Retirement Savings – Strategies to Make Savings Last – Wells Fargo

Post on: 2 Июнь, 2015 No Comment

Once you’ve estimated your retirement expenses. determined your retirement income sources, and started a strategy for investing your income sources, the next step is to understand various strategies for withdrawing your retirement savings and decide which withdrawal options make sense for your situation.

What is the recommended withdrawal rate for retirees?

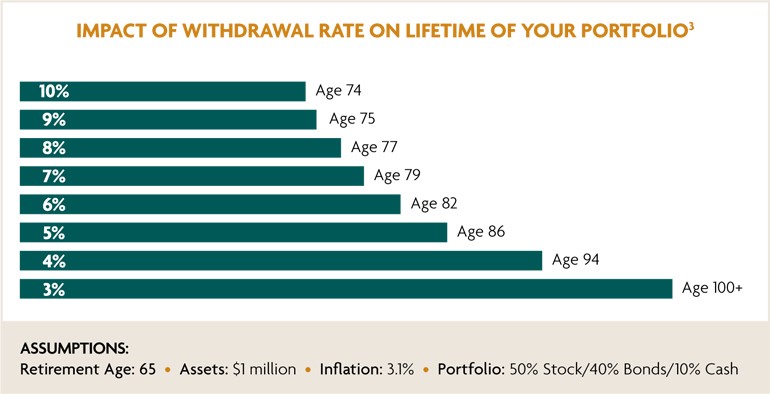

As a general rule of thumb, many industry experts suggest using the 4% rule to create a rough estimate of how much income your retirement savings may generate. For example, for every $100,000 you save, withdrawing 4% a year would equate to $4,000 in annual income.

A 4% annual withdrawal rate is reasonable and sustainable for many retirees, yet it’s generally prudent enough to not deplete your savings too quickly. In addition, keeping the rest of your portfolio invested and diversified gives it the potential to continue growing. And, if your portfolio produces at least a 4% annual return, withdrawing 4% a year enables you to live off your portfolio’s earnings — helping to ensure the sustainability of your portfolio.

How long will your assets last? Consider your withdrawal rate.

Assumptions:

- Retirement age 65

- Assets $1 million

- Inflation 3.1%

- Portfolio: Stocks 50%, Bonds 40%, Cash 10%

IMPORTANT: Projections generated by Morningstar regarding the likelihood of various investment outcomes using the Ibbotson Wealth Forecasting Engine are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary over time and with each simulation. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. © 2013 Morningstar. All Rights Reserved. 3/1/2013

What is the right annual withdrawal rate for you?

While the 4% rule is a good starting place, you can more specifically determine the amount you should withdraw annually in retirement by considering:

- Your estimated expenses — How much you plan to spend each year in retirement

- Your longevity — How many years you could potentially spend in retirement

- Your lifetime income sources — The total amount you expect to receive from lifetime income sources (e.g. Social Security. pensions, annuities. insurance)

- Your investments — The total amount of your personal savings (e.g. IRAs, 401(k)s, 403(b)s, 457, savings accounts, CDs)

Depending on your personal expenses, longevity, and income sources, you may consider raising or lowering the 4% withdrawal rate to meet your needs. And, once you’re retired, it’s important to review your retirement income plan whenever your circumstances or the markets significantly change, but at least annually, so you can adjust your spending strategy and withdrawal rate as needed.

Develop a tax-efficient strategy for withdrawals and RMDs

In addition to determining a suitable withdrawal rate, you also need to decide the best order to withdraw funds from your investment portfolio to help minimize retirement taxes. Certain accounts require you to take distributions once you reach age 70½, so be sure to factor these required minimum distributions (RMDs) into your withdrawal strategy.

Although your withdrawal options vary based on your age and the types of accounts you own, a commonly used strategy is to withdraw money in an order that allows your portfolio to continue experiencing tax-advantaged growth and minimizes retirement taxes. But, because every situation is different, your financial and tax advisors are best equipped to help you determine the most appropriate withdrawal strategy for you.

Simplify your finances by designating one retirement income account

While working, most people receive a predictable paycheck. Your retirement income, however, can be more cumbersome to monitor because your income may arrive at different times and vary in amount. For example, you may receive Social Security at the beginning of each month, your pension payment at mid-month, dividend payments every quarter, and RMDs from your IRA annually.

There are various methods for withdrawing money to “pay yourself” in retirement, but regardless of the method you choose, be sure to consider ways to simplify your cash flow. For example, designate one account for managing your retirement income, such as a checking account, and then:

- Directly deposit your lifetime income payments into your primary account.

- Set up regular withdrawal amounts from your equity and fixed income investments, and move them into your primary account automatically.

- Automatically sweep quarterly interest and dividend payments into your primary account.

- Maintain a cash cushion in your primary account so you’ll have enough money to cover your expenses.