Savings accounts Stocks or Mutual funds The 8 advantages of investing in mutual funds

Post on: 6 Август, 2015 No Comment

I have always been a financial consultant first, stock market trader and investor second. I never believe that there is just one single investment that fits everyone and will take that person into the financial goals that they have set out. Professionally, it is about finding a good mix of investments that will fit the investor and it also about totally avoiding an investment that does not fit him. This article is dedicated explore another possible avenue for investors as we will discuss the advantages of investing in mutual funds. I have my Ninong Ramir Libre of Sun Life Financial (also a stock market trader and technical analysis trader) talk about the 8 advantages of investing in mutual funds.

Again because mutual funds invests in either bonds or stocks, as an investor this also subjects you to the risk and volatility in the market. What I am trying to say here is if you go beyond bank accounts, you would not find any guaranteed investment that would give you a fixed return. If there was one that is what you call a scam.

In the next few weeks and months this year, I will be talking more about other investment avenues where us Filipinos can put our money. All towards moving into financial freedom! The future is bright! Enjoy the article!

1. LOW INITIAL INVESTMENT For as low as 5000 pesos, you can be invested in Mutual Funds.

2. SUCCEEDING INVESTMENT EVEN LOWER THAN INITIAL INVESTMENT- after placing an initial investment of 5000 pesos, investor can make additional investment of 1000 pesos per transaction, whether monthly, weekly or as frequent as he wants.

3. NO 20% withholding Tax- unlike in other bank instruments such as Savings, Time deposits and SDAs, clients are being charged by 20% withholding tax on their interest. Mutual Funds will not be charged with tax as mandated by R.A. 8424.

4. EXPERT and PROFESSIONAL FUND MANAGERS-

Funds are managed by experienced professional managers who spend much of their time “obsessing” about which stocks to buy or trade.

Let the professional fund managers do it for you. To buy and sell equity stocks you need to deal with stockbroker and it should be authorized by the Philippine Stock Exchange. There a lot of things that you should learn like fundamentals of the stock you want to buy. You also need to know when to buy and sell this requires skill in technical analysis, so better leave this to the experts, let them grow your money.

5. BEATS INFLATION, ATTRACTIVE LONG TERM RETURNS-

Better yield than any bank instruments as mentioned above.

SDA ‘s interest rate is around 2.0% per annum less 20% withholding tax.

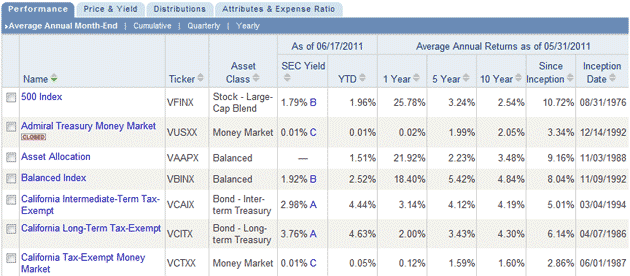

Please see below an example of actual performance of Mutual Fund from Sun Life Prosperity Funds Dec 28, 2012:

Equity Fund

1 year return – 33.6%

3 year return 94.4%

5 year return- 73.0%

Balanced Fund

3 year return 70.4%

5 year return- 57.4%

Bond Fund

1 year return – 5.9%

3 year return – 23.7%

5 year return- 33.0%

6. DIVERSIFICATION a risk management technique that mixes a wide variety of investments within the portfolio.

Studies and mathematical models have shown that maintaining well-diversified portfolio of 25 to 30 stocks will yield the most cost effective of reduction. Source: Investopedia

e.g.

If you have 10,000.00 pesos and you want to buy PLDT stocks, this amount is not even enough to buy a minimum board lot of 5 shares of PLDT at 2910 per share.

Computation :

Php 2910 x 5 = 14550.00 this excludes broker’s fee and taxes.

However if invest you the 10,000.00 pesos in mutual fund, your investment is spread over numerous listed companies. Companies like PLDT, SM,AYALA CORP.,METROBANK,BDO, BPI and big corporations.

Just like what they say, it is like putting your egg in different baskets.

7. LIQUIDITY – this means you can withdraw and get your cash if you need it. For some Mutual fund companies, it will take only 3 days to get your cash.

8. CAN ACCESS INFORMATION EASILY- Investors can easily access information about their fund value thru websites of the mutual fund companies.

It is also published daily in the newspapers.

——————————————————————————————————————————