Risk Management Foreign exchange Interest rate Trade

Post on: 26 Июнь, 2015 No Comment

You can’t avoid risk completely, but there are tools and advice available to help manage it.

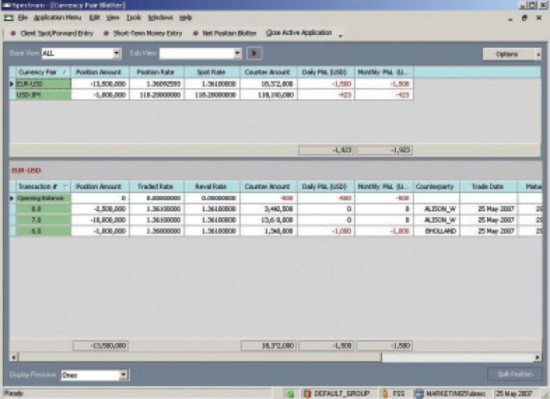

Foreign exchange risk

Foreign exchange risk is your exposure to fluctuating exchange rates. Foreign exchange markets are volatile and are constantly moving. These movements can have implications for any business that has receipts and/or payments in a foreign currency. On conversion, these receipts/payments can change in value from one day to the next, depending on the rate at which they are exchanged.

Interest rate risk

Interest rate risk refers to your exposure to fluctuating interest rates. Interest payments can be a major cost for many businesses. If an interest rate of 5 per cent moves up just 0.5 per cent it will result in a 10 per cent increase in interest cost. This is a significant direct cost that may impact cash flow, profitability and the business’ strategy as cash that may have been reserved to pursue other opportunities is absorbed by the interest rate change.

Commodities price risk

Commodity risk refers to your exposure to either fluctuating movements in commodity prices or uncertainty surrounding expected commodity production, affecting both producers and consumers.

Commodity prices can be volatile, which can expose your business to unfavourable prices when it’s time to buy or sell in the market place. Ignoring commodity risk can impact your business’ cash flow, profitability and future planning.

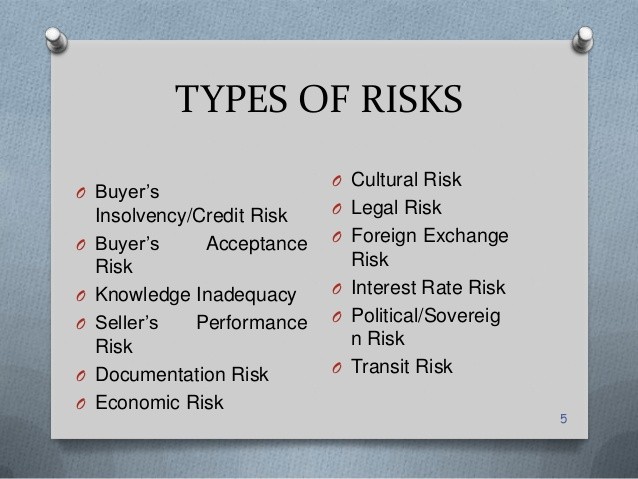

Trade risk

We can help you manage or minimise the most common trade-related risks for your business.

Goods not in accordance with the contract of sale

If you’re an importer, we can talk to you about the risks of dealing with new suppliers. We can advise you about how to check their reputation and inspect goods before shipment to avoid potential loss.

Goods not received in the time required

We’ll advise you about how to avoid issues with late arrival of goods, like making sure a contract of sale is clear about shipment dates.

Goods damaged or lost in transit

We can advise you on the steps you need to take to cover the risk of damage or loss of goods in transit.

Credit risk

Credit risk is the risk of your trading partners becoming insolvent, defaulting on payment, committing fraud or being unwilling to accept goods.

We can help you get reports on your potential trading partners and advice on the best ways of insuring against this type of risk.

Transfer risk

Transfer risk is the risk that you, as an exporter, may not be able to receive payment in a currency other than your importer’s domestic currency.

You can reduce transfer risk by using a confirmed letter of credit as your means of payment. We can help you by receiving, authenticating and confirming a letter of credit in your favour.

If you don’t use a letter of credit to get paid, we can put you in contact with export finance insurers who might cover this type of risk.