Restricted Stock Units (RSU) Sales and Tax Reporting

Post on: 11 Май, 2015 No Comment

by Harry Sit on February 25, 2008 233 Comments

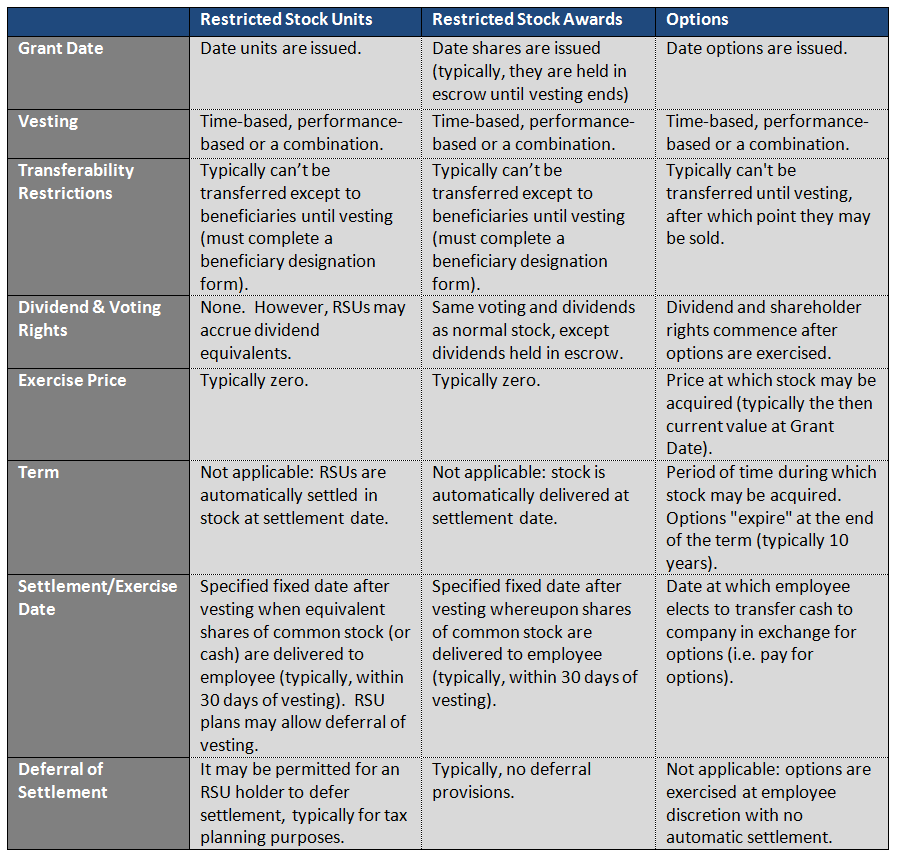

RSU stands for Restricted Stock Units. Its the new form of stock-based compensation that has gained popularity after the employers are required to expense employee stock options. The biggest difference between RSUs and employee stock options is that RSUs are taxed at the time of vesting while stock options are usually taxed at the time of option exercise. The employer is required to withhold taxes as soon as the RSUs become vested.

In a previous post, Restricted Stock Units (RSU) Tax Withholding Choices. I wrote about what I chose among the three tax withholding choices same day sale, sell to cover, and cash transfer and why. This time Im writing about how to account for taxes on the tax return, especially if you use tax software like TurboTax or H&R Block At Home.

Im going to use this simple example:

Suppose you had 100 RSUs vested on October 31. The closing price of the stock on that day is $50, and the tax withholding rate is 40%.

Regardless of which choice you made for tax withholding some employers dont give you a choice your employer will include on your W-2 as wages the total value of the vested RSUs. In our example, its $50 * 100 = $5,000. They will also withhold the same amount of taxes regardless of your choice. In this example its $5,000 * 40% = $2,000. They will also include the taxes withheld on your W-2. How you account for taxes on your tax return for the rest will depend on your tax withholding choice.

1. Net Issuance. In net issuance, you dont have a choice about tax withholding. The employer will deduct a number of shares from your vested shares and give you the rest. You do not receive a 1099-B from a broker for the shares you didnt receive. In our example, although your employer says you have 100 shares vested, you actually only receive 60 shares.

You dont have to report anything for the vesting event. Use the numbers on your W-2 as-is.

