Roth IRA 101

Post on: 9 Апрель, 2015 No Comment

The best way to start investing is with a Roth IRA.

Too many people claim they want to invest for their future but do nothing about it. There’s a big difference between just thinking about something and actually doing it. Many people think investing is too confusing, but it’s actually pretty simple. Learning the basic rules of investing and taking the proper steps forward can lead to wealth and security (which is what you want, right?).

The best way to start investing is with a 401(k) or other matching plan if your employer provides a match. Start there and invest up to the match. After that, you should start investing in a Roth IRA. If you have no clue what this is or always get confused when you hear an investing term, this is just for you. There are no big words here you can’t understand. A Roth IRA is simply:

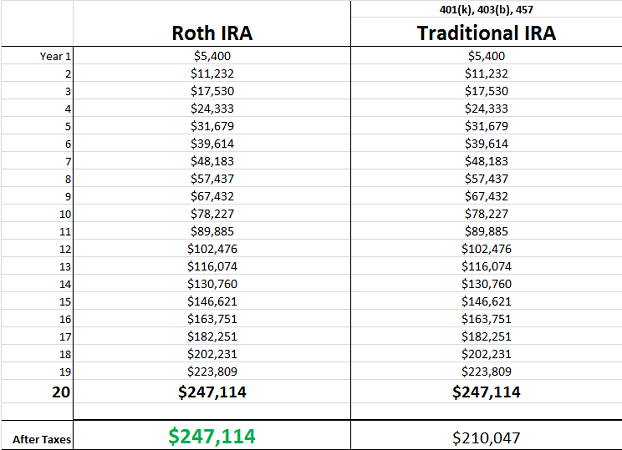

- A retirement savings account that grows tax free ! You won’t pay taxes as the money accumulates or when you cash it out at retirement. Did you get that? It grows tax free !

- A perfect retirement account for young people because your money really adds up in the long run.

- Extremely flexible. You can invest in mutual funds, bonds or real estate.

Roth IRA Rules:

- You can only contribute the maximum amount each year. In 2013, the max is $5,500.

- You can only contribute to a Roth IRA if you earn an income or if you’re married to someone who earns an income. You can’t open an account in your child’s name unless they earn an income. (Look into a 529 plan or ESA account instead.)

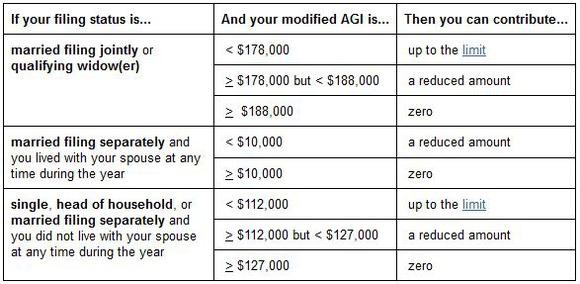

- In 2013, if you are single and make less than $112,000, you can invest the max amount each year. For married couples, you must make less than $178,000 combined to contribute to aRoth IRA. If your income is over these amounts, look into a traditional IRA.

Although you can pull your money out of a Roth IRA in certain circumstances, Dave doesn’t recommend doing this. If you pull the money out before you hit age 59 1/2, you will most likely face fees for taking it out early. So, make sure you can afford to invest in a Roth IRA.

Make this as simple as possible by having a set amount withdrawn from your bank account and put into your Roth IRA each month. You won’t even feel like you’re missing the money since you never saw it to begin with. Basically, put the money in and forget about it. It’s very simple to set one up.