Retention ratio Questions & Answers

Post on: 23 Июнь, 2015 No Comment

Retention ratio

A retention ratio is the proportion of net income retained to fund the operational needs of a business. When there is a high retention level, it typically means that management believes there are uses for the cash internally that will provide a rate of return higher than the cost of capital. However, if management is retaining funds for which there is not a good use, investors may end up earning a negative return on the funds.

The ratio is used by growth investors to locate those companies that appear to be plowing money back into their operations, on the theory that this will result in an increase in their stock price. This anticipatory use of the ratio may be incorrect in cases where company management anticipates a business downturn, and elects to retain extra funds simply to build a reserve against the leaner times that are expected in the near future.

A sudden reduction in the retention ratio can reflect a recognition by management that there are no further profitable investment opportunities for the business. If so, this can signal a major decline in the number of growth investors and a notable increase in the number of income investors who own the company’s stock.

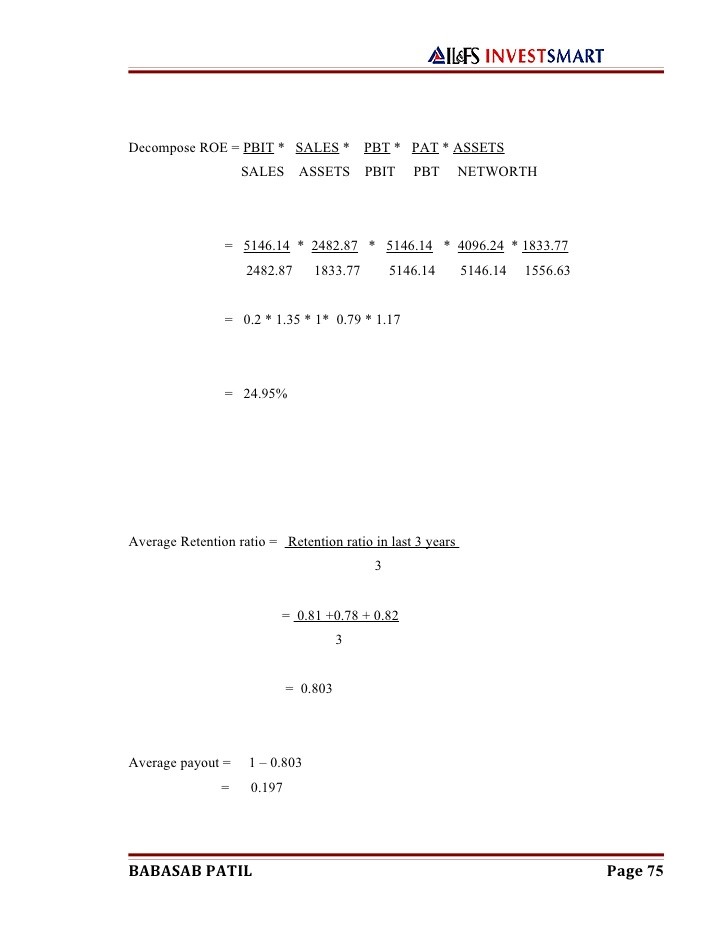

The retention ratio formula is:

(Net income — Dividends paid) / Net income

For example, ABC International reports net income of $100,000 and pays $30,000 of dividends. Its retention ratio is 70%, which is calculated as follows:

($100,000 Net income — $30,000 Dividends paid) / $100,000 Net income = 70%

A problem with this formula is the timing of the dividend payment. The board of directors may declare a dividend but not authorize payment until a period outside of when the retention ratio is being calculated, so no dividend subtraction appears in the numerator.

Another problem with the ratio is the underlying assumption that the amount of cash generated by a business matches its reported net income. This may not be the case, and especially under the accrual basis of accounting, where there can be a substantial divergence between the two numbers. When cash flows significantly differ from net income, the outcome of the retention ratio is highly suspect.

The retention ratio is the inverse of the dividend payout ratio, which measures the proportion of net income paid out to investors as dividends or stock buybacks.

Similar Terms

The retention ratio is also known as the plowback ratio .

Related Topics