Sectors And The Business Cycle A Primer

Post on: 6 Апрель, 2015 No Comment

This article will help you understand where and how to look for profitable investing opportunities within sectors. It intends to give a description of different sectors of the economy and show how a basic knowledge of these can be helpful in identifying the stocks most likely to produce better than average returns. It will help long term investors identify entry points. A brief discussion will then describe the business cycle and the best sectors for different points in the cycle.

Sectors

The word sector has many meanings. In its basic form it means a portion of something, often divided into sections with similar characteristics. For example, one may speak of the public and private sectors. For the purposes of this article, we define sector as a divisions of the economy, described by the function that sector involves. Standard & Poor’s in collaboration with Morgan Stanley Capital International developed the Global Industry Classification Standard (GICS). The GICS consists of 10 Sectors, 24 Industry Groups, 68 Industries, and 154 Sub-Industries. Many firms, such as Fidelity investments, use this system of classification.

Other information providing sources, Dow Jones, Morningstar and Yahoo Finance, for example, use slightly different schemes. However, the differences are small enough so that they do not interfere with using several different financial reporting services for sector research.

Within a sector, there will be several Industry Groups.

Sector: Consumer Staples

Industries:

- Tobacco

- Personal Goods

- Household Goods

- Food Products

Within each industry group, there will be a number of companies.

Food Product Companies

Sectors have unique performance characteristics. For example, the Utility Sector has the highest average dividend yield. Because utilities serve a fixed geographic area, and are very limited in the scope of their business, they are often a slow growth proposition. On the other hand, if you are seeking growth in 2012 and beyond you might look in Consumer Discretionary, Technology or Industrials. If one wishes to invest in a sector but not in individual stocks, they may do it with ETFs or mutual funds.

The below table is from the site for SPDR Select Sectors Funds. There is much data, many charts and market maps available as well as customizable correlation studies.

Historic Performance by Sector 12/31/2011

In 2011, Utilities, Consumer Staples and Healthcare were the leaders. Finance, Basic Materials and Industrials were the losers. As we shall see later in this article, where we are in the business cycle (economic cycle) is somewhat of a factor in which sectors will perform the best.

There is, as Alta Vista advisory service notes in graphic form, often a trade-off between getting a high yield today or good growth for tomorrow. The sector in the upper left corner of the scatter graph, utilities (NYSEARCA:XLU ), is a stable producer of high dividends but a slowly growing sector. By knowing some of the characteristics of a sector, you may better be able to find the attributes you are looking for in investments.

One of the very good things about having at least a basic understanding of sectors is the possibility of utilizing the wealth of information categorized by sector. Below is a sector map of the energy sector. The source of this is Smart Money. part of the The Wall Street Journal .

Above, I have highlighted, by clicking on a button on the top of the chart, the 5 stocks in the Energy Sector that were up the most on the day I accessed this. One of the things I like about this presentation is that I can see which companies are in each industry, and judge their relative size (market cap) by the size of their block. Moving your mouse over the company’s block opens a window with basic information. The big block in the upper left is ExxonMobil (NYSE:XOM ). In stock performance, there is a high correlation between industries in a sector, and a high correlation between companies in an industry, in some cases over 80%.

You can also zoom in on a subsector, such as Oil & Gas Exploration and Production. After doing so below, I turned on the pointers for the 5 lowest performers for that day, below. The Major Integrated Oil and Gas Companies have an average yield of over 3%. The exploration and oil field equipment firms yield about 1%.

The view below gives us a picture of the Major U.S. Integrated Oil and Gas producers. In this case, all were up for the day.

Understanding sectors helps you understand more of the free and fee-based information available on the internet. We all have heard the maxim, buy low, sell high, but how do you know where to look for something that is low — or at least undervalued and on sale? A Morningstar commentary that I read noted that the Energy and Telecommunications sectors were about 10% undervalued. One way I could look at the stocks in the Energy Sector, would be to look at the holdings of the iShares Energy ETF. Here is a list of the top 25 stocks of that fund.

