Risks of Bond ETFs

Post on: 15 Июль, 2015 No Comment

Know the Risks of the Bonds in Your ETF

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Every investment has risk; nothing is guaranteed to make money. Sure, there are some investments that have very little risk and others that are considered high risk, but the rewards associated with those investments are relative to risk levels as well. So it’s always important to know the risks and potential returns with any asset…including bonds.

Like other investments, bonds have risks. And if you are investing in a bond ETF, then you should be very aware of these bond risks since they will impact the value of your exchange traded fund as well. So with that in mind, here are the types of risks for bonds and bond ETFs…

Interest Rate Risk

Bond prices have an inverse relationship with interest rates. As interest rates rise, the price of a bond will decrease. So one of the risks of a bond is an increase in interest rates, which will decrease the bond price. And since bonds are part of a bond ETF, an increase in interest rates will decrease the value of a bond fund as well. The amount of decrease of the bond fund will depend on the actual bonds correlated with the ETF.

Yield Curve Risk

So we know that interest rates impact bond price, but each bond will react differently to rates depending on different factors. Price, maturity, coupon, etc. So if a bond ETF is a mini-portfolio of bonds (or an asset that tracks multiple bonds), then the amount of interest rate risk is the yield curve risk. In other words, how sensitive is your bond portfolio to interest rate risk.

Every bond ETF will have a different yield curve risk – a sensitivity to interest rates based on the bonds correlated with the fund.

Call Risk

Every bond has a duration – a defined maturity. However, some bond issuers have the option to “call” the bond early. And this is a risk to the bond holder. So since some bonds create revenue streams, those streams can be stopped early if the bond is called. Your revenue stream is not 100% guaranteed. A risk to a bond and an ETF that holds the bond.

Reinvestment Risk

Typically, bonds are called early when interest rates are below the coupon rate. Then the holder is subject to reinvestment risk. The investor will have to “reinvest” back into a bond with an interest rate lower than the coupon rate.

Default Risk

Basically, default risk is the chance that the debt issuer won’t honor the agreement. He will “default” on the loan, or in this case the bond. So if you have a bond ETF, there is risk that a bond associated with your fund could default. And that could have a negative impact the overall value of your bond ETF.

Credit Spread Risk

There is a correlation between bond prices and interest rates. We know that. And the sensitivity of this relationship is the yield curve, which we also discussed. However, part of that yield curve sensitivity is the credit spread. The default risk of the issuer based on the difference (spread) in rates.

For example, in tougher economic climates, bond issuers will have less profit or cash flow. Cash flow that would be used to pay off the obligation of the bond. Credit spread risk measures the risk of an issuer defaulting on payment due to interest rates and the economic impact. Basically, it’s the risk of default risk so to speak.

Downgrade Risk

All bonds have a rating, which impacts their risk profile. Higher rated bonds have less default risk vs. low-rated bonds. But the logic is that low-rated bonds have more reward potential. So, if your bond ETF contains high-rated bonds, then you have a lower risk associated with your fund than say a junk bond ETF (high risk).

However, what if some of the bonds in your ETF get a lower rating (get downgraded)? All of a sudden, your bond ETF now has more risk – downgrade risk.

Liquidity Risk

This is the risk associated with trading in and out of your bond positions…or in this case of your bond ETF positions. The liquidity risk of a bond in this case is going to differ than the liquidity risk of the bond ETF. In most cases, a bond ETF will be a little more liquid than an individual bond (not always, though) because some bond ETFs traded actively on the exchanges. So there could be less liquidity risk for the ETF than an individual bond within the bond fund.

However, just to recap, the liquidity risk of a bond is the risk of not being able to sell your asset before its maturity. So it may be a little harder to lock in an early profit.

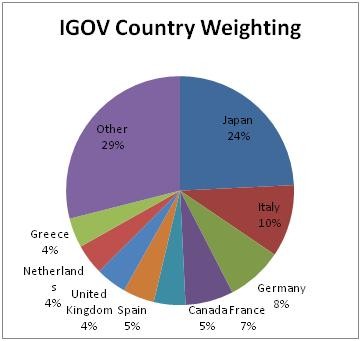

Currency Exchange Risk

This applies to foreign bonds that do not remit payments in the domestic currency. Whenever you deal with bonds in foreign currencies, the value of your revenue streams are subject to exchange rates. So as currency rates fluctuate, so does the value of your payments. Therein lies the exchange rate risk.

Inflation Risk

Speaking of your payments, like any other form of revenue, they are subject to inflation. Meaning, the value of the payment decreases with higher inflation rates. The cash from you payment won’t have as much purchasing power in times of higher inflation. So you have risk if inflation increases, the coupons are not worth as much as they are in times of lower inflation.

Volatility Risk

This type of risk applies to bonds that are callable (or putable). As the volatility of rates change, so will the price of the bond. So as rates fluctuate up and down, the prices of bonds will go down and up. Therefore there is more risk that a bond with a call or put option to be executed. In other words, increased rate volatility will lead to increased chance the bond will be called (or the put option will be exercised). As volatility risk increases, callable (or putable) risk increases.

Event Risk

Factors unrelated to the structure of a bond, can increase risk. Meaning there are other things that can impact the price of a bond other than interest rates, duration, etc. One of those types of risk is event risk. The risk that a certain event can impact the value of a bond or bond ETF.

For example, a war in another country could increase the risk associated with a foreign bond ETF. An earthquake or a change in a country’s financial climate, both could change the value of a bond fund.

Or, in the case of a corporate bond fund. changes in a company or sector could impact the value of the bond. Is there a shortage of materials for the sector? Are two major players in the industry merging? Some unforeseen events can happen, which is always added risk for your bond fund.

Sovereign Risk

Similar to event risk, sovereign risk is the risk of a foreign government impacting the value of the bond. Law changes, failure to honor the debt obligation (default risk), etc. A government can seriously impact the price of a foreign or domestic bond ETF, so there is always sovereign risk.

And while the above risks aren’t the only risks associated with bonds and bond ETFs, they are the main types of risk to consider. So with any investment, ETF, bonds, bond ETF or otherwise, make sure you conduct your due diligence and understand the risks involved. And if you have any questions, make sure to consult your broker, advisor or financial professional before you make any investments.