Risk Return in Modern Portfolio Theory

Post on: 16 Март, 2015 No Comment

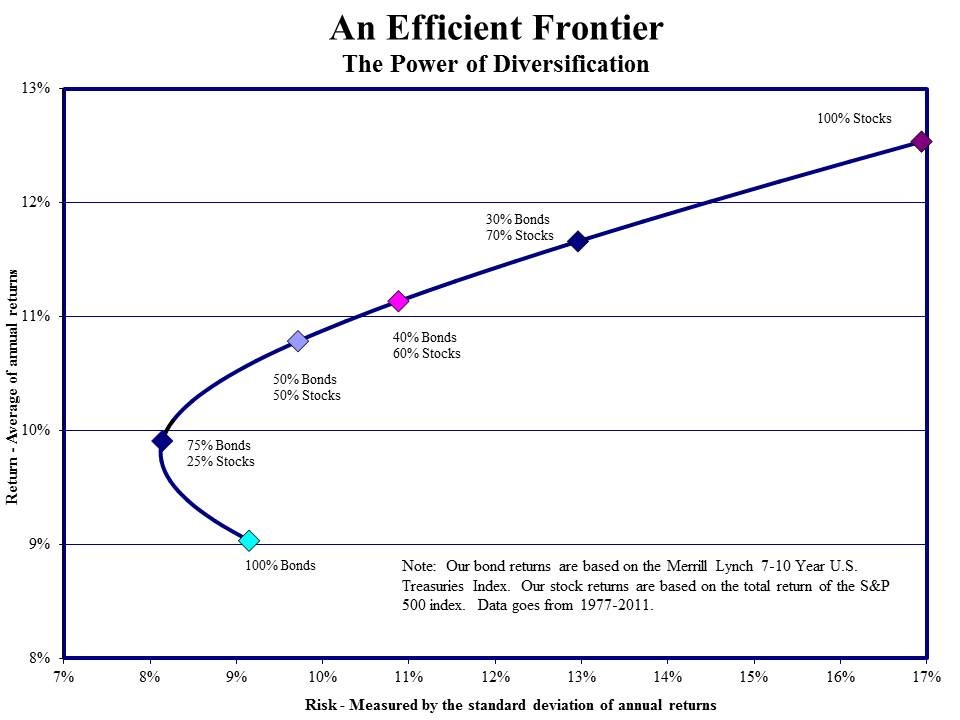

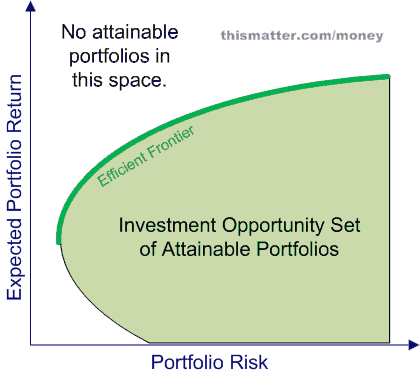

For a lot of investors, risk is in general considered to be connected with dire reports. What many individuals do not succeed in noticing is that all investment involves risk, and that any investor who desires to get a return that is superior to the risk free rate will need to be taken on with some investment risk. Modern portfolio assumption supposes that investors are coherent beings who are risk averse and that given equal returns will favor an investment that has the less risk. If two investments have the same amount of risk, a rational investor will have a preference to the investment with a higher return. Investors are not as reluctant to risk as they are reluctant to losses. A forecast of a securitys return is a probable or expected value which is representative of the investors prospects of the return distribution for the security, and the expected return consists of both the expected taken in and unrealized yearly income. Famous returns are not good predictors of future returns. The anticipated return of a portfolio is the weighted average of the expected returns of the securities that encompass it. On the other hand, the risk of a portfolio is a function different features that include, the comparative weights of each of the assets which consist of the portfolio, the unpredictability of each of the portfolios components as calculated by the standard deviation of returns, and the association of the returns amongst every pair of assets which consist of the portfolio.

Specialists and experts make use of a number of tools to make easy the assessment of portfolios, one being the routine supposition. The routine supposition shows that the returns on a security are grouped around a sole number. Experts call this the central tendency towards the mean or average. This routine supposition allows an investor or portfolio manager to make choices of securities based on two different measures which are the anticipated return of the security, and the standard variation of the securitys return.

Standard deviation is a measure of the anticipated deviation or unpredictability of returns in relation to the projected return. Ordinary deviation is a numerical measure of the spread of the securitys returns. In most cases, the higher the standard deviation, the higher the total risk of a security or a portfolio.

The standard deviation of a portfolio is always under or equal to the weighted average of the standard deviations of the component securities. The standard deviation of a portfolio can be calculated from the standard deviations of the individual securities that make up the portfolio. Even if the return distributions of the individual securities inside a portfolio are not usually dispersed, as the whole number of securities held in the portfolio raises, the distribution of the portfolios return leans towards regularity. The typical variation connected with the return on an asset reduces with time. As a result, the longer the analysis horizon is, the lower the standard deviation of the annualized returns over the horizon will be. Expanding the time horizon reduces the risk of a stock investment in relation to an asset that is not at risk. An insignificant estimate error can have a significant impact on the ending portfolio value if the analysis horizon is long.