SEC Adopts Final Rules for Disclosure of OffBalance Sheet Arrangements and Aggregate Contractual

Post on: 16 Март, 2015 No Comment

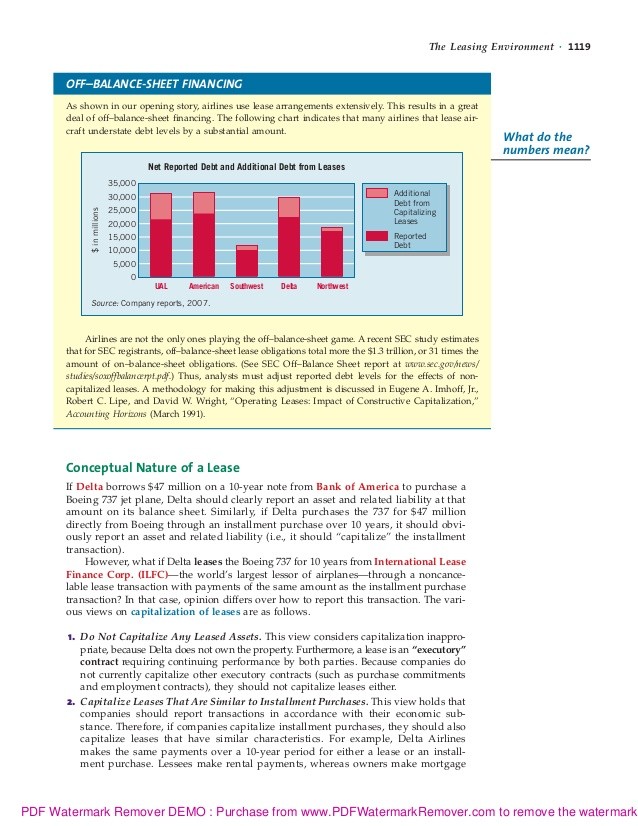

On January 22, the Securities and Exchange Commission (the SEC) adopted rules under Section 401(a) of the Sarbanes-Oxley Act of 2002 (the Act) for mandatory disclosure in Managements Discussion and Analysis of Financial Conditions and Results of Operations (MD&A) of off-balance sheet arrangements and contractual obligations (the Final Rules). Existing MD&A rules already require disclosure regarding certain off-balance sheet arrangements and contractual obligations. However, the Final Rules (i) require that disclosure of off-balance sheet arrangements be set apart in a designated section of MD&A and (ii) require additional disclosure regarding both off-balance sheet arrangements and aggregate contractual obligations.

Section 401(a) of the Act requires the SEC to issue rules providing that periodic reports shall disclose all material off-balance sheet transactions, arrangements, obligations (including contingent obligations), and other relationships of the issuer with unconsolidated entities or other persons, that may have a material current or future effect on financial condition, changes in financial condition, results of operations, liquidity, capital expenditures, capital resources, or significant components of revenues or expenses.

In addition to providing for the disclosure required by Section 401(a), the Final Rules also codify recent statements of the SEC calling for improved MD&A disclosure in the area of liquidity and capital resources. While Section 401(a) does not require the SEC to adopt a disclosure requirement regarding contractual obligations, the SEC stated that it believes that aggregated information about such items in a single location would improve the disclosure of a companys liquidity and capital resources.[fn1] In addition, although the Act only requires disclosure of off-balance sheet arrangements in periodic reports, the Final Rules also apply to disclosure in registration statements under the Securities Act of 1933.

The Final Rules require a reporting company to provide in its MD&A (1) a comprehensive explanation of its off-balance sheet arrangements, and (2) an overview of its aggregate contractual obligations in a tabular format. As noted above, only the first item is required by the Act. The SEC had also proposed requiring additional aggregate disclosure (either tabular or textual) regarding contingent liabilities. This proposal was dropped in response to comments.

