Seth Klarman The Margin of Safety Part Eight

Post on: 16 Апрель, 2015 No Comment

This is part eight of a multi-part series on Seth Klarman, value investor and manager of Boston-based Baupost Group. Parts one through seven can be found at the respective links below. To ensure you do not miss the rest of the series sign up for our free newsletter .

Seth Klarman – Part eight: The Margin of Safety

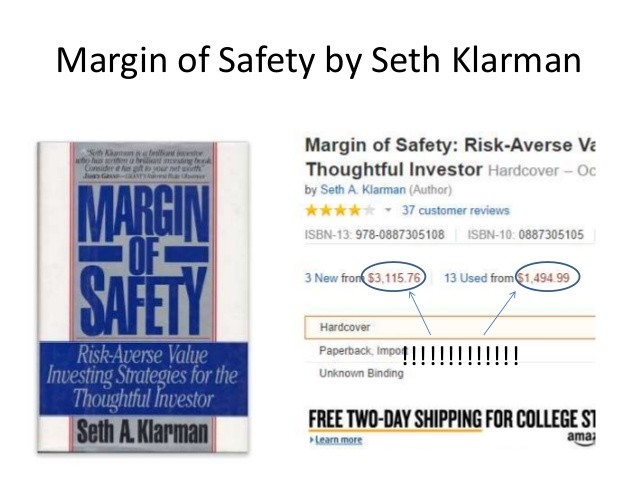

The information below is based on Seth Klarman’s out of print book, Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor ; hopefully you’ll find some useful tips.

Most, if not all value investors will have heard of the Margin of Safety; buying undervalued securities that trade at a wide discount to their underlying value. Key to this process is the, what Seth Klarman calls, “the element of a bargain”. In other words, it’s key to establish a margin of safety that not only enables you to make a sufficient profit, but also gives a wide enough discount from the underlying value, so that you are still able to profit even if your estimate of the underlying value is incorrect. However, its often difficult for investors to maintain the discipline of only investing when the discount is wide enough:

“The greatest challenge for value investors is maintaining the required discipline. Being a value investor usually means standing apart from the crowd, challenging conventional wisdom, and opposing the prevailing investment winds. It can be a very lonely undertaking…”

Seth Klarman notes that value investors have to keep the discipline, no matter how bad things many seem. Earlier in this series, I covered Seth Klarman’s performance in the run up to the dot-com bubble, where Baupost significantly underperformed the wider market, reporting single-digit gains (and even losses) while the wider market surged higher. Throughout this turmoil, Seth Klarman kept his cool and stuck to his value investing principles.

Over the short-term, there may be periods where the value approach seems outdated and ill conceived. However, over the long-term, the devoted advocates of the strategy are rewarded and the value approach works so successfully that few, if any, advocates of the philosophy ever abandon it. The message here is stick to your principles, don’t over trade and believe in the value discipline.

On the subject of maintaining the value discipline, Seth Klarman notes that many investors are often pressured into investing prematurely; the cheapest security in an overvalued market may still be overvalued. It is often the case that another opportunity to buy will come along soon, offering a better return for your money.

Nevertheless, value alone is not sufficient, investors must choose only the best absolute values among those that are currently available. Oddly, this is where Seth Klarman actually advocates increased trading, or rebalancing.

“ Value investors continually compare potential new investments with their current holdings in order to ensure that they own only the most undervalued opportunities available. Investors should never be afraid to reexamine current holdings as new opportunities appear, even if that means realizing losses on the sale of current holdings…”

The Art of Business Valuation

Of course, achieving an appropriate margin of safety is entirely dependent upon the ability of the investor to be able to place an appropriate value on the underlying business. In a warning to potential investors, Seth Klarman states that:

“Reported book value, earnings, and cash flow are, after all, only the best guesses of accountantsProjected results are less precise stillYou cannot appraise the value of your home to the nearest thousand dollars. Why would it be any easier to place a value on vast and complex businesses? if expert analysts with extensive information cannot gauge the value of high-profile, well-regarded businesses with more certainty than this, investors should not fool themselves into believing they are capable of greater precision when buying marketable securities based only on limited, publicly available information…

This is clearly a warning to all those who invest based on book values and stated financial figures alone. It’s also the basis of the margin of safety principle. Seth Klarman is wary of figures such as net present value and the internal rate of return, they are only as accurate as the figures and assumptions used to calculate them.

It’s here that Seth Klarman even criticizes Benjamin Graham’s an approach to valuations. Graham’s back-of-the-envelope estimate of a companys liquidation value, net-nets was based on imprecise values this is why he often discounted figures on the balance sheet to arrive a discounted liquidation value, a suitable and appropriate margin of safety.

Price fluctuations

On another note, Seth Klarman sets out to warn investors not to give too much weight to day-to-day market fluctuations. Many investors consider price fluctuations to be a significant risk, but in reality these temporary price fluctuations are not a risk; not in the way that permanent value impairments are, and then only for certain investors in specific situations.

Unfortunately, it’s not easy for investors to distinguish temporary volatility, from price movements related to business fundamentals. In this case, the reality may only become apparent after the fact. Still, as always, Seth Klarman is looking for long-term outperformance, not short-term trading patterns:

“If you are buying sound value at a discount, do short-term price fluctuations matter? In the long run they do not matter much; value will ultimately be reflected in the price of a security…”

Conclusion

In summary then the margin of safety principle is key for all value investors but investors should be wary of stated financial figures. Short-term price volatility is irrelevant for long-term investors and as long as you are investing with a wide enough margin of safety, even a change in the underlying business fundamentals can save you from total disaster.

Stay tuned for part nine.