Sample Investment Policy Statement

Post on: 9 Июль, 2015 No Comment

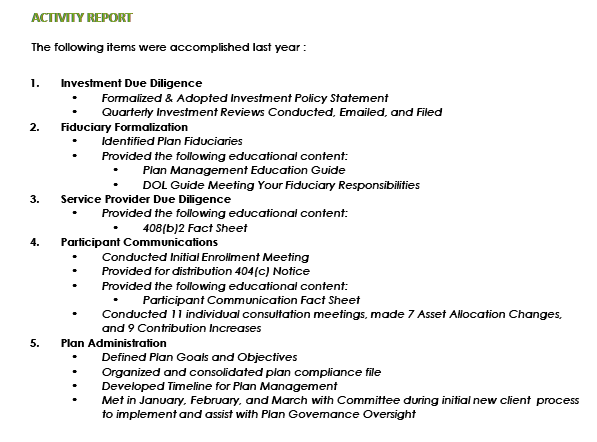

I. Purpose The purpose of this Investment Policy Statement (IPS) is to guide HNW Wealth Management Inc. and Mr. and Mrs. Wealthy Client in effectively implementing and supervising a strategy for managing the Clients’ investment assets. This is accomplished by:

- Describing the Clients’ attitudes, expectations and objectives

- Outlining the various asset classes, allocations and management styles to be used to yield the desired rate of return with full regard for the Clients’ risk preferences.

- Providing guidelines for investment policy and security selection

- Establishing criteria to evaluate and monitor manager performance

II. Objectives Having completed a comprehensive review of the Clients’ current and future financial requirements, it was jointly agreed that the objectives were:

- Liquidity – To have sufficient liquid assets to pay all known current obligations and to have an allowance for unexpected expenses

- Income – There is no income requirement at this time. Income will be required beginning in Year 6 of the plan.

- Growth – To achieve growth in overall portfolio values equal to the rate of inflation plus five percent (5%) on an after-tax, after-fee basis. This is to be accomplished by the application of reasonable and prudent investment strategies, controlling costs of managing the portfolio and minimization of taxes.

III. Investment Policy

- Time Horizon

The strategy is based on a long-term perspective of ten (10) years or more. Consequently, short-term market fluctuations should not require deviation from the plan.

- Risk Tolerance

The Clients recognize that investment markets fluctuate and that some short-term volatility must be accepted in order to achieve the long-term objectives. The Clients have described themselves as “moderately risk tolerant” and expressed an ability to manage a loss in overall portfolio values of up to 20 percent in any twelve-month period and 30 percent in any 24-month period.

- Performance Expectations

As stated in the Objectives, the desired rate of return is “inflation plus five percent” on an after-tax, after-fee basis. Minimum acceptable three-year return is 15 percent before tax. These rates have been based on the assumption that future returns will approximate those historically earned on the types of assets to be included in the Clients’ portfolio. The Clients’ acknowledge that past performance may not be indicative of future results and that a real return of five percent may not be realistic under some market conditions. Therefore, additional performance benchmarks are outlined in Section VI — Monitoring to be applied in those situations where expected long-range returns are not being realized.

- Asset Allocation

The Clients have reviewed the long-term performance of various asset classes and, based on a balance of acceptable risk and reward, have chosen the following asset allocation:

- Rebalancing

The Clients recognize that market conditions may cause the asset allocation to occasionally become “out-of-balance”. To avoid unnecessary transaction costs and possible tax consequences, each asset class will be permitted to vary by up to ten percent from its allocation. Variations greater than ten percent will necessitate rebalancing according to the above limits. Additional contributions that the Clients may make from time to time should be proportionately allocated to maintain the asset mix in effect at that time.

IV. Security Selection The following guidelines should be applied to the selection of securities:

- Equities

- No more than ten percent of the portfolio’s equity component may be invested in any one company (or related companies)

- No more than 30 percent of the portfolio’s equity component may be invested in any one economic sector

- Bonds

- No more than ten percent of the portfolio’s fixed income component may be invested in any one bond issuer

- All bonds shall have a rating at least equivalent to a “BBB” as ranked by a recognized rating agency

The following securities are not acceptable investments:

- Companies directly involved in the tobacco industry

- Companies operating for less than two years

The following transactions are not permitted:

- Short selling

- Lending cash or securities

V. Manager Selection

HNW Wealth Management Inc. will select money managers who are:

- Registered Investment Counselors

- Able to provide historical performance data for the five previous years

- Able to provide written statements of their investment philosophy, policies and procedures

- Able to report on a monthly, quarterly and annual basis

- Free from any pending legal or regulatory entanglements

VI. Monitoring

- Money Manager Responsibilities

- To manage the Clients’ assets according to the IPS

- To inform HNW Wealth Management Inc. of any material changes that might affect the management of the Clients’ assets

- Performance Benchmarks

In addition to the performance criteria stated previously, the following benchmarks will be used for peer group evaluation:

VII. Reporting and Review

On a monthly basis, each money manager shall provide an accounting of all transactions, current holdings and market value.

- Quarterly

- HNW Wealth Management Inc. and the Clients will meet on a quarterly basis to review:

- Money manager performance

- Consistency with IPS

- Annually

At each fourth quarter review, HNW Wealth Management Inc. and the Clients will review the Clients’ risk tolerance, desired rate of return, asset class preference and time horizon to major disbursements. Expenses and fees paid will also be analyzed.

- Money Manager Review

- Money managers will be placed under review if:

- Their performance is in the bottom half of their peer group in any quarter or annual period

- Their five-year performance is in the bottom half of their peer group

- There is a material change that might affect the management of the Clients’ assets