Selling Options_1

Post on: 1 Июль, 2015 No Comment

Like many investors, I started off my trading experience with shares, or stock trading, conventionally thought of as the safest and easiest form of trading until I was exposed to the wonderful world of options trading a few years back. I have never looked back since then. There are basically two types of options in options trading, the call option and the put option. Basically, a seller of a call option has the obligation to deliver 100 shares of the underlying once the option is being exercised. On the other hand, a seller of a put option will have 100 shares of the underlying being put to him upon exercised of the option.

In options selling, the seller of the option, be it a call or a put option, will have time working for him. He can make money if he is right, of course, and also make money even if he is wrong! However, when he is too wrong, then adjustment to his strategy will come in for the repair and in most cases, will make that losing trade into a winning trade too! I started out options trading using the covered call strategy, the most conservative strategy that is believed to exist. As I explored more into the options world, I discovered another strategy which I thought is more powerful than the covered call strategy, at least that is my belief! That is, selling put options. Covered call on stock option and selling a put option against an underlying will put the investor at the same amount of risk. If the stock goes to zero, the covered call writer will bear the full risk of his investment going to nil while the put option seller will also suffer the same fate with his put option being exercised against him.

Turn your spare time into cash.

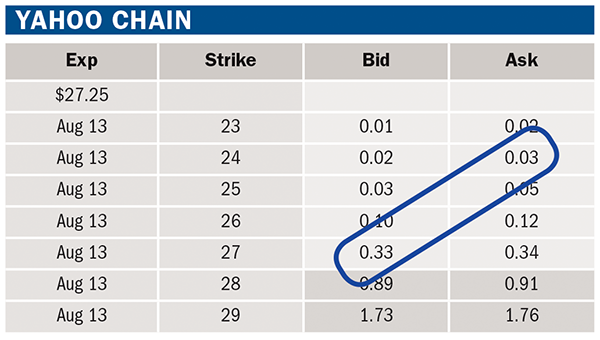

Selling a put option against an underlying gives one the opportunity to possess the underlying at a price one is comfortable with and does not mind holding on to. For example, for an underlying share ‘A’ trading at $24 at this moment, I would sell a put option either in the current month or next at says $22. Out front, I will be collecting the premium from the sale of the put option. If the underlying price stays anywhere above $22, the put option sold will expire worthless and I stand to pocket the premium for free! On the other hand, if the underlying drops to say $22, the put option sold will still expire worthless. The break-even point is $22 — the premium collected. However, if the share price drops to below $22, one must be prepared to buy the underlying at a discounted price of $22. Actually, the effective price you actually bought the 100 shares is $22 — premium. Good deal right? Two cases here: First, with the put option expiring worthless, we will do the same thing again next month, selling put option against the underlying. Second case, the option is being exercised and the shares being put to us. The strategy of selling put option will be transformed to a covered call strategy in which we now write or sell call option against these 100 shares that we now owned.

You know exactly what number to pick for every game.

I have found this option selling strategy profitable, consistent and simple to use. Of course, depending on one’s appetite for profit margin and investing habit, this strategy could be worth your consideration. Good luck!

Get access to over 1 billion records.