However, the iShares list only includes stocks that are within the S&P 500, and excludes foreign issues. Next, I click on the Energy Sector on the Morningstar sector list, below, and get an international list of energy companies. Following that is the results of that click, the first 25 companies on that list, which I sorted by market capitalization.

Now, I can click on any of those companies and be taken to the Morningstar page for that firm. I would like to find a large cap energy company which has a low debt level, a yield of at least 3% and a low beta. After looking at some of the larger firms, I selected five, all debt levels of less than 0.35, for further evaluation. They are Exxon Mobil (XOM ), Chevron (NYSE:CVX ), Conoco-Phillips (NYSE:COP ), Royal Dutch Shell (NYSE:RDS.B ) and Total S.A. (NYSE:TOT ). Below is some of the initial data I collected and compiled. Data concerning the beta and the stock price chart are from Yahoo Finance.

The data table and charts are interesting in many respects. These companies are highly correlated in their performance, as is shown by the 1-year price graph. It is remarkable that they all have very similar P/E’s and 4 Star ‘Buy’ ratings from Morningstar. The beta varies between 0.60 for XOM to 1.2 for TOT, in an apparent inverse correlation to yield. There is a range of yields, from 2.2% to over twice that at 4.55%. XOM does not meet the yield hurdle of 3% for my Dividend Growth Portfolio, so first I would eliminate that from consideration.

If I were to continue on to select a stock, my next step would be to determine the valuation of each of these, most likely by using a Discounted Future Earnings model and F.A.S.T. Graphs. If a contender remains for purchase, I would give it complete due diligence as I discussed an earlier SA Article. The Importance of Due Diligence. However, this exercise is to demonstrate how one could look at an opportune sector, and then drill down to find an appropriate pick or picks. That we have done.

The Business Cycle

The clock pictured may have been the first of its type; it appeared in the London Evening Standard in 1937. I set the clock at 7:30 AM, which is my guess of where we are in the cycle. The National Bureau of Economic Research, often long after the fact, determines official business cycle dates.

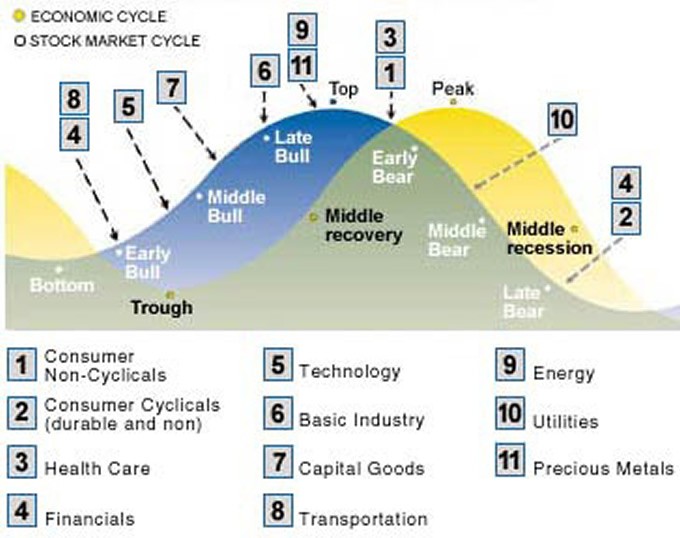

The economy expands and prospers, goes through a boom as it nears its peak, and then recedes. This is the business cycle, and it recurs repeatedly. Shown as a sine wave here, it has a long-term upward growth trend. Idealized models provide illustrations; the economy is just not as neat as shown.

While the business cycle is quite predictable, the current cycle is unusual because of the financial upheaval of 2007-2008 and the degree of government intervention. Stock market volatility is high, which may be in part a result of the exit of small investors from the market and the increase in computerized program trading. During days or weeks of extreme volatility and volume the financial markets act as one, that is, all asset classes and sectors move in concert. The value of sector selection is diminished on those occasions.