The impact of the Final Rules will be most significant for companies that have entered into one or more of the following transactions:

- securitizations;

- hedging transactions;

- certain types of structured leasing transactions;

- off-balance sheet research and development arrangements;

- certain types of financing transactions using unconsolidated subsidiaries or other affiliates;

- arrangements involving keepwells, guarantees or other financial support; and

- transactions with special purpose entities providing liquidity, market or credit risk support for the company.

The Final Rules go into effect as follows:

- new disclosure regarding off-balance sheet arrangements is required for SEC filings that include financial statements for fiscal years ending on or after June 15, 2003; and

- table of contractual obligations must be included in filings that include financial statements for fiscal years ending on or after December 15, 2003.

Off-Balance Sheet Arrangements

Definition

The SEC revised the definition of off-balance sheet arrangement from that originally proposed in order to incorporate concepts from U.S. GAAP.[fn2] The Final Rules define the term off-balance sheet arrangement as any contractual arrangement to which an unconsolidated entity is a party, under which the company (whether or not a party to the arrangement) has, or in the future may have:

- any obligation under certain guarantee contracts ;

- a retained or contingent interest in assets transferred to an unconsolidated entity or similar arrangement that serves as credit, liquidity or market risk support to that entity for such assets;

- any obligation (including a contingent obligation) under certain derivative instruments ; or

- any obligation under a material variable interest in an unconsolidated entity that (1) provides financing, liquidity, market risk or credit risk support to the company or (2) engages in leasing, hedging or research and development services with the company.

Although Section 401(a) of the Act does not make this distinction, the SECs definition only includes contractual arrangements. The Final Rules include an instruction that a company would not be obligated to disclose an off-balance sheet arrangement until there was an unconditionally binding definitive agreement, subject only to customary closing conditions or, if there were no such agreement, until settlement of the transaction. This instruction is consistent with the SEC policy set forth in its 1989 Interpretive Releases on disclosure of preliminary negotiations.

In the definition of off-balance sheet arrangement, a guarantee contract is defined by reference to paragraph 3 of FASB Interpretation No. 45 (Guarantors Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others), excluding the items described in paragraphs 6 and 7 of FIN 45. Paragraph 3 of FIN 45 includes the following types of arrangements:

- financial standby letters of credit or guarantees of the market price of the common stock of the guaranteed party;

- performance guarantees;

- certain types of indemnification agreements; and

- keepwell agreements and certain other indirect guarantees of indebtedness of others.

The second prong of the definition is designed to capture situations in which a company structures an off-balance sheet arrangement by retaining an interest in assets transferred to an unconsolidated entity, where the value of the retained interest could decline and have a material effect on a companys financial condition. This would include, for example, a subordinated retained interest in a pool of receivables transferred to an unconsolidated entity for the purpose of providing credit support to the entity.

The third prong of the definition includes derivative instruments that are excluded from FASB Statement of Financial Accounting Standards No. 133 (Accounting for Derivative Instruments and Hedging Activities) pursuant to paragraph 11a of SFAS 133.[fn3] The SEC noted in the adopting release that it included this element in the definition of off-balance sheet arrangement to better apprise investors of the impact of these types of derivative instruments. The SEC stated that the impact of certain derivative instruments may not be apparent to investors because they are classified as equity and subsequent changes in fair value may not be recognized in the financial statements.

The last prong refers to the concept of variable interest in the recently issued (January 2003) FASB Interpretation No. 46 (Consolidation of Variable Interest Entities). Variable interest is defined in FIN 46 as contractual, ownership, or other pecuniary interests in an entity that change with changes in the entitys net asset value. The definition of off-balance sheet arrangement, however, includes only variable interests in entities that provide financing, liquidity, market risk or credit risk support, or engage in leasing, hedging or research and development services with the company.

The definition of off-balance sheet arrangement encompasses arrangements between a company and an entity conducting off-balance sheet activities, as well as arrangements between that entity and third parties and between the company and third parties.

