RSI Unleashed Building on Forgotten Characteristics Part 1

Post on: 16 Март, 2015 No Comment

RSI Unleashed — Building on Forgotten Characteristics Part 1

By Frederic Palmliden, CMT

Senior Market Technician, TradeStation Labs

Summary

While the Relative Strength Index (RSI) is probably the most commonly known and used technical oscillator, the original intent behind the RSI is often unknown to traders. This paper presents a custom indicator that highlights and builds on some of the initial RSI concepts that can be used to generate multiple different trading systems, such as shifting RSI ranges. A TradeStation workspace and three analysis techniques for the custom RSI are attached to this report in order for you to better understand and explore the content presented in this paper.

Background

The RSI was originally developed by J. Welles Wilder, Jr. more than 30 years ago. It is calculated using the following formula:

RSI = 100 — 100 / (1 + RS*)

*Where RS = Average of x days’ up closes / Average of x days’ down closes

Introduction

The usual application of the RSI consists mainly at looking for overbought and oversold levels with regard to a particular security. Some market commentaries will even suggest shorting or going long a security just on the premise that the oscillator is in overbought or oversold territory, respectively, disregarding the fact that, for example, an oscillator can stay overbought for a long time as the security continues to move higher and higher. On the other hand, did you know that Wilder considers divergence the single most indicative characteristic of the RSI? Also, did you know that the behavior of the RSI can be used to help determine whether a security is in a bullish or bearish mode? In other words, the RSI can be used to identify trends, which goes against common wisdom that the indicator is only effective in non-trending markets.

Analysis Techniques

The ideas around the revised RSI (rRSI) include multiple advanced concepts and any one concept could potentially be used to create and develop a trading strategy. Three separate sections below explain these concepts: 1) Two RSIs with Shifting Ranges; 2) The RSI Spread; and 3) Moving Fibonacci Retracement Levels. Three separate TradeStation analysis techniques are necessary in order to completely display the different concepts. The three analysis techniques do not entirely follow the order of the three sections.

While similar, all three analysis techniques have different purposes. For instance, one analysis technique is a TradeStation PaintBar, while the other two are TradeStation indicators. Also, the second and third analysis techniques display certain information directly on the security, as opposed to information being displayed in sub-graph 2. General information on each of the three analysis techniques is found in the different sections below.

Once the different analysis techniques have been generally described in the three sections below, additional attention is given to the main analysis technique, such as a detailed description of the inputs. The structure of the second and third analysis techniques is mostly identical to the first, which is why no additional detailed content will be provided for them.

Section 1: Two RSIs with Shifting Ranges

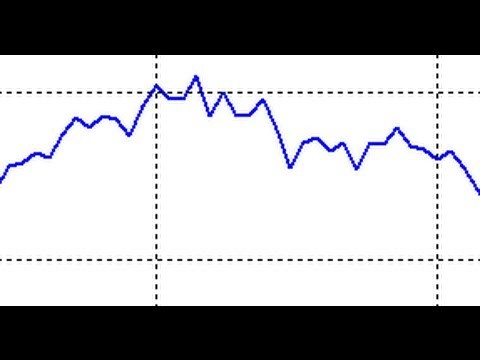

Two RSI oscillators are displayed in the middle sub-graph of the window (see Figure 2 below). The difference between the two RSIs is simply that one is slower (longer length) than the other. What differentiates these RSIs from the supplied version has to do with the overbought and oversold boundaries. Here they are dynamic. The typical 30/70 limits will shift to higher or lower limits based on specified rules. Two dotted lines are used to mark the normal range when the RSIs are using the higher or lower range.

Figure 2: Two RSIs with Shifting Ranges

%img src=

/media/Images/TradeStation/Education/Labs/Analysis /%

The different lengths below are used for a price chart using a daily interval. If another time interval is used (e.g. intraday), adjustments to the different lengths may be necessary as will be seen in the Analysis section below.

The higher range of 45/85 is implemented if the following three conditions are true

- The regular RSI has not been under 30 for 100 days.

- The regular RSI has stayed above 52 for the last 7 trading days.

- The usual 30/70 boundaries have been used for 15 trading days.

The higher range will shift back to the normal range if:

- The regular RSI is below 35 AND the RSI has stayed in the higher range for 15 trading days

OR

Also, the typical 30/70 limits will shift to a lower range of 15/55 if the following conditions are true:

- The regular RSI has not been over 65 for 100 days.

- The regular RSI has stayed below 48 for the last 7 trading days.

- The usual 30/70 boundaries have been used for 15 trading days.

The lower range will shift back to the normal range if:

- The regular RSI is above 65 AND the RSI has stayed in the lower range for 15 trading days

OR

Section 2: The RSI Spread

The spread between the regular RSI and the slow RSI from Section 1 is displayed in the lower sub-graph of the window (see Figure 3 below). The spread is the difference between the two RSIs. Bollinger Bands are also shown around the spread, as well as fixed upper and lower boundaries at +10 and -10, which tend to be extremes for the spread over time.

Figure 3: RSI Spread

%img src=

/media/Images/TradeStation/Education/Labs/Analysis /%

Section 3: Moving Fibonacci Retracement Levels

The moving 61.8% Fibonacci retracement level from both extremes of the 50-day range (highest high and lowest low for the last 50 trading days) are displayed directly on the security in the upper sub-graph of the window using dotted lines (see Figure 4 below). The 50-day range is shown using solid lines.