Rolling your option spreads

Post on: 15 Июль, 2015 No Comment

optionsguy posted on 07/02/09 at 12:08 PM

“Rolling” is a common way options traders adjust options positions when their forecast on the underlying seems wrong in the short-term, and they just want to buy a little more time for the trade to play out . You can roll a single put or call, or you can roll a two-legged spread. This post discusses rolling spreads at TradeKing, including how and when to do it, plus the risks and costs involved.

Good news, traders: now you can roll options spreads at TradeKing!

I’ve blogged in the past about rolling a covered call sale and rolling a cash-secured put. We also discussed some tips to help you roll with success. If you’re not already familiar with this, I’d strongly suggest you review this before moving on to rolling spreads. As you’ll see, rolling options will result in additional commission costs. It may also affect your tax situation, so be sure to consult your tax advisor.

Rolling can help buy you a little more time and hopefully dodge assignment in the meantime, but it also has risks. Yes, you may believe “time will tell” and a little extra time is all you need for your forecast to play out. But you have no idea what may happen in that timeframe, good or bad. If you choose to roll and your position continues to move against you, rolling can compound your losses. Be very careful about using rolling to “chase” a trade gone sour. Sometimes, you have to just let your trade go, cut your losses, and move on to the next trade.

Rolling with spreads: an intro

Let’s take a short call spread as our rolling example – this baby is also known as a “bear call spread” or a “vertical spread”, and you can check out the details of the trade at Education > Options Playbook > Play #14, Short Call Spread.

A short call spread is a bearish trade in which you sell a slightly out-of-the-money call (Strike A) and buy an even more OTM call (Strike B). Similar to selling a covered call, it’s time-erosion play: you collect a credit on the trade and then hope the underlying price stays below the strike price of the call you sold, so you can keep the full premium at expiration. (That credit is your max potential profit. ) Your break-even is Strike A plus the net credit received when opening the position; your max potential risk is limited to the difference between Strike A and Strike B, minus the net credit received.

(Keep in mind: multiple-leg options strategies, like short call spreads, involve additional risks and multiple commissions and may result in complex tax treatments. Consult with your tax advisor as to how taxes may affect the outcome of these strategies.)

But what if your short call spread goes awry? Remember, this is a bearish trade in which you’re hoping the underlying to finish below Strike A at expiration. If the underlying stock starts rising to the point where it costs you more to buy back the spread for more than the net credit you initially received, you’re in a tough spot.

If you think this bullish move is just a blip, you can act on that forecast by rolling the entire spread out further in time and a little higher in strike prices. (Of course, if you’re worried that your initial forecast is wrong, rolling wouldn’t be the best course of action – getting out of the trade and cutting your losses is the smarter move.)

Rolling a short call spread: an example

This should become a lot clearer with an example. Take imaginary stock XYZ, trading at 48. Your initial spread might look like this:

XYZ @ 48

Sell 1 XYZ July 50 call

Buy 1 XYZ July 55 call

Net credit of $1 —> your max profit

Max risk: $4 (55-50-1)

Break-even: 51 (50+1)

(Assuming a one contract spread, you would incur total commission costs of $11.20 to enter this trade: $4.95 per leg plus 65 cents per contract traded).

Let’s say you put on this spread 30 days before expiration. Fast-forward 15 days, and XYZ is now trading at 50. Hmm: your bearish forecast on the spread isn’t looking too hot, and if XYZ keeps rising it’ll eat away at your $1 net credit – plus you’ll run the risk of getting assigned on the sold call.

You may be down on this spread, but not out. If you’re still a firm bear and decide to roll, here’s how you might do it:

Buy-to-close 1 XYZ July 50 call

Sell-to-close 1 XYZ July 55 call

Net debit of $1.50

(This roll tacks on an additional commission cost of $11.20.)

This closes out your existing spread, replacing it with the following “roll”:

Sell-to-open 1 XYZ August 55 call – 1 month further out, next strike up

Buy-to-open 1 XYZ August 60 call – 1 month further out, next strike up

Net credit of $1.50 —> your max profit

Max risk: $3.75 (60-55-1.25)

Break-even: 56.50 (55+1.50)

(This new position adds on commission costs of $11.20.)

For simplicity’s sake, let’s assume it costs the same amount to get out of the old spread as we bring in on the new roll – so we’re net-zero on this roll. (Keep in mind that the real world may not be so kind; you may have to decide whether it’s worth a net debit to roll your position.)

What have we accomplished with this roll? Well, now XYZ has to move past 55 before you’re in the danger zone again, so you bought yourself some wiggle room there. Your max risk is about the same. However, here comes the down side: you now have to wait another 45 days to see how this trade plays out. If XYZ continues its bullish run, you may have to bail out the trade anyway and incur your max loss. (Exiting this spread will cost another $11.20 in commissions.)

Final caveats on this example: the above calculation is an imaginary projected return. The example also assumes none of the options mentioned get exercised or assigned before expiration – but in the real world, that can happen, so plan accordingly.

Rolling a spread at TradeKing

If you’re a TradeKing client, here’s how you can roll a spread on our site. Login and go to Accounts > Holdings. where you’ll see a new drop-down menu that says “Roll Spread”. It looks like this:

Simply check both legs of the spread you’d like to roll, then select “Roll Spread” in this drop-down and click the green trade button to be taken to a new page, called the “4 Legs Free Form” order entry screen. From there you can add the two new legs you’d like to roll into. You’ll see both your old spread and your proposed new spread on the same screen.

This screen enables you to roll out of the old spread without worrying about the market risk of closing one spread and then simultaneously trying to open a new one.

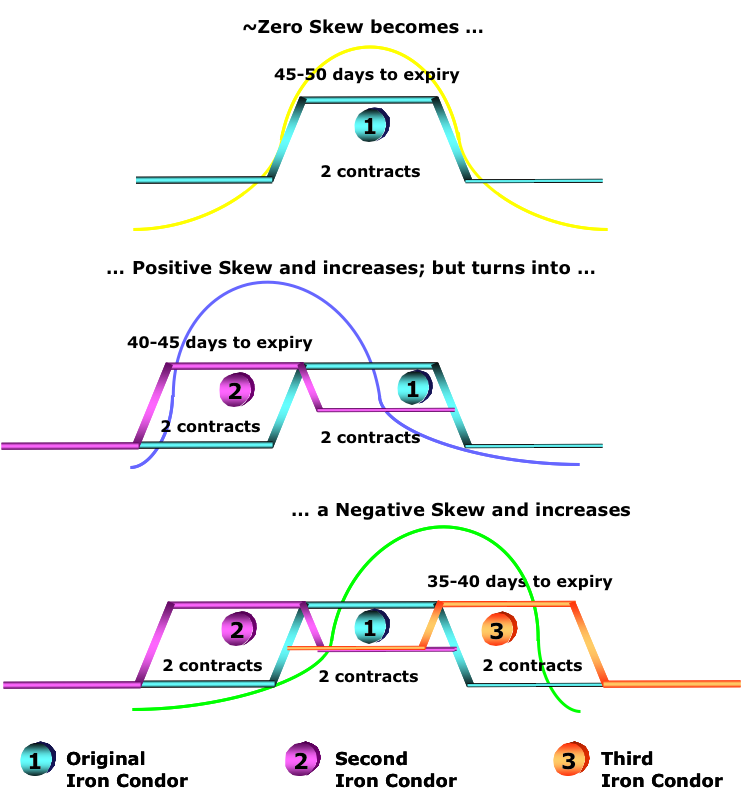

Coming soon: rolling for condor traders

The next step in this discussion is to talk about rolling for iron condor traders. Previously if you closed one of the spreads in your condor, you’d get no release of cash to your account from TradeKing. But, you’ll be happy to hear this site upgrade gives condor traders a handy way to navigate around that inconvenience. More on that in a future post!

Regards,

Brian Overby

TradeKing’s Options Guy

www.tradeking.com/ODD .

The theoretical return for this trade is not actual and does not guarantee future results.

Supporting documentation for any claims made in this post will be supplied upon request. Send a private message to All-Stars using the link below the profile image.

Any strategies discussed or securities mentioned, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities.

TradeKing provides self-directed investors with discount brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.