Short Grains ETF on a Rising US Dollar

Post on: 16 Март, 2015 No Comment

January 27, 2015 By Lance Jepsen

The rising US dollar is playing havoc on all commodities, not just oil. I believe this gives us an opportunity to short grains .

The question to ask is what US sector will plunge next if the Federal Reserve does not move to defend (devalue) the US dollar? I think the answer might be farming and by that I mean grains.

Heres the logic and catalyst for shorting grains.

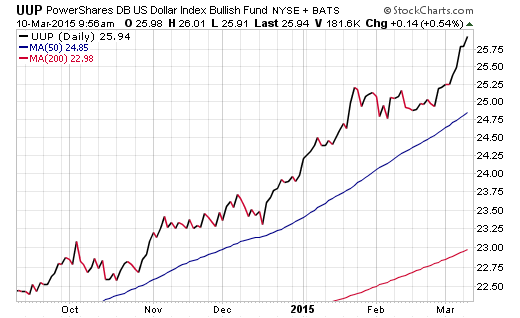

The US dollar is up about +20% in just the last 6 months. This means that U.S. products sold around the world have gone up 20% in just the last 6 months. Grains are a major export market for the U.S. People around the world are not going to buy as much grains from the U.S. because the price has gone through the roof in the last 6 months. In many cases, they will take their business to other countries with cheaper prices.

To see how the price of grains correlate with the US dollar, we can overlay both charts.

JJG is like an ETF but its technically an ETN. It is the Dow Jones-AIG Grains Total Return ETN. Notice the correlation indicator below the chart is -0.82 on January 27, 2015. That proves a strong correlation between both these charts.

There is no short grains ETF that trades over US exchanges. With Etrade you can trade over other exchanges but you have to be careful because of currency differences and exchange rates. What could be going down in the US, might be going up in another country.

I like a straight up short of JJG. Its the closest thing to a short grains ETF on US exchanges. The iPath Dow Jones-UBS Agriculture Total Return Sub-Index ETN is an exchange-traded note. The Notes will provide investors with a cash payment at the scheduled maturity or early redemption based on the performance of the underlying index, the Dow Jones-UBS Agriculture Total Return Sub-Index.

Notice how the volume has done a classic stair step up into the downward move. This suggests a slowly increasing number of sell orders as traders begin to increasingly head for the exit.

I would not stay in an ETN for any longer than is necessary. This is a swing move down trade with a target of -9% to the October 2014 low of $32.58.

Disclosure: I do not hold any position in any stock mentioned in this article. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.