Risk Management How To Avoid Emotional Investing

Post on: 31 Май, 2015 No Comment

Thursday, April 21, 2011

How To Avoid Emotional Investing

Investors have a knack for piling into investments at the top and selling at the bottom. Many investors get caught up in media hype or fear and buy or sell investments at the peaks and valleys of the cycle. Why does this type of emotional investing happen and how can investors avoid both the euphoric and depressive investment traps? Read on for some tips on how to keep an even keel — and keep your investments on track.

Tutorial: Understanding Behavioral Finance

Investor Behavior

The behavior of investors has been well documented; there are numerous theories that attempt to explain the regret and overreaction that buyers and sellers experience when it comes to money and the potential gains and losses on that money. Investors’ psyche overpowers rational thinking during times of stress, whether that stress is a result of euphoria or fear.

The typical non-professional investor is putting his hard-earned cash at stake and, while hoping for a gain, wants to protect that cash against losses. Investors get investment information from many sources, such as mainstream media, financial news, friends, family and co-workers. Oftentimes investors get enticed by the market during periods of market calm (low volatility) and prolonged bull markets.

Bull markets are periods when the market tends to go up indiscriminately. During such times of market exuberance, investors tend to listen to stories from friends or family members about how much money they are making in the market, creating a stir and compelling those not invested to test the waters. Likewise, when investors read stories about a bad economy or hear reports about a volatile or negative market period, fear takes over and they sell at the bottom. (Not all investors are mentally prepared for when a much-awaited bull market finally comes charging in. To learn more, check out Is Your Psyche Ready For A Bull Market?)

Bad Timing

The lag between when an event occurs and when it is reported is what typically causes investors to lose money. The media will report a bull market only once it has already hit; unless the trend continues, stocks will retract in upcoming periods. Investors, influenced by the reports, often choose these times of premium valuations to build up their portfolios. It is worrisome when the daily stock market report leads off the mainstream news because it creates a buzz and investors make decisions based on opinions that are often outdated. Market uncertainty creates fear and brings about an atmosphere of emotional investing.

Time Tested Theory

The theory that many market participants buy at the top and sell at the bottom has proved to be true based on historical money flow analysis. Money flow analysis looks at the net flow of funds for mutual funds. Over a period from 1988 through 2009, money flow analysis showed that when the market hit its peak or valley, money flows were at the highest levels.

Money continued to flow into funds until the market hit bottom, and only then did investors start to pull money out of the market and money flows turned negative. The net outflows peaked at market bottoms and continued to be negative even as the market moved into an upward trend. Because the market was shown to fall before funds were sold, and funds were often reinvested after the market had alreayd moved up, it’s clear htat investors often fail to time their trades in the most beneficial manner.

A Bright Spot

Despite the strong tendencies that investors portray at the peaks and valleys, they have gotten other periods correct. Throughout the 1990s, there was a steady flow of funds into the market during a period when the market was on a prolonged bull run. Likewise from 2004 to 2007, during another strong bull market, investors poured money into the market. So it can be hypothesized that during periods of very little volatility (such as prolonged bull markets), investors become more comfortable in the market and begin to invest. However, during periods of volatility, or when bull or bear markets begin and end regularly, money flows tend to reflect confusion and the timing of the flows becomes mismatched with actual market movement. (Discover how some strange human tendencies can play out in the market. Are we really rational? Check out Understanding Investor Behavior.)

Strategies to Take the Emotion Out of Investing

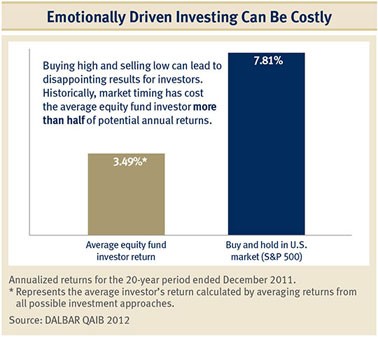

A 2009 study of investment behavior by DALBAR showed that over the 20-year period from January 1989 to December 2008, the S&P 500 returned an average annual 8.4% by by Kristina Zucchi

how-to-avoid-emotional-investing.asp_ (investopedia.com)

but the average stock investor returned only 1.9% annually. The evidence suggests that emotional investing gets the best of the typical investor during periods of uncertainty. There are strategies, however, that can alleviate the guess-work and reduce the effect of poorly timing fund flows.

The most effective tends to be the dollar-cost averaging of investment dollars. Dollar cost averaging is a strategy where equal amounts of dollars are invested at a regular, predetermined interval. This strategy is good during all market conditions. During a downward trend, investors are purchasing shares at cheaper and cheaper prices. During an upward trend, the shares previously held in the portfolio are producing capital gains and fewer shares are being added at the higher price. The key to this strategy is to stay the course- set the strategy and don’t tamper with it unless a major change warrants revisiting and rebalancing the established course. (There is more than one way to work this strategy. Find out more in Choosing Between Dollar-Cost And Value Averaging.)

Another technique to diminish the emotional response to market investing is to diversify a portfolio. There have been only a handful of times in history when all markets have moved in unison and diversification provided little protection. In most normal market cycles, the use of a diversification strategy provides downward protection. Diversifying a portfolio can take many forms — investing in different industries, different geographies, different types of investments and even hedging with alternative investments like real estate and private equity. There are distinctive market conditions that favor each of these subsectors of the market, so a portfolio made up of all these various types of investments should provide protection in a range of market conditions.

Conclusion

Investing without emotion is easier said than done, especially because uncertainty rules the market and the media. Evidence suggests that most investors are emotional and maximize money flows at the wrong times — a surefire way to reduce potential returns. Strategies that eliminate the emotional response to investing should produce returns that are significantly greater than those indicated by the typical investor responding to the market rather than proactively investing in the market. Dollar-cost averaging and diversification are two proven strategies within a multitude of other alternatives to reduce an investors emotional reaction to the market. (Curious about how emotions and biases affect the market? Find some useful insight in Taking A Chance On Behavioral Finance.)