Interest rates might follow a natural cycle within the business cycle, but the manipulation of them by governments in an attempt to influence the business cycle adds but another complicating factor. Perhaps actions by the Fed are beneficial and move us more quickly to expansion and full employment than might have happened otherwise. Perhaps, they also are able to mitigate inflation in an overheating economy. Not all are convinced. The sovereign debt crisis and federal deficits of the US and other countries cast doubt on the ability of governments to manage money. In any case, the life of the investor is made more complicated, though general rules concerning cycles and sectors still apply and are useful.

Sector Rotation

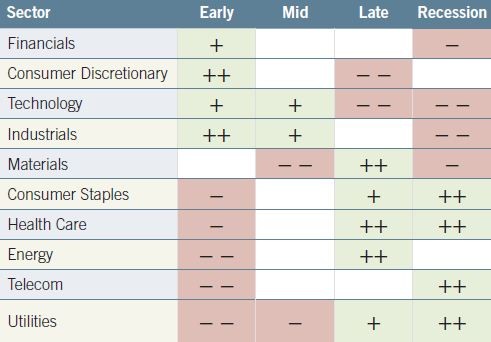

Observers noted many years ago that certain sectors of the economy perform better at different points in the business cycle. While the predicting of business cycles, let alone their effects on business and industry, is by no means an exact science, there are strong correlations between points in the business cycle and sector performance.

That is, Sectors perform in predictable patterns. Sector Rotation is the term that describes a strategy where an investor rotates out of some sectors into others as the cycle moves forward. One may accomplish this by changing their portfolio sector allocation of individual stocks, by buying and selling different sector ETFs or by buying funds that manage the rotation.

During the expansion of the economy, when unemployment becomes lower, spending on Consumer Discretionary goods picks up as consumers have more money. It then follows that the stocks of companies that sell discretionary items will go up. Transportation, part of the Industrial Sector, increases along with the increase in economic activity. Technology also thrives early in the economic cycle, perhaps because of pent up demand for previously unaffordable capital items.

By following business cycles, an investor chooses sectors that will perform well in the forecasted phase of the business cycle. Selection of individual companies is the usually by fundamental and technical analysis. Sector rotation typically causes selling stock in one industry and buying in another. It is a dynamic process and one that requires attention to the economic factors affecting sectors and industries, and the purchase and sale of stocks sometimes on a flexible schedule.

There never seems to be complete agreement concerning where we are in the business cycle, or which sectors will prosper. Some investors and traders have great success with sector rotation and outperform the market. iShares Sector Spider ETFs are a popular way to easily buy and sell sectors. Here is a table with advice from two different sources concerning which sectors to overweight and underweight in 2012.

How does understanding the business cycle and sector performance help the long-term investor, especially the Dividend Growth investor? I believe there are several advantages of having an awareness of the economic cycle and its effect on the performance of sectors. Every investor has occasion to buy stocks at some time. I moved some cash to equities last fall. The two most out of favor sectors were Basic Materials and Financials. I believed that these sectors would prosper as the expansion continued, along with Technology Sector. I choose to invest in Metal Miners, BHP Billiton (NYSE:BBL ) and Rio Tinto (NYSE:RIO ) and Canadian Banks, Bank of Montreal (NYSE:BMO ) and Bank of Nova Scotia (NYSE:BNS ). The Sectors are doing better since the first of the year as are the industries and many companies within them. My other significant purchases were Microsoft (NASDAQ:MSFT ) and Intel (NASDAQ:INTC ). While I do not intend to practice active sector rotation, understanding sectors helped me determine where to look for opportunity. Did I make good picks? We shall see.

The colorful table below shows performance by sector for the last 10 years. One thing is very clear: Different sectors do better or worse from one year to the next. I expect the best sectors in 2012 to be quite different from those in 2011.