Retirement Planning in Your 40s Making Retirement a Priority

Post on: 26 Апрель, 2015 No Comment

As you move into your 40s, everything in life – including retirement planning – becomes more serious. You still have at least 20 years to fund your retirement, but the ultimate time horizon is starting to become visible.

The competitions for money intensifies

Everyone wants your money!

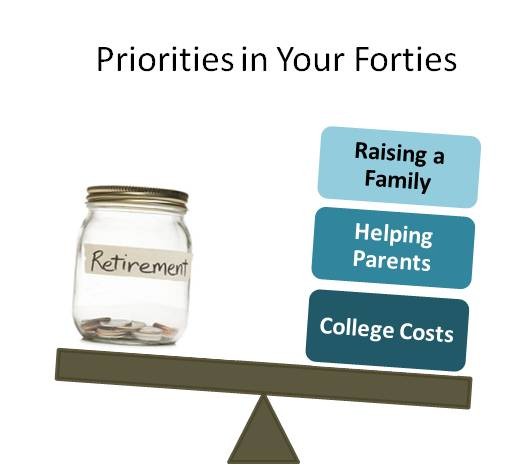

Most people have at least one decade in their lives where money is going into everything except savings. This often happens when children start coming-of-age, and that’s usually the decade of your 40s. This will be especially true if you have teenage children who have, or soon will, enter college. You may have also accumulated some debt over the years that needs to go away. And on the career side of the equation, you may be starting to experience some stiff resistance on the income front.

On balance, you’ll probably find that you need more money in your 40s than any other time in life. That can get in the way retirement planning at the very time that you need to stay on track, and maybe even accelerate your efforts.

Hopefully you have already front-loaded your retirement plan. paid down or paid off your mortgage, and put at least some money away or your children’s college education. If not, you may find yourself in a situation where you will have to reduce your retirement contributions in order to deal with financial needs that are more immediate.

Keeping yourself on track with your retirement goals

You will need to monitor your retirement progress even more closely, especially in light of the heavy demand on your financial resources at this time in life. Once again, a retirement calculator will help you to stay on track.

If you determine that your retirement savings are not where they need to be based on your goals, you’ll have to develop a plan for making up for lost time. Conversely, if you find a you’re right on track, you may have the luxury of putting your retirement planning on automatic pilot. All you need to do is keep doing what you’ve been doing – making your regular retirement contributions – then tend other business in life.

That last part may seem like an oversimplification, but if your retirement savings are great enough after 20-plus years of saving, you may do just that – put yourself on automatic pilot. Some people are particularly well-funded in their plans and in a position to stop making contributions altogether. For example, if you’re 45 years old, want to retire at 65 with $3 million, and already have $650,000 in your retirement plan earning an average of 8% per year, you may be able to stop making retirement contributions.

At 8% per year, your $650,000 401(k) will grow to $3 million by the time you’re 65 years old without any additional contributions. That is the amazing power of compound interest !

Making up for lost time

What if you’re not on track? If you’re finding it difficult to save money for retirement, and your income is no longer rising as rapidly and predictably as it did in your twenties and thirtiess. you may have to look at your expenses and see where you can make up the difference.

For example, if your children are going off to college, this can be an excellent time to consider trading down on your home. Since the house payment is typically the largest expense for most people, reducing it can free up a lot of money in your budget that can be redirected into retirement savings.

You can also consider holding on to your cars for longer than you normally do. Just eliminating car payments can substantially improve cash flow. And though it may seem a bit early, your 40s are an excellent time to begin scaling down your standard of living in anticipation of retirement. The less money you will need to live on in retirement, the less pressure there will be to build a bigger retirement portfolio.

Any savings you can achieve, anywhere in your budget, will help you to make room to maintain retirement contributions at the levels that will produce the retirement portfolio that you need.

Asset allocation in your 40s

Sample Asset Allocation (Vanguard)

By the time you reach your 40s, your asset allocation mix is certain to become more conservative. “Target date funds ” can establish the allocation for you, but even if you choose not to use them, you can still use their allocations as a model for your own portfolio.

Based on a target date allocation, your portfolio might include something like 86% in stocks, and 14% in bonds (the examples given in this article are from Vanguard ). This is not a huge departure from what you might have had in your 30s, and that’s because you still have at least 20 years left before you retire. With that much time, you’ll still need to be aggressive with your investing. comfortable in the fact that you have at least two decades to make up for temporary declines in the financial markets.

Your asset allocation should change as you near retirement age (Vanguard).

How to manage your asset allocation across multiple accounts: Its important to look at your entire investment portfolio as one large bucket when you balance your investments. An easy way to help perform a asset allocation across your entire investment portfolio is with a free tool called Personal Capital. This powerful tool can help you see how your investments work together. You can learn more in our Personal Capital Review. or sign up for a free account at their site .

In so many ways, the 40s are the most critical decade for retirement planning. It’s a time allowing you to either make up for less aggressive savings in the past, or make necessary changes that will ensure that you will reach your retirement goals in the future. Either way you will still have enough time to set yourself on the right course for a comfortable retirement.

More in this series: