RockSolid Dividend Shares to Start 2015 With

Post on: 16 Март, 2015 No Comment

Rock-Solid Dividend Shares to Start 2015 With

When it comes to dividend investing, a mistake I see and hear about often would be investors chasing stocks with high yields. There’s nothing wrong with wanting a fatter dividend cheque from the shares you own – but picking an income share based on its yield alone can be a dangerous game to play.

That’s because a share’s dividend yield tells us nothing about how strong its business has been and is likely going to be. And ultimately, a share’s future dividends which is what should be of concern to us investors – is inextricably tethered to the performance of its underlying business. Without a thriving business, those dividends can’t grow and we run the risk of seeing those payouts get reduced or removed completely.

Finding rock-solid dividends

On that note, here’re some useful pointers which can help us separate the wheat from the chaff when it comes to picking up rock-solid dividend shares:

1. A company’s track record in growing its dividend. This is important as it gives us valuable insight on management’s commitment to rewarding shareholders as the company grows.

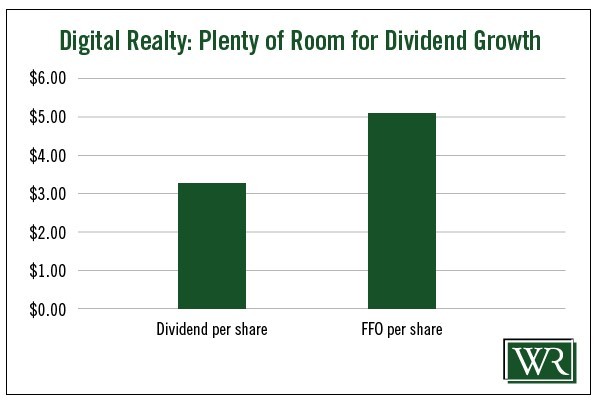

2. A company’s ability to grow its free cash flow and generate free cash flow in excess of dividends paid. Dividends are paid using the cash a company has. There are a few sources that every firm can access to acquire that capital: A company can borrow money, issue new shares, or simply generate sufficient cash from its daily business operations.

Although there are always exceptions, it’s generally more sustainable for a firm to fund its dividends using cash that’s generated from its businesses. It thus follows that investors should keep an eye on a company’s free cash flow as it is the cash that’s left after the necessary funds have been spent to maintain the company’s businesses at their current state.

3. The strength of the company’s balance sheet. Companies that have weak balance sheets that are laden with debt are generally at higher financial risks and that can have negative impacts on their dividends. A strong balance sheet that is flush with cash provides a company with plenty of room for error to tide over tough times.

I decided to run the 750-plus listed companies in Singapore through those pointers, using their financials in 2007 as a starting point. The starting year is chosen as such because looking at a company’s track record since that year can give us clues on how strong its business is since that timeframe encompasses the Great Financial Crisis of 2008-09.

The great ones

So, shares like Raffles Medical Group Ltd (SGX: R01) and Straco Corporation Ltd (SGX: S85). among others, managed to filter through.

Source: S&P Capital IQ

Healthcare services provider Raffles Medical runs more than 100 medical centres in Singapore, in addition to its flagship Raffles Hospital located along North Bridge Road. As you can see from the chart above, the company’s dividends have grown steadily from 2007 to 2013, and its free cash flow has also been consistently higher than its dividends while clearly climbing upward over the years. Raffles Medical’s balance sheet has also strengthened over the years, as seen from how the gap between its cash and borrowings has widened.

Source: S&P Capital IQ

Straco’s an owner and operator of tourism assets in China and Singapore; it owns the Shanghai Ocean Aquarium, Underwater World Xiamen (these two are in China), and the Singapore Flyer. I trust it’s obvious to see that Straco’s chart above has ticked all the right boxes.

A Fool’s take

These two shares do not carry particularly high yields. At Raffles Medical’s and Straco’s current prices of S$3.92 and S$0.765, they carry yields of 1.3% and 2.6% respectively (based on their dividends for their last completed financial year). In comparison, the SPDR STI ETF (SGX: ES3). an exchange-traded fund which tracks Singapore’s market barometer the Straits Times Index (SGX: ^STI). has a yield of around 2.6% at the moment.

With such yields, the two firms would likely not be thought of as good income shares. But, if their businesses can continue performing like how they’ve done in the past, then investors might be able to sit on a much larger yield in the future on their original investment cost.

None of the above is to say that both shares would definitely make for a great investment for investors seeking strong dividends as the inherent business risks have not even been considered. But at the very least, the beautiful track records of these two companies might make them a suitable target for further study as investors hunt for rock-solid dividend shares to start 2015 with.

For more investing analyses and important updates about the stock market, sign up to The Motley Fool Singapore’s free weekly investing newsletter, Take Stock Singapore. Written by David Kuo, it can help you grow your wealth in the years ahead.

Like us on Facebook to follow our latest hot articles.

The Motley Fool’s purpose is to help the world invest, better .

Get FREE Issues of TAKE STOCK

By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms of Service .

When it comes to dividend investing, a mistake I see and hear about often would be investors chasing stocks with high yields. Theres nothing wrong with wanting a fatter dividend cheque from the shares you own but picking an income share based on its yield alone can be a dangerous game to play.