Revenue and Sales on the Income Statement

Post on: 16 Март, 2015 No Comment

Investing Lesson 4 — Analyzing an Income Statement

Total Revenue or Total Sales

The first line on any income statement is an entry called total revenue or total sales. This figure is the amount of money a business brought in during the time period covered by the income statement. It has nothing to do with profit. If you owned a pizza parlor and sold 10 pizzas for $10 each, you would record $100 of revenue regardless of your profit or loss. If you owned a furniture store and sold a bedroom set for $25,000, you would record $25,000 regardless of your profit or loss. If you owned a hamburger joint and sold 100 cheeseburgers for $3.99 each, you’d record $399 in revenue regardless of your profit or loss.

The revenue figure is important because a business must bring in money to turn a profit. If a company has less revenue. all else being equal, it’s going to make less money. For start-up companies and new ventures that have yet to turn a profit, revenue can sometimes serve as a gauge of potential profitability in the future.

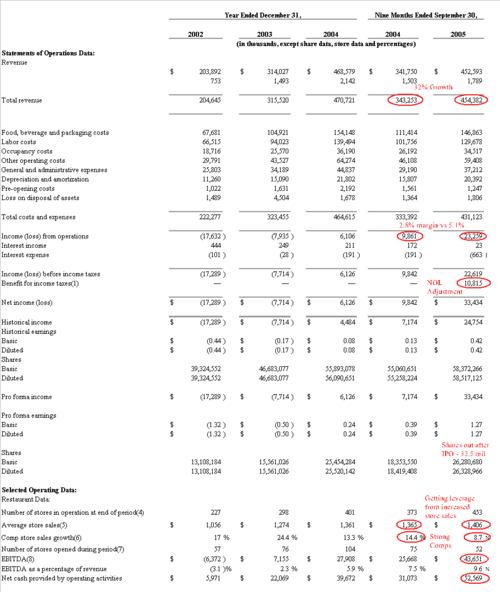

Many companies break revenue or sales up into categories to clarify how much was generated by each division. Clearly defined and separate revenues sources can make analyzing an income statement much easier. It allows more accurate predictions on future growth. Starbucks’ 2001 income statement is an excellent example (see Table STAR-1 at the bottom of this page).

As you see in the chart at the bottom of this page, sales at Starbucks come primarily from two sources: retail and specialty. In the annual report, management explains the difference between the two several pages before the income statement. Retail revenues refer to sales made at company-owned Starbucks stores across the world. Every time you walk in and order your favorite coffee, you are adding $3 to $5 in revenue to the company’s books. Specialty operations, on the other hand, consists of money the company brings in by sales to wholesale accounts and licensees, royalty and license fee income and sales through its direct-to-consumer business. In other words, the specialty division includes money the business receives from coffee sales made directly to customers through its website or catalog, along with licensing fees generated by companies such as Barnes and Noble, which pay for the right to operate Starbucks locations in their bookstores.

From the perspective of an owner, there is often a mistaken belief that growing sales is always a good thing. While this is generally true, there can be exceptions. In an industry such as property and casualty insurance, growth is almost always achieved by lowering policy costs, which can hit profits hard if management isn’t careful, though it may not show up for several years as there is a delay between when the policy is priced and when the losses are incurred. Likewise, if growth is financed by diluting existing stockholders, taking on too much debt. or engaging in riskier activities, it can result in a partial or total wipe-out down the line. History is full of companies that are cautionary tales, from former blue chip banks and thrifts such as Wachovia and Washington Mutual. insurance conglomerates such as AIG, and investment banks such as Lehman Brothers and Merrill Lynch. Growth in sales or revenue should not be the goal by itself. Growth in profitable sales and revenue, adjusted for risk, and in a way that rewards the existing owners, is the objective. As you learn more about the income statement, this will make more sense. The short version is that you should only want a business to generate more sales if it is going to benefit you in some capacity over the long-run. After all, it’s your hard-earned money that is at risk in the enterprise.

Depending on the business and its economics, the revenue or sales figure on the income statement may be reduced by what is known as a reserve for allowance of returns. What that means is a business that knows, traditionally, 1% of its sales end up being returned by customers might go ahead and include that 1% reduction in the revenue figure as that is what experience shows is likely to happen. When you become more advanced, you will need to study these five methods of revenue recognition management can use to smooth the way they report sales.