Review Application Process Updated Asset Allocation

Post on: 26 Апрель, 2015 No Comment

Updated with new asset allocations 2013. Betterment.com is an online investment tool that rolls portfolio management, trading commissions, and rebalancing into one website. I opened an account when it started with $1,000 to look under the hood. Since then, theyve actually made several changes in response to feedback and constructive criticism.

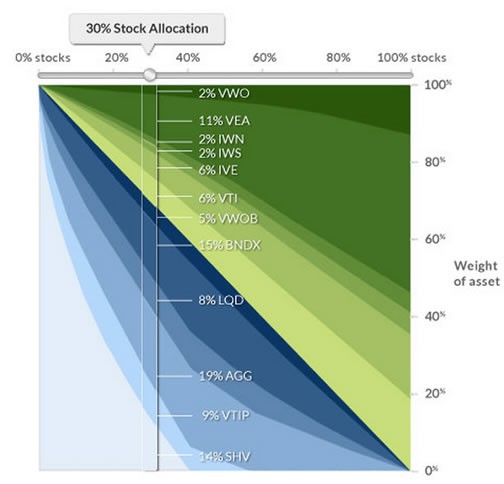

The main attraction of Betterment is simplicity. It boils everything down to a single slider (see above) to indicate your risk preference, and takes care of everything else in the background. ETF buying, ETF selling, rebalancing, and so on. On the surface, its as easy as having a bank account, besides the critical fact that you can lose money!

Application Process

The new account application was conducted entirely online. You provide your usual personal info and investing background, and they verify your identity using a quiz based on information from your credit reports (your actual credit score is not checked nor is it a factor). You then provide your bank routing and account numbers, and they deposit and withdrawal trial amounts to verify that you own that account. After that, you can transfer money electronically back and forth easily. This part was indeed simple and easy. Heres a screenshot of part of the application:

(click to enlarge)

Asset Allocation (Updated)

Based on my answers to their risk questionnaire algorithm, I ended up with a 63% stocks vs. 37% bonds allocation. My initial review circa June 2010 was critical of the fact that (1) their stock allocation was all US-based and (2) their bond allocation was entirely Treasury Inflation-Protected bonds. As of November 2010, they indeed added nominal Treasury Bonds to their asset allocation. As of September 2011, the adjusted their stock portfolio to add international stock exposure in the form of a conservative 35% international/65% US split. (Market-cap weighting is closer to 55% international/45% US.) Below is their old target breakdown for stocks and bond portions (late-2011 to late-2013):

Stock Portion Only

- 25% Vanguard Total Stock Market (VTI )

- 25% iShares S&P 500 Value (IVE )

- 25% Vanguard Europe Pacific (VEA )

- 10% Vanguard Emerging Markets (VWO )

- 8% iShares Russell Midcap Value (IWS )

- 7% iShares Russell 2000 Value (IWN )

Bond Portion Only

- 50% iShares Barclays TIPS Bond ETF (TIP )

- 50% iShares Lehman 1-3 Year Treasury Bond ETF (SHY )

In September 2013, Betterment announced more tweaking to their asset allocations, with the bond portion now including the following ETFs:

- Cash iShares Short 0-1 Year Treasury Bond ETF (SHV)

- Vanguard Short-Term Inflation-Protected Bond ETF (VTIP)

- iShares Core Total US Bond ETF (AGG)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Vanguard Total International Bond ETF (BNDX)

- Vanguard Emerging Markets Bond ETF (VWOB)

The actual asset allocations are no longer fixed in terms of stocks and bonds, but you can roughly determine the breakdown with the chart provided below:

Happily, they are using passive index ETFs that offer good tax-efficiency and low costs. The average weighted expense ratio for the ETFs by themselves will vary with portfolio risk level, but should be a little under 0.20%, or 20 basis points.

I do like the current asset allocation a lot more than I did before, although I wish it was more carefully considered in the beginning because it resulted in a lot of unnecessary trades for early adopters like myself. The silver lining is that the tax info imports nicely into TurboTax software.

Implementation

Betterment.com tries to make things simple a la ShareBuilder. and thus also uses fractional shares. This way, you can own exactly $10 or $100 of an ETF, even if the price of a single share may be $76. I believe they buy and sell shares between other users of Betterment:

DUAL AGENT CAPACITY: In executing your trades Betterment Securities has acted as both an agent and dual agent, with the exception that in the case of a trade which totals a whole number of shares we have acted as an agent only. For portions of your trades for which Betterment Securities acts as a dual agent you received an execution price equal to the bid (when selling shares) or ask (when buying shares) quotes on the open market.

As long as they are providing a fair price and not using the system as a profit-generating venture, then that would make practical sense. If I need to sell some shares and someone else is buying, then swapping them out internally would save money and commissions all around.