Many off-balance sheet arrangements involve the use of special purpose entities (SPEs), structured in such a way as to not require the reporting company to consolidate the SPE into its financial statements under GAAP. The SEC noted in the proposing release that accounting standard setters in the United States are currently reevaluating the accounting guidance for consolidation of SPEs.[fn4] The SEC indicates that it believes disclosure of off-balance sheet arrangements involving SPEs is vital to investor understanding, regardless of whether consolidation of such entities is required.

Disclosure Threshold

The existing MD&A materiality disclosure standard is whether information is reasonably likely to have a material effect on financial condition, changes in financial condition or results of operations. The Final Rules utilize this same disclosure standard.

In the proposing release, the SEC indicated that it interpreted the may language (may have a current or future material effect) in Section 401(a) of the Act as requiring a lower threshold for disclosure. The Proposed Rules would have required disclosure of off-balance sheet arrangements under circumstances where management concludes that the likelihood of the occurrence of a future event and its material effect is higher than remote; in other words, where it may have a current or future material effect.

In the Final Rules, the SEC returned to the existing MD&A materiality disclosure threshold, noting that use of the reasonably likely standard was most likely to reduce overly voluminous and insignificant disclosure and to focus on information most relevant to the understanding of a companys financial condition. The SEC also commented that the use of a consistent disclosure threshold through MD&A was important to avoid confusion.

Disclosure about Off-Balance Sheet Arrangements

Under the Final Rules, a company must disclose, in a separate section of its MD&A, to the extent necessary to an understanding of the companys off-balance sheet arrangements and their material effects on financial condition:

- the nature and business purpose of the off-balance sheet arrangements (for example, enabling a company to lease a facility rather than acquire it or to finance research and development costs without recognizing a liability);

- the importance to the company for liquidity, capital resources, market risk or credit risk support (or other benefits) (for example, how often a company securitizes it financial assets, to what degree securitizations are a material source of liquidity and whether it has materially increased or decreased securitizations);

- the financial impact on the company, and the companys exposure to risk as a result of the arrangements, including:

- the amounts of revenues, expenses and cash flows arising from such arrangements;

- the nature and total amount of any interests retained, securities issued and other indebtedness incurred; and

- the nature and amount of any other obligations or liabilities (including contingent obligations or liabilities);

The SEC eliminated a number of disclosure requirements that it had originally proposed, electing to rely instead primarily on the type of principles-based approach found in the current MD&A rules. In particular, the Final Rules do not require a company to disclose the nature and amount of the total assets and total obligations of an unconsolidated entity that conducts off-balance sheet activities, although the SEC indicated that a company may need to disclose the nature and amount of assets transferred to an unconsolidated entity, in order to explain the nature and purpose of the relevant off-balance sheet arrangement.

The Final Rule requires a company to aggregate off-balance sheet arrangements in groups or categories that provide information in an efficient and understandable manner and avoid repetition and disclosure of immaterial information. For example, if a particular triggering event would require a company to become directly obligated under a number of off-balance sheet arrangements, and the overall obligations would be material, then the Final Rules would require an analysis of the aggregate effect.

Contractual Obligations

Under the Final Rules, a company (other than a small business issuer) must disclose, in a tabular format, its contractual obligations aggregated by type, for the periods specified in the table below. Although the Proposed Rules would have permitted a company to use either the suggested categories or other appropriate categories, the Final Rules require the use of the five categories specified in the table shown below, and require that the table be substantially in the form provided. A company may, however, disaggregate the specified categories by using other categories suitable to its business, but the table must include all the obligations that fall within the specified categories. The company must provide the information as of the latest fiscal year end balance sheet date.

The disclosure may be placed anywhere in the MD&A that the company deems appropriate. A company will not be required to include the table of contractual obligations in its quarterly reports, but may instead limit disclosure in such reports to a discussion of material changes.