Retirement Planning for Physicians and Surgeons

Post on: 21 Июль, 2015 No Comment

Dollar Strength = Falling exports, VT, VTI, VB, S&P 500 calls

March 14, 2015

The dollar continued to strengthen against the Euro and the Yen this week. The volatility was huge, with intraday swings in the S&P of more than 20 points (1 %) each day. The S&P ended the week at 2053 after bouncing off the 2040 level on Weds and Friday. I would note that the small cap indexes are doing much better than the DOW and the S&P 500. Large investors are selling the large cap stocks, who tend to be much more dependent on exports for earnings, and rotating into smaller cap stocks who tend to sell their services or products domestically. This would be a very appropriate response to the strengthening dollar. You may recall in my 2015 overview that I suggested buying the VTI (Vanguard Total Stock Market Index) rather than the SPY (S&P 500 ETF) because small caps had lagged last year. The VTI is in fact holding up much better. If you are looking for a way to take advantage of this trend you could buy the VB (Vanguard small cap ETF). Just recognize that if the US really slows down the small caps will suffer more than the large caps.

Interestingly, I suggested adding exposure to the VT (Vanguard Total World stock market ETF) in one of my recent posts. Thus far, despite the rise of the European stock markets, this suggestion has not performed as well as the VTI, because the rate of currency change has overwhelmed any effect from foreign market improvement. Dollar cost averaging into this should be a good idea long term, but I fear we may be in for continued rapid currency fluctuations and as such this may not feel good for a while. Remember that psychology is a huge part of investing. All of us crave immediate gratification with a gain in the stock or ETF we just bought. Dont expect to get that this year unless we are lucky, in which case we should become even more nervous about a bubble popping.

Some economic indicators in the latter part of the week were interesting. Retail sales for February were published Thursday. They dropped by 0.6%. The market decided it was due to weather and chose to ignore it (for the day). I have been in Boston for most of the past few months, I will attest that no one was going anywhere that wasnt essential. Restaurants and stores were empty due to the epic snowfall.

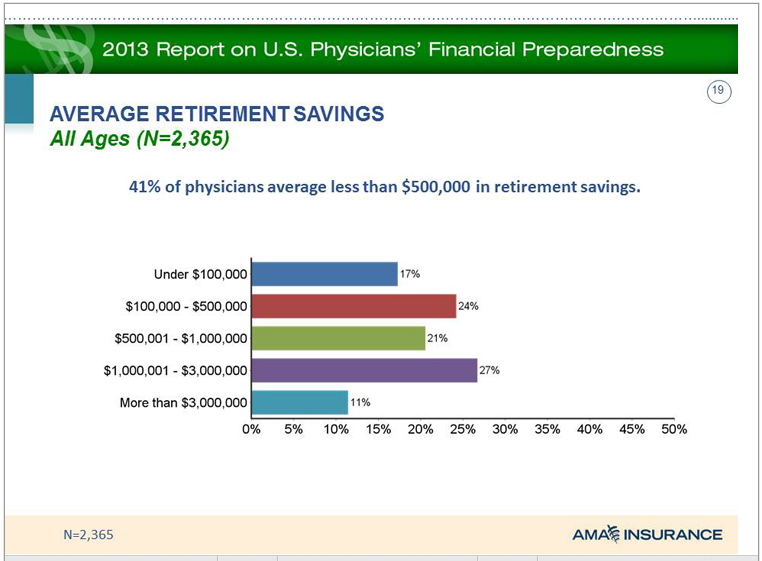

But the weather outside of the northeast was not that bad. The US is a 70% consumer driven economy. What if we are seeing a generational change in attitudes about spending money. My own impression is that we are not going to see the rebound in spending that would have accompanied a drop in gas prices in the past. The young people I know are watching their parents struggle with debt and they themselves have been lacking jobs for far too long. I predict very modest increases in spending when they have any increased cash. As for their parents, the boomers are facing retirement and most of them have very little in savings. Dont expect them to rescue the economy. One thought on the positive side of the ledger is the transfer of trillions of dollars in wealth from the Depression babies to their children. Unfortunately, I suspect this will only concentrate the wealth to a greater extent. Robert Reichs movie Inequality for All (available on Netflix) does a good job of explaining why we need a healthy middle class to really have a vibrant economy. Because the political parties have been hijacked by their extremists, I dont see either political party offering ideas that solve that problem. We will need invest accordingly.

The Producer Price Index dropped 0.5% for February. This was the fourth month in a row of declines. If the big debate this year is whether we are experiencing the beginning of worldwide deflation, as stated in my 2015 overview, then count this in favor of deflation. On the other hand, since much of the recent turmoil in the currency and stock markets is in anticipation of the US Federal Reserve Bank raising rates, it provides a justification to hold off on doing so. Next week there will be a Fed meeting, after which Janet Yellen was expected to drop the word patient from their official statement. If that happens dont be surprised to see the S&P 500 drop below the January lows of 1980. If it doesnt, dont be surprised to see the currency markets switch directions. That would be a boost to the US stock market and would add a currency tailwind to foreign holdings like DODFX and the VT. Oil might even get a little bounce. The VXX would drop. I know the Fed would like to raise rates so they could have a little room to move in the next crisis, but with the recent currency shifts and the PPI data I suspect they will delay and continue patient. Because of this belief, I will buy a few short term calls on the S&P 500 right before the meeting. On a technical basis, I believe we are headed a little lower next week, for that reason I will hold off buying those call until a little later in the week. Recognize this is not investing, it is betting based on probability. If you copy me, keep it very small and short term. If the market soars, I will capture the gain, but if it falls we will lose the bet. On the other hand, my VXX positions will be rewarded and we can look for bargains to buy.