Fees (Last changed early 2012)

When Betterment first rolled out, it offered a flat fee of 0.9% annually for accounts with balances up to $25,000. There were no monthly fees, no maintenance fees, no minimum requirements, and no commission charged for any trades. As of March 2012, their fee schedule has been changed to lower fees for most users, but also raised some fees for certain smaller accounts. However, if you were an existing customer which opened an account before February 21, 2012. you can choose to keep your old fee schedule.

Heres the new fee schedule, which breaks down into three plan options:

Note that for accounts under $10,000 in size, there is a requirement to add $100/month to your account. Otherwise, youll be subject to a $3 monthly fee. For smaller accounts that dont contribute $100 a month, this is comparatively a fee increase. However, I think this requirement is understandable because Betterment needs active and growing accounts for their business model to work, and this also encourages a certain level of saving. If you do add $100 a month, your annual fees are now 0.35% instead of 0.9% previously. Once you reach $10,000, there is no monthly requirement and you are looking at 0.25% annually.

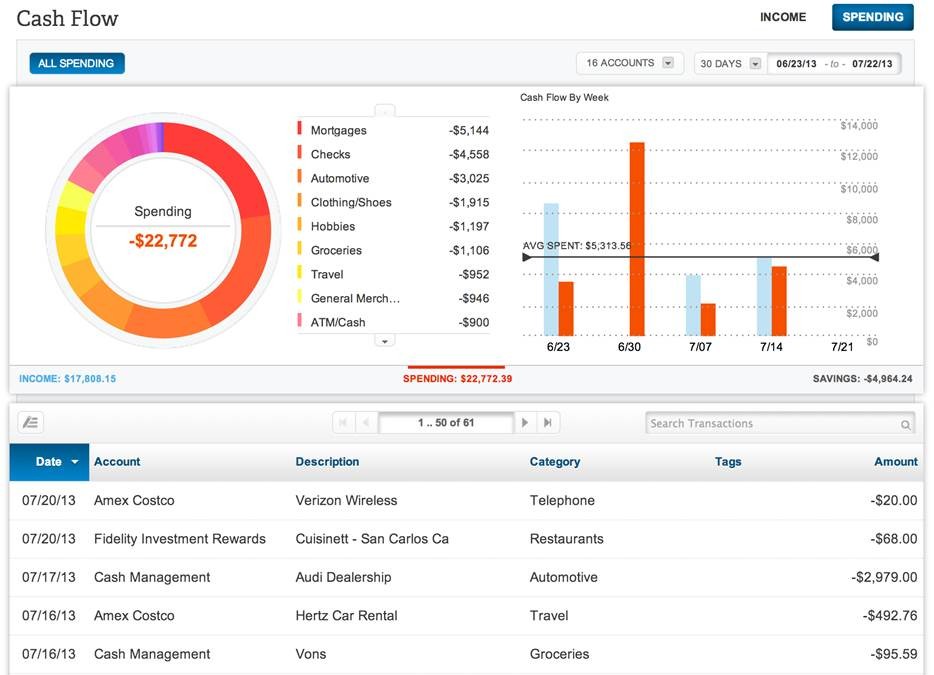

All in all, I think the updated fee structure is more equitable than before and a more realistic solution for the long-term. For a $1,000 account that adds $100 a month, your annual costs will be about $6. Less than ten bucks a year, including all commission costs but on top of the expense ratios of the individual ETFs? Thats a pretty good deal even if you wouldnt mind making trades yourself. Even with a discount brokerage youd pay $7/trade at Scottrade or $3.95/trade at OptionsHouse. When you look at the whole fee picture, Betterment can be very economical. Here is a screenshot of my automated transaction history:

Custom portfolios. $100,000 is a lot of money, but this is where I think Betterment is getting somewhere cool. With $100k they will let you design a custom basket of ETFs and then maintain it for you. For example, I could add ETFs that cover Real Estate, Commodities, or Gold. Now, 0.15% of $100,000 is $150. I actually think I might pay a few hundred dollars a year for them to maintain an ETF portfolio as that would include trade commissions. The only problem here is portfolio fragmentation my money is split in a bunch of different accounts (IRAs, 401ks, Solo 401ks) which makes holistic asset allocation harder to achieve using automated tools.

Alternatives. You can already buy a nice all-in-one mutual fund from Vanguard like the Vanguard 2045 Target Retirement Fund (VTIVX) with a $1,000 minimum investment. In a similar manner, you can manage your overall asset allocation by altering the date and they’ll maintain and rebalance for you as well, gradually becoming more conservative as time goes on. You can transfer funds to/from a bank account in $100 increments. Transactions are also free when you hold them at Vanguard.com, and all this costs just 0.20% annually including all fees.