Selling Covered Calls On Most ETFs Guaranteed To Lose You Money In The Long Run

Post on: 16 Март, 2015 No Comment

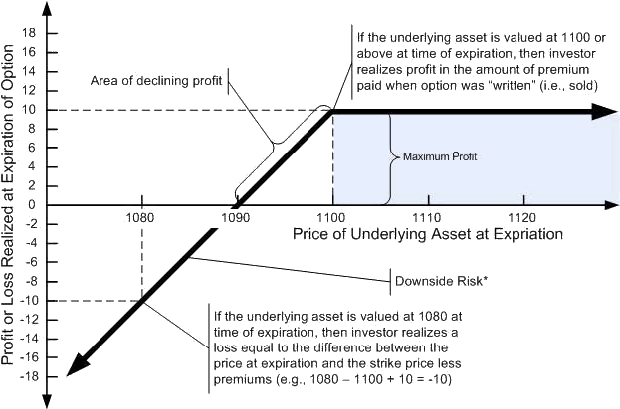

The story behind writing calls on your existing holdings is very compelling on the surface and very intuitive to understand. You have your holdings and you sell the right to buy that holding at some price above current market price to another investor in exchange for immediate cash. The idea is that if you write call options far enough out of the money so that they expire worthless the majority of the time you risk very little and gain a consistent source of income.

The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. The investor still benefits from their stock holdings appreciation up to the strike price just as they would otherwis e, s o psychologically it’s easy to give up extra future gain for real cash right now. It’s a bird-in-the hand versus future potential bias. It’s difficult to value future potential but the cash is easy to count.

The other reason why the strategy is so seductive is its similarity to regular dividends in the mind of the investor. The limiting of gains is not treated as a loss in our heads so it’s almost like enhancing your dividend yield for nothing. The investor treats it as a clear win-win strategy.

The last and most important reason why investors love writing covered calls has to do with a psychological bias that mostly everyone has. The nature of the human brain means that we are pre-conditioned to prefer immediate and consistent rewards over the potential of one time future gains. In additio n, w e hate losses and anything that causes losses. The small but consistent profit from writing covered calls means we get immediate satisfaction and our strategy is very quickly validated. The fact that writing the covered call in itself cannot cause us to actually lose money (defined as ROR < 0% for the investment period) adds to the appeal. If the stock loses money during the investment period the investor mentally assigns this loss to the stock selection not the covered call strategy. If we sell the covered calls sufficiently out of the money there is a 75-80% chance that we will get a real positive return out of this strategy even counting the loss of gain on the stock holding. This means the investor is very likely to get positive feedback on the strategy quickly while the possibility of negative feedback is very low. This drives him or her to continue the strategy for another period.

To summariz e, s elling covered calls is a high probability strategy that generates consistent income and is guaranteed not to cause direct loses. Investors gain significant psychological benefits from selling calls even if the financial gains are questionable. They feel good about their strategy. Why is it guaranteed to lose money then?

Whenever evaluating a strategy or tactic it’s always important to isolate the benefit derived from that strategy versus what could be achieved without it. In the case of covered call s, t he benchmark should simply be the return you could get from holding the stocks without selling covered calls. It is not enough to say that covered calls did not directly cause you losse s, b ecause if they limited your gains on your stock portfolio by more than you gained by selling the m, t hen it’s a losing strategy.

The calls I will focus on in this example will be SPY calls with a March 28 2013 expiry. When looking at the implied yield curve for SPY option s, i t is actually the most beneficial expiry term in that curve to sell covered calls but I have done analysis similar to this for various expiry terms and I get exactly the same conclusions. However, I certainly encourage the readers to check for themselves.

The next step would be to decide how far out of the money to sell the call option at. The trade-off is between the annualized option yield expected from selling the call versus how likely is the option to end up in the money. The annualized yield is relatively easy to calculate as is the % the option is out of the money. The SPY chain on Jan. 9, 2013 for options expiring on March 28, 2013 looks as follows: