Retained Earnings and Book Value

Post on: 16 Март, 2015 No Comment

Entries to the Retained Earnings Account, Book Value

Earnings Per Share, Other

Entries to the Retained Earnings Account

Net Income or Loss

The closing entries of a corporation include closing the income summary account to the Retained Earnings account. If the corporation was profitable in the accounting period, the Retained Earnings account will be credited; if the corporation suffered a net loss, Retained Earnings will be debited.

Dividends

When dividends are declared by a corporation’s board of directors, a journal entry is made on the declaration date to debit Retained Earnings and credit the current liability Dividends Payable . As stated earlier, it is the declaration of cash dividends that reduces Retained Earnings.

Appropriations or Restrictions of Retained Earnings

A board of directors can vote to appropriate, or restrict, some of the corporation’s retained earnings. An appropriation (or restriction) will result in two retained earnings accounts instead of one: (1) Retained Earnings (or Unappropriated Retained Earnings ) and (2) Appropriated Retained Earnings .

The subdividing of retained earnings is a way of disclosing the appropriation on the face of the balance sheet. (An appropriation might occur when a corporation is expanding its factory and its cash must be preserved.) By displaying the appropriated retained earnings account on the balance sheet, the corporation is communicating a certain situation and is potentially limiting itself from declaring dividends by having reduced the balance in its regular (the unappropriated) retained earnings. (Legally, dividends can be declared only if there is a credit balance in Retained Earnings.)

To record an appropriation of retained earnings, the account Retained Earnings is debited (causing this account to decrease), and Appropriated Retained Earnings is credited (causing this account to increase).

An alternative to having Appropriated Retained Earnings appearing on the balance sheet is to disclose the specific situation in the notes to the financial statements. The board of directors can simply not declare dividends or dividend increases.

Prior Period Adjustments

If an error is made on a previously issued income statement (as opposed to a change in estimate), a corporation must restate its beginning retained earnings balance. If the error understated the corporation’s net income, the beginning retained earnings balance must be increased (a credit to Retained Earnings). If the error had overstated the corporation’s net income, the beginning retained earnings balance must be decreased (a debit to Retained Earnings). The adjustment to the beginning balance is shown on the current retained earnings statement as follows:

Book Value

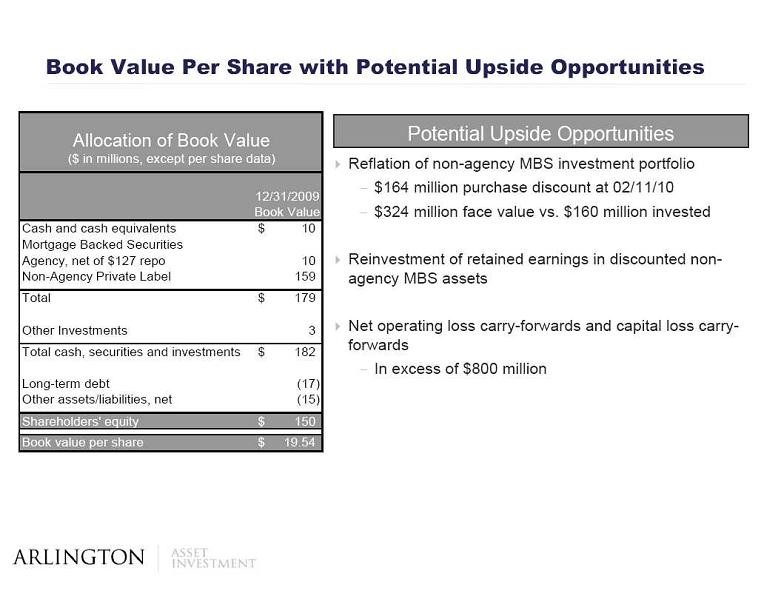

The term book value is used in a number of ways: book value of an asset, book value of bonds payable, book value of a corporation, and the book value per share of stock. We will focus on the last two.

Book Value of the Corporation

The book value of an entire corporation is the total of the stockholders’ equity section as shown on the balance sheet. In other words, the book value of a corporation is the balance sheet assets minus the liabilities.

Since the balance sheet amounts reflect the cost and matching principles, a corporation’s book value is not the same amount as its market value. For example, the most successful brand names of a consumer products company may have been developed in-house, meaning they would not be included in the company’s assets since they were not purchased. Other long-term assets may have actually appreciated in value at the same time the accountant has been properly depreciating them; as a result, they are listed on the balance sheet at a small fraction of their fair market value.

As these examples suggest, a corporation could have a market value far greater than its book value. In contrast, a corporation that has recently purchased many assets, but is unable to operate profitably, may have a market value that is less than its book value. Although we can calculate a corporation’s book value from its stockholders’ equity, we cannot calculate a corporation’s market value from its balance sheet. We must look to appraisers, financial analysts, and/or the stock market to help determine an approximation of a corporation’s fair market value.

Book Value: Common Stock Only

Let’s use the following stockholders’ equity information to calculate (1) the book value of a corporation, and (2) the book value per share of common stock:

- The book value of a corporation having only one class of stock-common stock-is equal to the total amount of stockholders equity: $78,000.

- If common stock is the only class of stock issued by the corporation, the book value per share of common stock is $39. It is calculated as follows:

Total stockholders’ equity of $78,000 divided by the 2,000 shares of common stock that are outstanding: $78,000/2,000 shares = $39.00 per share of common stock

Book Value: Preferred Stock and Common Stock

When a corporation has both common stock and preferred stock, the corporation’s stockholders’ equity must be divided between the preferred stock and the common stock. To arrive at the total book value of the common stock, compute the total book value of the preferred stock, and then subtract that amount from the total stockholders’ equity.

Preferred Stock’s Book Value

The book value of one share of preferred stock is its call price plus any dividends in arrears . If a 10% cumulative preferred stock having a par value of $100 has a call price of $110, and the corporation owes a total of two years of dividends, the book value of this preferred stock is $130 per share. If the corporation has 9% noncumulative preferred stock having a par value of $50, a call price of $54, and the corporation owes a total of three years of dividends, its book value is $54 per share (call price of $54 and no dividends in arrears since the stock is noncumulative).

The total book value of the preferred stock is the book value per share times the total number of shares outstanding. If the book value per share of preferred is $130 and there are 1,000 shares of the preferred stock outstanding, then the total book value of the preferred stock is $130,000.

Let’s compute the total book value of preferred stock by using the following information:

The call price of the preferred stock is $109. It is cumulative preferred and three years of dividends are owed.

The book value per share of the preferred stock equals the call price of $109 plus three years of dividends at $9 each, or $136 ($109 + $27 = $136).

The total book value for all of the preferred stock equals the book value per share of preferred stock times the number of shares of preferred stock outstanding, or $40,800 ($136 X 300 = $40,800 ).

Common Stock’s Book Value

When a corporation has both common stock and preferred stock, the book value of the preferred stock is subtracted from the corporation’s total stockholders’ equity to arrive at the total book value of the common stock. Using the information above, we have: