nasdaq returned to 1999 levels.

Momentum is a funny thing. Whether in physics or the stock market, it’s something you don’t want to stand in front of. All it takes is one big shorting mistake to kill you. Just as you wouldn’t jump in front of a pack of stampeding bulls, don’t fight against the trend of a hot stock.