Retirement Planning Using Monte Carlo Simulation to Test

Post on: 16 Март, 2015 No Comment

Monte Carlo Simulation Helps Asses Risk in Your Plan

You can opt-out at any time.

Please refer to our privacy policy for contact information.

A Monte Carlo simulation is a method of testing an outcome over a range of possible variables. I think of it as stress testing for your financial future.

In retirement planning, Monte Carlo simulations are used to determine the likelihood that you can have a particular level of retirement income through life expectancy.

- Portfolio size

- Portfolio allocation

- Annual income to be withdrawn

- Inflation increases to be applied to the income withdrawn

- Time horizon

With these variables the Monte Carlo simulation would test the outcome over possible combinations of portfolio returns. You can change spending, inflation, your time horizon, and your annual withdrawals and see how that affects your likelihood of success.

Why Monte Carlo Simulations are Important to Your Retirement Plan

Simulations are important to your retirement plan because no one knows what your future portfolio returns will be. When you look at historical data, you can see that over twenty year time periods, returns for stocks and bonds can vary widely.

As a retiree, you can follow the same allocation model as another retiree who retired five or ten years earlier or later than you, and experience a completely different outcome – even though you made identical choices.

Monte Carlo simulations test your outcomes over a wide combination of possible market returns, and typically deliver an answer in terms of your probability of success.

The goal in retirement is to have a high probability of success – which is a slightly different goal than the typical goal of a younger person – which is accumulating wealth and assets.

Most financial planning software used by professionals incorporates some type of Monte Carlo simulation. You can also use free online tool such as the one offered by Flexible Retirement Planner.

Understanding the Results of a Monte Carlo Simulation

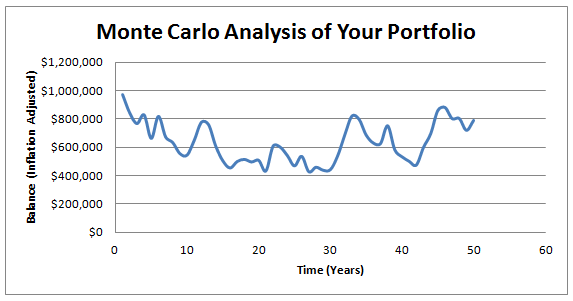

I use a Monte Carlo simulator that is built into financial planning software by Finance Logix. It incorporates an analysis that also includes other variables like your Social Security, pension or other sources of income.

I ran a test case assuming the following:

- $300,000 of investments in non-retirement accounts

- $700,000 of investments in retirement accounts

- $80,000 a year of spending increasing by 3% a year to keep pace with inflation

- Retirement time horizon 2015 – 2047

- Investment allocation: 5% cash, 55% bonds, 45% stock index funds

- I had also input the person’s expected pension of about $24,000 a year and Social Security benefits of about $10,000 a year.

The results said such a person has a 95% chance of success of having $80,000 a year of inflation adjusted income through the year 2047.

What about the 5% of the time where the plan fails? In this case, it assumes that person makes no changes in their lifestyle and keeps right on spending the same amount. Because you can identify in advance if your probability of failure is increasing, I think it is important to continuously test your plan in retirement.

The Importance of Ongoing Monte Carlo Simulations

In retirement, I think you need to update your plan each year and run a revised Monte Carlo simulation. This can help you identify any potential problems years in advance and make adjustments. If you encounter a very poor set of economic circumstances in your early retirement years, you may need to make some adjustments in your spending to insure the 5% failure scenario does not occur. Much like many health situations, in retirement when you identify a small potential problem early on, you have time to remedy it. It is difficult to identify these potential problems without the proper testing – which does involve some form of Monte Carlo simulation.