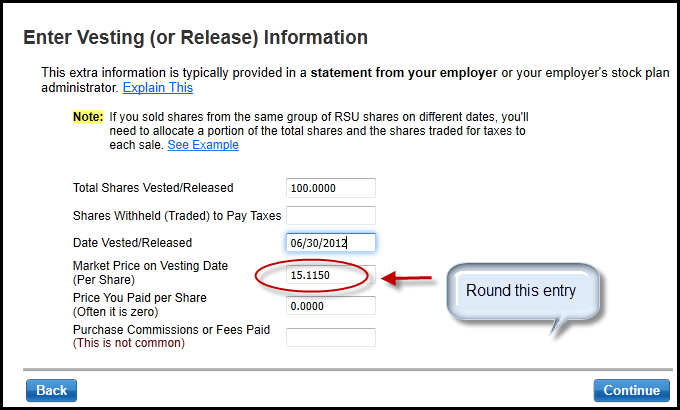

Make a note of the closing price on the vesting date. You have to remember the date and this number until you sell the remaining shares. In our example, thats $50 per share. If you sell the 60 shares for more than $50 per share, you will have a capital gain. If you sell them for less, you will have a capital loss. You report the capital gain or loss in the year you sell the remaining shares. For a step-by-step guide on how to report the sale in TurboTax, see Restricted Stock Units (RSU) and TurboTax: Net Issuance .

2. Same Day Sale. If you make this choice, you sell everything. Lets say on the day after the vesting date the shares are sold for a total of $4,989. The employer withholds $2,000. You are left with $2,989. At tax time, you will receive a 1099-B from your broker listing the stock sale proceed of $4,989. You enter in TurboTax or H&R Block At Home, or on Schedule D of Form 1040:

Description: 100 shares XYZ, Inc.

Net Proceeds: 4,989

Date of Sale: 11/01/20xx

Cost Basis: 5,000

Date Acquired: 10/31/20xx

Your cost basis is the amount your employer included on your W-2, which is the closing price on the vesting date times the number of shares vested. In this example, you will show a short-term loss of $11 on your tax return because of the brokerage commission and the SEC fee. The income and the associated tax withholdings are already included on your W-2. Use those numbers as-is.

3. Sell to Cover. [Update on April 9, 2008: I wrote a follow-up post RSU Sell To Cover Deconstructed to clarify this option. Jump ahead to that post if youd like.] If you make this choice, or if you dont have a choice, your employer sells just enough shares to cover the tax withholding. The key difference between Sell to Cover and Net Issuance is that the employer uses a broker in Sell to Cover but doesnt use a broker in Net Issuance. Suppose 41 shares are sold for $2,030. The employer takes away $2,000 for tax withholding. You are left with $30 in cash and the remaining 59 shares. At tax time, you will receive a 1099-B from your broker listing the stock sale proceed of $2,030. You enter in TurboTax, H&R Block At Home, or on Schedule D of Form 1040:

Description: 41 shares XYZ, Inc.

Net Proceeds: 2,030

Date of Sale: 11/01/20xx

Cost Basis: 2,050

Date Acquired: 10/31/20xx

Once again, your cost basis for the shares you sold is the amount your employer included on your W-2 for those shares, which is the closing price on the vesting date times the number of shares you sold for tax withholding ($50 * 41 = $2,050). After the sale, you show a short-term loss of $2,050 $2,030 = $20 because of the brokerage commission and the SEC fee. Again, the income and the associated tax withholdings are already included on your W-2; you just use those numbers as-is.

For the remaining 59 shares, you keep a cost basis of $50 per share ($50 * 59 = $2,950). You have to remember the date and this number until you sell the remaining shares. Whenever you sell them, you enter in TurboTax, H&R Block At Home, or on Schedule D of Form 1040:

Description: 59 shares XYZ, Inc.

Net Proceeds: whatever you sell them for, copy from 1099-B

Date of Sale: your date of sale

Cost Basis: 2,950

Date Acquired: 10/31/20xx

You will show a short-term or long-term gain or loss for these remaining shares depending on your date of sale and the sale price.

4. Cash Transfer. If you make this choice, you give your employer cash for the tax withholding. They dont sell any of your shares. You can sell the shares either immediately or keep them for however long you like. The tax accounting is the same as if you bought the shares at the closing price on the vesting date. Whenever you sell them, you enter in TurboTax, H&R Block At Home, or on Schedule D of Form 1040:

Description: 100 shares XYZ, Inc.

Net Proceeds: whatever you sell them for, copy from 1099-B

Date of Sale: your date of sale

Cost Basis: 5,000

Date Acquired: 10/31/20xx

You will show a short-term or long-term gain or loss for these shares depending on your date of sale and the sale price. The income from RSU vesting and the associated tax withholdings are already included on your W-2, and you just use those numbers as-is.

Thats all. Hope this is helpful to someone looking for info on the tax treatment and implications of RSU sales.