RoboAdvisors Can Not Live by Millennials Alone ASI s Andrew Rudd Wealth Management Today

Post on: 16 Май, 2015 No Comment

The industry press in 2014 was all abuzz about robo-advisors. Online, automated investment 2C222 /% advisory firms that are gobbling up assets at an alarming rate and scaring the pants (and skirts) off the management of traditional advisory firms.

Not so fast, says Andrew Rudd, CEO of Advisor Software, Inc. (ASI).

There has been a lot of virtual ink spilled about the robo-advisors trend, including their technology prowess and potential to disrupt the wealth management space, it is much ado about nothing, according to Rudd.

We met Rudd for coffee in midtown Manhattan last week and got his take on where the robo trend is headed, his definition of what is a robo-advisor and why he doesn’t think robos are doing a very good job building their brand.

ASI, which Rudd founded in 1995, built what might be the first robo-advisor platform for a Washington-based wealth management firm back in 2001. Like current robo-solutions, it was designed to service small accounts with online investment selection tools, institutional-type package trades, using mostly Exchange Traded Funds (ETFs).

Robo-advisors will not go away anytime soon, Rudd believes, but they also will not disrupt the industry or put existing advisory firms out of business. The industry will evolve to support a wide spectrum of solutions, from fully-automated to traditional face-to-face advice. Robos will occupy just a small niche in this spectrum, he predicted.2C185 /%

The World Beyond Millennials

There are a number of reasons for this, Rudd explained. One is that robos have a flawed business model that is based primarily on targeting the Millennials market. “The world is more than just Millennials,” he noted. They will have difficulty attracting a large enough asset base to become profitable unless they broaden their offering to other demographic groups. (See Why Demographic Differences Define How Advisors Should Talk to Clients )

The assets under management for all robo-advisors was pegged at around $19 billion at the end of 2014. Rudd questioned if this total was real. His theory is that if the top four firms have $5-6 billion in AUM among them, it seems unlikely that the rest of the field could be managing another $13-14 billion. Even if these number can be verified, he feels that they still have a long way to go, considering how much money has been invested in them.

Robo Branding Problems

The current crop of robo-advisors “have not done a particularly good job of branding themselves,” Rudd insisted. They do have a difficult job in marketing to a group of people who normally do not think much about investing. Rudd quoted a study that estimated the cost of creating nationwide brand-awareness at around $1 billion.2C169 /%

If you add up all the funding that has been provided to robo-advisors, including both venture capital, public and private, it totals around $500 million. Based on Rudd’s projection, they would have to spend 200% of what they have raised just on advertising in order to build their brands properly. (See What Robo-Advisors Can Teach Us About Focusing on the Client )

Of course, they cannot do that. They need to spend heavily on technology just to keep up in the new robo arms race. Now that the first wave of companies gained their footholds in the market, it has attracted second and third waves of competitors who can smell the new revenue streams.

This competition now includes members of the big 4 custodians including Fidelity, which partnered with both Betterment and Learnvest. as well as Charles Schwab, who is offering their robo platform to advisors for free.

Customer Acquisition

Another costly part of the advisory business that some robo-advisor firms may have underestimated is that customer acquisition is very costly. According to Tom Kimberly, the founder of white-label robo-platform Upside. most robo-advisor will need between three and four years to break even on a new customer. Will they have enough investor cash to support that long of a runway to profitability?

2C225 /% What Exactly is a Robo-Advisor?

Rudd tried to differentiate between the robo-advisors based on the breadth of their solution as opposed to their level of automation of their investment process. Motif Investing should not be considered a robo-advisor, according to Rudd. They should be called an “automated investment platform”.

Robo-advisors should be able to solve a client’s lifetime investment problem. It is more than just a simple portfolio. But most have not even thought about it.

Firms that perform an automated investment function have been around for years, Rudd explained. Financial Engines should really be classified as a robo-advisor since they provide a fully-automated solution for providing advice on retirement savings. If they were classified this way, they would be the largest robo in the world with over $100 billion in AUM and almost $900 billion in assets under contract (AUC).

ASI’s Robo Service Offering

Rudd announced that ASI was planning to launch their own robo platform for advisors sometime in 2015. “Robos have provided a path to what advisors should be doing for small accounts,” Rudd commented. ASI’s offering will be better optimized for smaller account sized and will be easily customized to match each advisor’s brand.

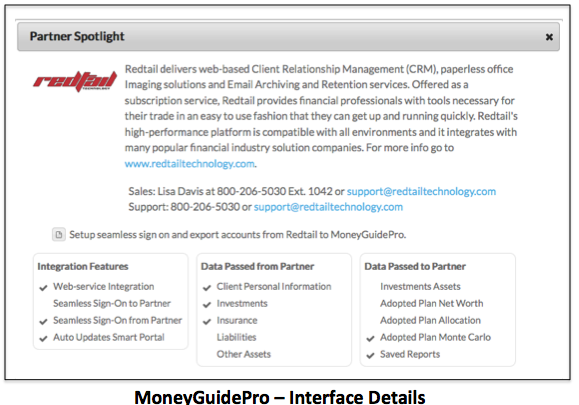

One differentiator of ASI’s platform will be its tight integration with their financial planning tool, Goalgami. Most other robo solutions concentrate on the investment management side or the financial planning side, but few do both very well. (See Orion Pumps Up Financial Planning with ASI Integration )

Rudd insisted that their platform will be more flexible, will provide a common solution for advisors as well as self-directed consumers and will support more complicated investments such as private equity and hedge funds.

There are currently no plans for ASI to move into the Turnkey Asset Management Platform (TAMP) space and compete against firms like FolioDynamix or Envestnet. Rudd is more than satisfied being the engine under the hood of the product offerings for his clients.

Follow us on Twitter @wm_today

Related WM Today Content