Sargent Lundy Savings Investment Plan

Post on: 12 Июль, 2015 No Comment

REASSESSING YOUR PORTFOLIO

The following excerpts are from an article in the January 2000 issue of Schwab’s On Investing magazine. The opinions expressed by the author, Matthew M. Stichnoth, may or may not reflect those of the SIP Committee. Reassessing your portfolio once a year will help improve the odds of meeting your long-term goals.

1. Revisit your investment assumptions. You save and invest for a reason: to send the triplets to Harvard, maybe, or to pay for that retirement house in Bimini. Whatever your goals, there are a number of key variables in the Great Investment Equation that, on a semi-regular basis, you need to keep an eye on.

They include, for instance, a) the size of the pile of money you’ll eventually need to fund your long-term goals, b) the length of time until you need to get at it, and c) the prevailing level of interest rates between now and then. This being the real world, reasonable assumptions for a, b, and c and be expected to change regularly — and some d’s, e’s and f’s will frequently get thrown into the mix. Reassess all those assumptions to make sure they square with the state of the world. If they don’t, you might consider changing the amount that you’re regularly socking away — or changing your long-term asset allocation.

2. Rebalance your portfolio. The fussies in the audience will say you should rejigger your blend of stocks, bonds, and cash a heck of a lot more often than annually, that’s for sure. They’re probably right; then again, those are the folks who’ll also tell you that you should floss three times a day.

For the rest of us, this is as good a time as any to make sure our portfolios are still structured to achieve our long-term financial goals. For instance, if you were heavily concentrated in technology stocks in 1999, it’s nearly certain that the equities component of your portfolio has gotten larger than your long-term investment plan originally envisioned. How might be a good time to get things back in sync by taking some profits in technology — or, if you prefer, to change your investment strategy by boosting your stocks allocation. Regardless of what you do, you should reflect, analyze, and decide. Control your asset allocation, or it will control you.

3. Consider new asset classes. This is going to sound crazy in the current only-the-tech- stocks-go-up investment environment, but it’s true: the more different types of assets you own, the better. You’ll make more money, face less risk, and have to endure fewer sleepless nights — as long as the returns of the assets you own are [pardon the geek-speak] noncorrelative.

Anyway, while stocks, bonds and cash are the Big Three of the investment world, additional types of investments will likely help carry the load in a very efficient manner. In particular, non-U.S. stocks have been on the outs with investors for years, yet many experts feel that the investment outlook in Europe and Asia might be better than it is in the U.S. right now. And while gold and other commodities are out of favor on Wall Street, a small exposure there could be a boon if a macroeconomic surprise were to occur. Regardless, the more classes you have, the more likely you are to earn ample returns no matter what happens.

4. Weed out your losers. Don’t, don’t, don’t, whatever you do, let your equity holdings become a garden of forgotten memories. Take the time to go through your portfolio and remind yourself why you own each stock that’s in it. If you draw a blank on certain names, they’re probably good sale candidates. This will help your portfolio performance in two ways: free it from the drag of the underperformers, and raise capital that can be put to more productive uses. The foregoing advice, by the way, goes for the winners in your portfolio as well.

5. Rethink your list of investment inputs. Even the Yankees tweak their lineup every year, and you should, too. Take a moment to think about whom you rely on for investment ideas and advice. A stock broker? A financial planner? Newsletters? Magazines? Friends and family? We all have a list that’s longer than we realize, and extremely varied. It sure doesn’t hurt to winnow that list from time to time by removing the names that are consistently unproductive or that might have simply lost their touch.

6. Reassess your investment needs. Did a new child or grandchild who figures in your long-term investment plan arrive in the past year? Is a little voice in the back of your mind whispering something about early retirement? Would your spouse like to stop working? If you haven’t made adjustments to your portfolio for changes like this, now’s a great time to do so. All that might be needed is an asset shift away from bonds into stocks, or a slight change in the amount you save every month. If you go through the numbers, you might find that those little voices are easier to please than you’d thought.

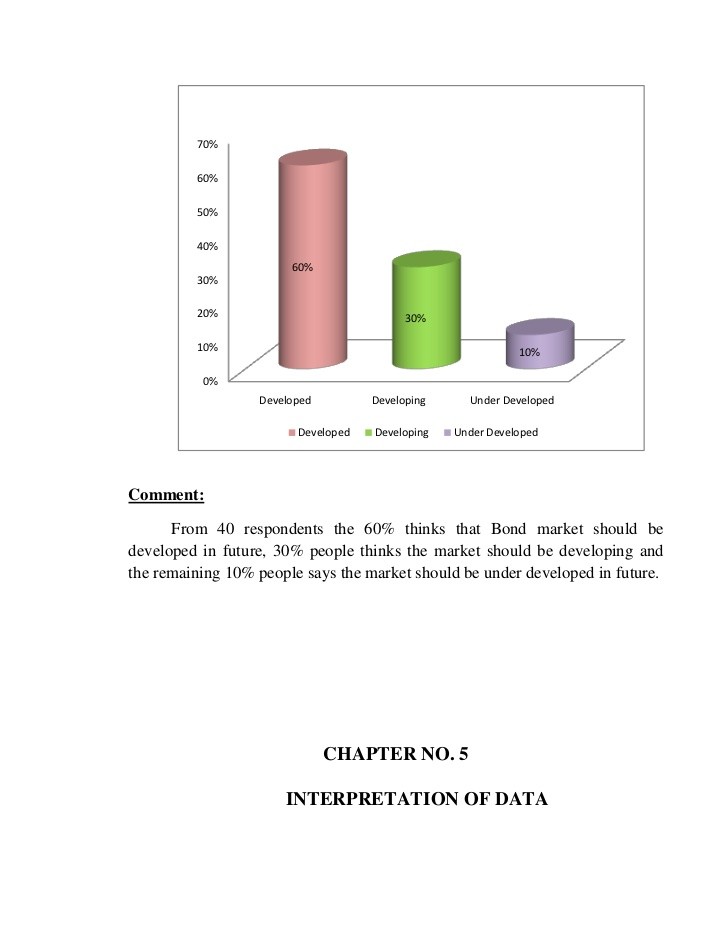

7. Find out what’s going on in the bond market. For the vast majority of individual investors, the best fixed-income strategy involves laddering maturities, in order to strike the right balance between yield and liquidity. That does not mean, though, that you need to be wedded to Treasuries for your whole life. Instead, check out the differences in yield between the various sectors of the fixed-income market — between government bonds and corporate bonds, say, or corporates and mortgages — in order to maximize your yield while managing risk.

There are other helpful steps you can take, of course, but these are the basics. See how easy it is? These steps won’t ensure that your next stock pick turns into a four-bagger — but they will enable your portfolio to stay within your long-term risk/reward parameters. That may not be as much fun as crowing about hot picks to your friends at cocktail parties, but over the long term it’ll be a lot more rewarding.

This page updated on 3/27/2000