Risk Management for China s Real Estate Pooled Investment Funds (Part II of II) Finance and

Post on: 12 Октябрь, 2015 No Comment

This article continues to discuss Risk Management for Chinas Real Estate Pooled Investment Funds. The first part of this article was published on Chinalawinsight on December 2011.

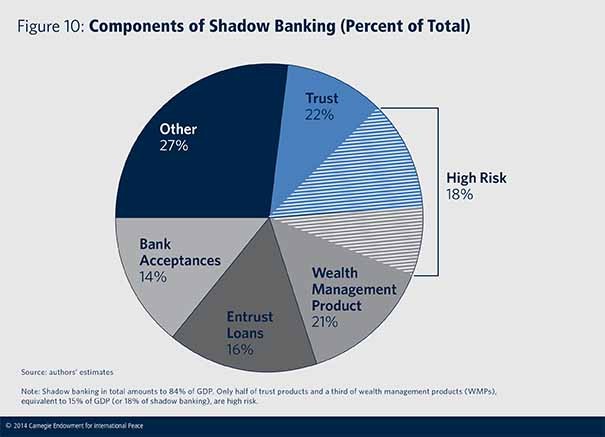

- Inherent Risks of Real Estate Trust Products

Inherent risks are closely related to the characteristics of real estate trust products and thus ingrained in such products as follows:

- Real estate pooled funds generate returns through specific assets

Real estate pooled funds generate and distribute returns by structuring the priority of beneficial interests: according to the financing agreement between trust companies and real estate developers, trust companies raise funds from the public for specific acquisition projects and guarantee investors beneficial interests as a priority payment. The parent companies or actual controllers (usually real estate developers) of the specific acquisition project transfer shares to the trust companies to gain secondary beneficial interests. Therefore, real estate developers interests are bound to the priority interests of investors and trust companies distribute returns to beneficiaries in a particular order.

In practice, different understandings regarding beneficial interests may cause deviation in judicial approaches. Beneficial interests cannot be defined as property rights, for there is no prescribed provision in the Property Law of Peoples Republic of China 1. Nevertheless, if beneficial interests are classified as creditors rights, trust companies profits might be severely affected by the complex factors attributed to creditors rights.

- Real estate pooled funds generate returns through equity investments

Trust companies raise funds from the public when investors subscribe to equity shares of a specific real estate project, participate in the management of the project, and receive returns from shared profits.

Underlying risks: (1) Regulatory compliance risks. Lack of equity structure and a mechanism for withdrawal of funds might lead to serious flaws in real estate pooled fund products. Take the mechanism of an equity interest with rights to repurchase at a premium as an example; while trust companies subscribe for equity shares in specific real estate project, the parent company or third party must repurchase equity shares at a premium. Such practice has been prohibited by the China Banking Regulatory Commission (CBRC) due to its lack of compliance with trust loan requirements. (2) Establishment risks. Most real estate developers are reluctant to share equity profits with investors and the uncertainty of the equity investment created additional risks for investors. (3) Program management risks. There are potential risks between trust companies and other shareholders when trust companies participate in program management.

- RE pooled funds generate returns through loans

Another increasing low-cost trust product is, trust companies issue loans to real estate developers and recall loan principal and interest when the trust products are due.

Risks are concentrated in: (1) Credit and capacity of the counter party. Count partys credit status and financing/profiting capacity directly influence loan repayment. (2) Flaws existing in guarantee offered by the counter party. When using real estate under construction as collateral: Whether the property right is clear? Will the construction companys priority for the property affect the collaterals value? Has the counter party completed the collateral registration? When pledging equity interests: Has the value of the equity been estimated? Is the estimated price fair? Has the counter party completed the pledge registration? If the guarantee is offered by the third party, hows the credit status of the third party? All of the above-mentioned guarantees have devaluation risks.

- RE pooled funds generate returns through a hybrid pattern

A pooled funds product combined with the above-mentioned methods is more complex and thus face higher risks.

Trust companies play overwhelming roles to dominate the whole process of RE pooled funds. There are suggestions for trust companies below:

- Careful Establish Real Estate Pooled Investment Fund to Avoid Policy Risk

Trust companies, however, remain cautious about real estate project after considering policies and regulations for real estate/trust industry.

- Reasonable Estimate Rate of RE Pooled Funds Return

Trust companies should preset rate of RE pooled funds return with objective and scientific attitude. High financing cost may lead to cash flow issues while unfulfilled return may cause investors complaint, perhaps even litigation.

- Take Due Diligence Investigation Seriously

Trust companies need to investigate the counter party through due diligence: (1) company information: business registration, duration, qualification, certification; fixed assets; outbound investment; operation structure; financial status; credit and debt, previous contracts, etc. (2) real estate project information: establishment, property ownership and other rights, certification, taxation. (3) financial status of the guarantor. (4) other related issues.

Guarantee offered by the counter party or specific project company cannot replace due diligence for the following reasons: Firstly, the reliability of the guarantee brings potential risks to the RE trust product; Secondly, false guarantee will pose a dilemma for trust companies to decide whether to terminate the trust plan for reputation or maintain the trust plan for trust returns.

- Documentary Audit

Usually, a complete trust document includes: (1) intentional and structural arrangement agreement; (2) transaction document, such as cooperative agreement; (3) company internal document, such as resolutions of shareholders meeting; (4) trust product document, such as trust product contract; (5) other documents, such as financial consultant agreement. In examining and verifying the above-mentioned documents, trust companies should focus on the documents compliance, integrity, enforcement, multiple breaches and penalty clauses, registration requirements and other factors.

- Risk Control

Professional real estate management institutions or real estate agencies, along with law firms, assist trust companies in identifying/controlling risks to improve safety of the RE pooled fund product.

- Information Disclosure obligation

In the trust plan duration period, trust companies should release operating information in a timely and adequately manner to avoid potential default risks.

- Apply to professional institutions for dispute resolution

Once disputes arise, trust companies should turn to law firms for help as early as possible and get ready for negotiation or litigation. After consulting with the professionals in this sector, the trust companies can prepare evidence and work out dispute resolution plan to recover the losses under professional guidance.

1 The Property Law of Peoples Republic of China was adopted on March 16, 2007, and became effective since October 1, 2007.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

To print this article, all you need is to be registered on Mondaq.com.

Click to Login as an existing user or Register so you can print this article.