SBI Magnum Equity Buy

Post on: 1 Июль, 2015 No Comment

A focus on quality and timely cash calls have given the fund a leg-up

August 24, 2014:

The mid-cap pack has run up spectacularly over the past six months, outperforming large-caps substantially. But investors not too keen on risk may be better off focusing on steadier large-caps, as these firms have reasonable earnings visibility.

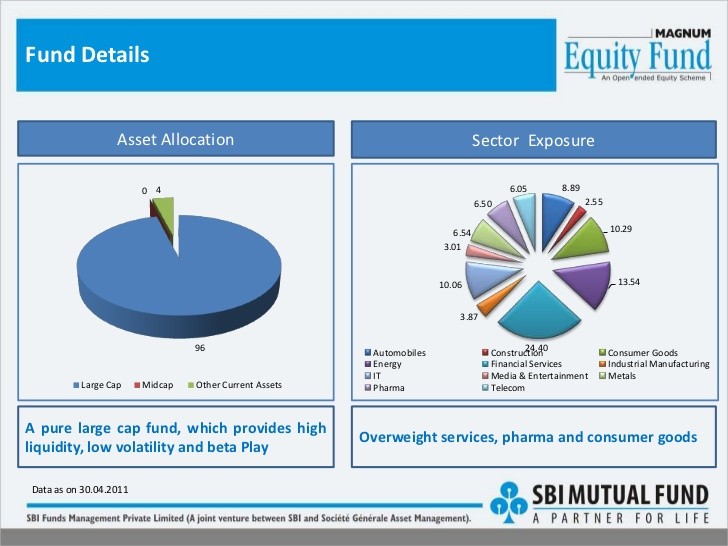

SBI Magnum Equity (Magnum Equity), which invests almost entirely in large-caps, is an attractive addition to investors portfolio. The fund has steadily improved its performance the last four-five years. It does reward long-term investors, but is not a chartbuster.

The fund has outpaced its benchmark Nifty over one-, three- and five-year timeframes. The outperformance has been to the tune of 1.5-4 percentage points.

Over the last five years, Magnum Equity has delivered compounded annual returns of 14.6 per cent, which places it in the top quartile of funds in its category, ahead of peer schemes such as Franklin India Bluechip and DSPBR Top 100 Equity.

The fund takes a concentrated approach to its top stock holdings, which makes it a tad risky. But such exposure is normally taken in quality index names. SBI Magnum Equity may be a good option for investors with a longer investment horizon of at least five years and who are looking for steady returns. The scheme could be a suitable diversifier to ones portfolio.

Portfolio and strategy

Magnum Equity takes high exposure to individual stocks, at times going over 7 per cent. In its recent portfolio, the top 10 stocks account for over 57 per cent of the overall pie.

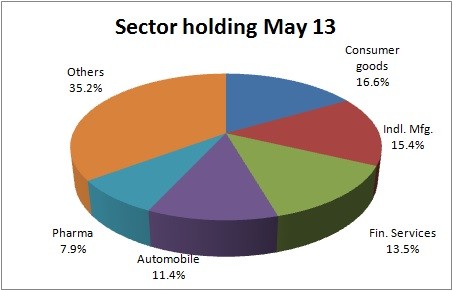

But the picks are mostly from the Nifty basket and hence offer some amount of stability. There are also quality names from outside the Nifty such as Zee Entertainment, Motherson Sumi, Eicher Motors and Shriram Transport Finance. Banks and financial services have always figured prominently in the funds portfolio across market cycles. Software and energy, too, are among the top sectors invested in. The fund increased exposure to automobiles early this year and has hence gained from the rally in the segment.

It did not go heavy on sectors such as capital goods and construction, which meant that its performance in the recent rally has not been top-notch.

The fund took good cash and debt calls to contain volatility during correcting markets. For example, during the 2011 correction, it held cash and current assets to the tune of 12 per cent of the portfolio.

With a track record of over 23 years, the scheme has managed to deliver returns that beat its benchmark and the category over the long term.

(This article was published on August 24, 2014)