Retirement Money Market Accounts

Post on: 13 Июнь, 2015 No Comment

Published August 1, 2011

Money Rates

Your Investments Should Change with You

When you are younger, it makes sense to invest money more aggressively, especially money you won’t be touching for a long time. In fact, investing too conservatively too early can make it difficult to reach your retirement goals. But your portfolio should shift as you move closer to retirement.

One way to do this is to start selling off your marketable securities when you hit middle age and buy CDs. And as you get closer to retirement, you will have a big batch of CDs with varying maturities and terms in your retirement account—and you’ll have to buy, track, manage, and roll them over or cash them out.

Put your Retirement on Auto Pilot

There’s an easier way. You can set up a retirement money market account and have money automatically transferred into it. As you get older, your portfolio becomes more conservative, and you don’t have to actively manage it. And as your balance grows, so can your interest rate.

Retirement money market accounts can be opened with low minimum deposits, as low as fifty dollars. The money is divided into tiers—for example, balances up to $2,500 may earn one interest rate, those up to $10,000 may earn a higher rate, and so on.

Retirement Money Market Accounts: The Rewards of Low Risk

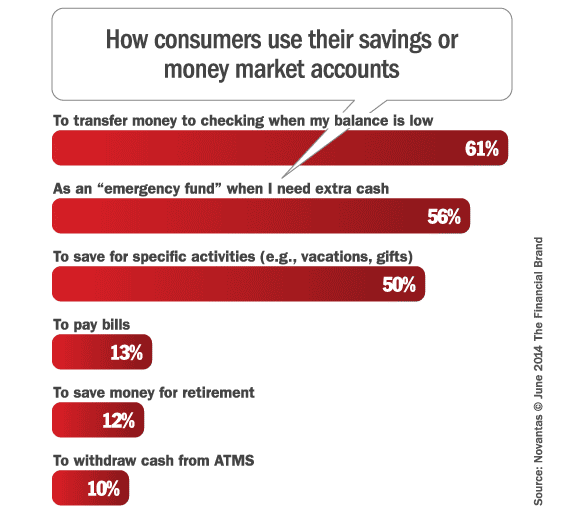

For many retired people or those approaching retirement, the most important thing is to feel that their money is safe. Retirement money market accounts provide this. Meanwhile, the rewards are pretty good. Money market rates are usually higher than those associated with regular savings accounts, and you may have the flexibility to write checks or use an ATM.Plus you can pull money out whenever you want, without penalty, once you are fifty-nine-and-a-half years old.

Comparison tools are available online for retirement money market rates. so you can evaluate different banks and find the best deals. Regardless of what particular bank you choose, you can rest assured that money market investment is fully backed by the FDIC, up to its statutory limit (which was recently increased to $250,000 per depositor, per institution).

The Risks of Low Risk

With most investment products, the risks are numerous. Money market investment carries a much lower risk profile than most other investments.

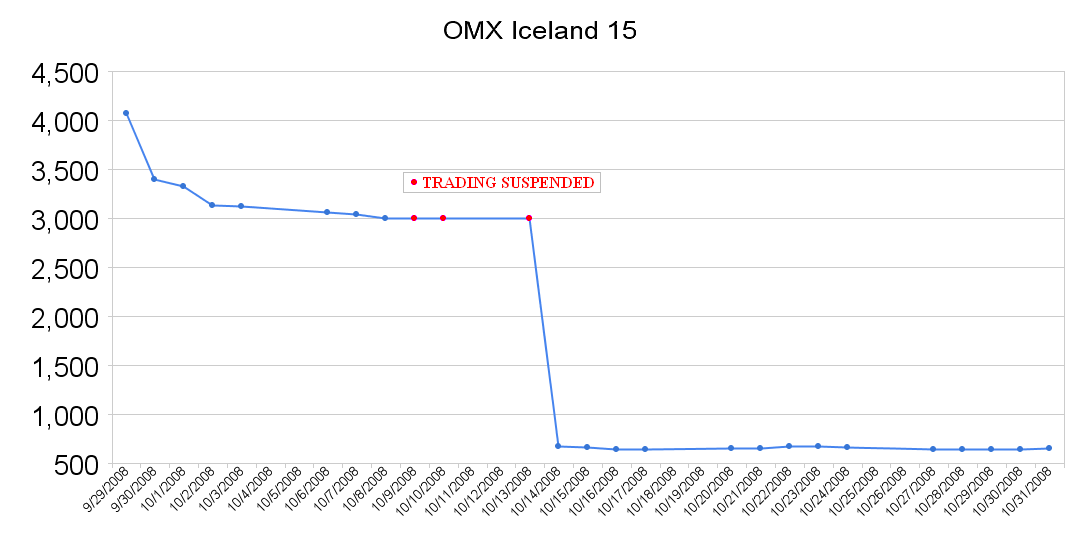

The main risk of money market investing, in fact, is that money placed in such an account may not grow as fast as money placed in riskier places like the stock market.

If you’re nearing retirement, though, the risk of not taking risk may be one risk you’re willing to take.

The original article can be found at MoneyRates.com:

Retirement Money Market Accounts

+ Follow Fox Business on Facebook