Share Buybacks by S P 500 Companies

Post on: 19 Август, 2015 No Comment

Share | Subscribe

Share buybacks allow companies to repurchase their own stocks outstanding on the market. Why do those companies want to do this? On one hand, the number of shares held by the public will be reduced, which will increase the earnings per share even if the total earnings are the same. The value of shares still available increases. It is valuable that a firm’s manager buy back shares when he believes that the firm’s stock is currently trading below its intrinsic value. On the other hand, executive compensation is often tied to executives’ ability to meet earnings per share targets. When it is difficult to meet the targets, the executives may repurchase shares in order not to affect executive or managerial rewards.

Generally speaking, buybacks can be treated as a signal that the company thinks that its stock is undervalued. Yet is this true? I will research the S&P 500 companies and see the results. Also I will show you which companies are good at share buybacks and which are doing this at the totally wrong timing.

Regarding buybacks, Warren Buffett has written about them multiple times, including in his most recent shareholder letter. His view is, if a company buys back shares at above their intrinsic value, buybacks destroy shareholder value. If a company buys back shares at below their intrinsic value, buybacks create value for existing shareholders. Warren Buffett said he may buy back stocks at 110% of Berkshire’s book. In 2012, Berkshire spent $1.3 billion in buybacks.

Assumptions and Facts

1. My research starts from the first quarter of 2000 to the second quarter of 2013.

2. All the quarterly share buyback data and quarterly market capitalization data are from the database of GuruFocus.com LLC.

3. All the prices I used in this research were the quarter-end adjusted close prices for splits and dividends. They are originally from yahoo finance.

4. You can see the complete S&P 500 companies list here. My research is based on the current S&P 500 companies, disregarding the old ones.

S&P 500 Companies

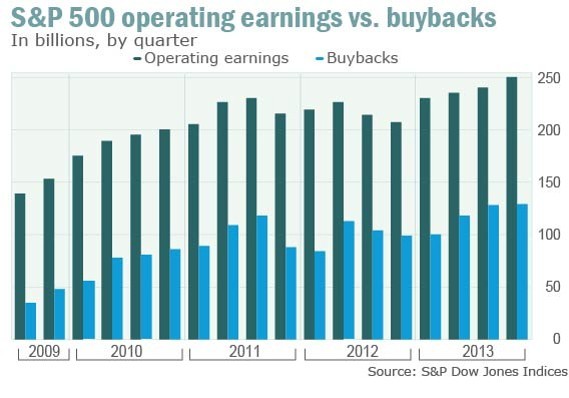

I added all the share buybacks for each quarter to get the total share buybacks for S&P 500 companies. The result is as follows:

From Chart 1, we can see surprisingly that the S&P 500 companies usually spent more money to buy back shares when their stock price was high and spend less when the market price was low. In the third quarter of 2007, S&P 500 companies spent more than $130 billion to buy back their own shares, which unfortunately were at the market peak. Then the market crashed. In the first quarter of 2009, the market capitalization shrank to almost half of the market capitalization it was in the third quarter of 2007, yet companies only spent $31 billion to repurchase stocks. From Chart 2, we can observe that when the market capitalization was low, only about 30% of the S&P 500 companies bought back shares. When the market went up, more and more companies repurchased their shares. From 2006 to 2007 and from 2011 to 2012, more than half of the companies spent money on buying back their shares.

As of now, the stock market is close to all-time high, about 60% companies are buying back shares. This number is also close to an all-time high. Does this tell us something?

How could it be possible that companies get the timing so perfectly wrong? There can be multiple reasons for this. One reason might be that those companies wanted to increase spending on shares when earnings were continuing up. In this way, their share value could go higher. Another reason is that when their stock prices are high, the companies are more optimistic and they think they have excess cash to spend. Unfortunately they are usually optimistic at the wrong time.

Individual Companies

Even though the S&P 500 companies as a whole did not perform well at buying back their shares, some companies did do better than others. Which companies are good at buying back stocks and which are bad at it? The following will answer this question.

For individual companies, we want to see how the stock prices go after share buybacks. I set four cases: 1) the one-year stock return after share buybacks; 2) the two-year stock return after share buybacks; 3) the three-year stock return after share buybacks; 4) the five-year stock return after share buybacks. Generally speaking, it is more valuable to buy back shares when stock is undervalued. The higher the stock return after share buybacks, the better the company is at share buybacks. Since different companies have different market capitalizations and different amounts of buybacks, I set a new ratio to adjust the return by weight.

In order to have a big impact for share buyback, I only consider the ones that were more than 0.5% in weight and ignore the quarters that have smaller weights.

After getting the ratio for each term, I average them to get the indicator for each company. We want to distinguish them and see who is good at share buybacks and who is bad at it.

1. Companies which are good at share buybacks

You can easily observe the one-year, two-year, three-year, and five-year returns on the table. Almost all stocks achieved high returns after buying back their own shares which indicates that companies were good at share buybacks during those periods.

2. Companies which are bad at share buybacks

You can easily observe the one-year, two-year, three-year and five-year returns on the table. Almost all the returns were negative which show that companies were bad at share buybacks during those periods.

The following table shows 10 companies which are good at share buybacks and 10 companies which are bad at share buybacks.

Conclusion:

Not all buybacks are created equal. The skills of the management in capital allocation and the culture of the company can make a difference in the outcome of the buybacks. Although buybacks are viewed as positive for stock prices, a lot of them happen at exactly the wrong time and destroy value for shareholders.

Based on this research, GuruFocus will develop a buyback rank system. We want to distinguish the good ones from the others. It is more meaningful to observe buybacks from the good ones and this buyback rank can serve as an indicator in our research, too.About GuruFocus: GuruFocus.com tracks the stocks picks and portfolio holdings of the world’s best investors. This value investing site offers stock screeners and valuation tools. And publishes daily articles tracking the latest moves of the world’s best investors. GuruFocus also provides promising stock ideas in 3 monthly newsletters sent to Premium Members .